Grab a chance to avail 6 Months of Performance Module for FREE

Book a free demo session & learn more about it!

-

Will customized solution for your needs

-

Empowering users with user-friendly features

-

Driving success across diverse industries, everywhere.

Grab a chance to avail 6 Months of Performance Module for FREE

Book a free demo session & learn more about it!

Superworks

Modern HR Workplace

Your Partner in the entire Employee Life Cycle

From recruitment to retirement manage every stage of employee lifecycle with ease.

Seamless onboarding & offboarding

Automated compliance & payroll

Track performance & engagement

Understanding Flat vs Reducing Rate Calculator: A Tool for Loan Interest Comparison

A Flat vs Reducing Rate Calculator is a financial tool designed to compare the total interest payable on loans offered at flat interest rates versus reducing interest rates. Understanding the difference between these two types of interest rates is crucial for borrowers in making informed decisions about loan options. This guide aims to explain the purpose of a Flat vs Reducing Rate Calculator, how it works, key considerations, and the benefits it offers.

What is a Flat vs Reducing Rate Calculator and its Purpose?

A Flat vs Reducing Rate Calculator is a tool used to compare the total interest payable on loans with flat interest rates versus reducing interest rates. Its purpose is to help borrowers understand the impact of different interest rate structures on the total cost of borrowing over the loan tenure.

How Does a Flat vs Reducing Rate Calculator Work?

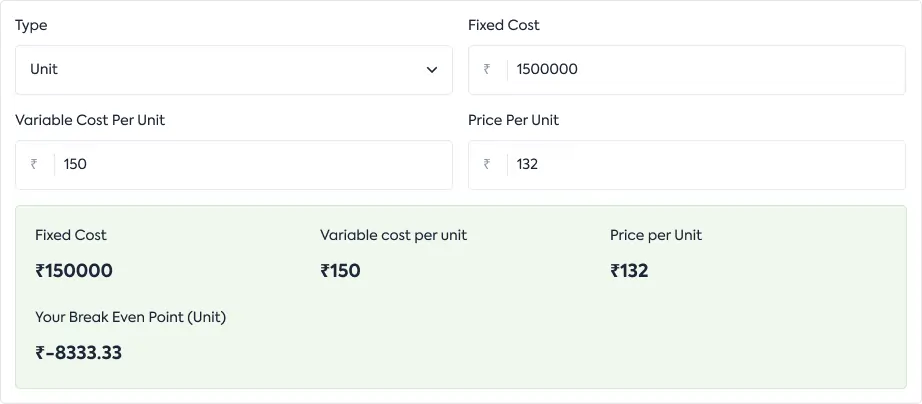

Users input specific loan details such as the loan amount, interest rate, and loan tenure into the Flat vs Reducing Rate Calculator. The calculator then computes the total interest payable for both flat and reducing interest rates, allowing borrowers to compare the total cost of borrowing under each scenario.

Key Considerations in Flat vs Reducing Rate Comparison:

-

Flat Interest Rate:

Under a flat interest rate, the interest payable remains constant throughout the loan tenure, calculated on the initial loan amount.

-

Reducing Interest Rate:

In contrast, under a reducing interest rate (also known as diminishing balance or reducing balance rate), the interest payable decreases over time as the outstanding loan balance reduces with each repayment.

-

Loan Tenure:

The duration for which the loan is borrowed, typically expressed in months or years, significantly influences the total interest payable under both flat and reducing interest rate structures.

Get Loan Insights and Save Big: Try Superworks Today

Benefits of Using a Flat vs Reducing Rate Calculator:

-

Transparent Comparison:

The calculator provides a clear comparison of the total interest payable under flat and reducing interest rate structures, helping borrowers evaluate the cost-effectiveness of different loan options.

-

Informed Decision-Making:

By understanding the implications of flat and reducing interest rates on the total cost of borrowing, borrowers can make informed decisions about selecting the most suitable loan option based on their financial circumstances and preferences.

-

Cost Savings:

Comparing the total interest payable under flat and reducing interest rates allows borrowers to identify potential cost savings and choose the loan option that offers the most favorable terms and conditions.

FAQs for Flat vs. Reducing Rate Calculator:

1. What is the difference between flat interest rates and reducing interest rates?

Flat interest rates involve charging interest on the entire loan amount throughout the loan tenure, resulting in fixed periodic payments. On the other hand, reducing interest rates entails charging interest only on the outstanding loan balance, leading to progressively lower interest payments as the loan is repaid.

2. Which type of interest rate is more cost-effective for borrowers: flat or reducing?

Reducing interest rates is generally more cost-effective for borrowers compared to flat interest rates. With reduced rates, borrowers pay interest only on the outstanding loan balance, resulting in lower total interest payments over the loan term compared to flat rates.

3. How do flat and reducing interest rates impact the EMI (Equated Monthly Installment) amount?

EMIs for loans with flat interest rates remain constant throughout the loan tenure since the principal and interest components are fixed. In contrast, EMIs for loans with reducing interest rates decrease over time as the outstanding loan balance decreases, leading to a reduction in the interest component of the EMI.

4. Are there any specific types of loans or financial products that typically use flat interest rates?

Flat interest rates are commonly used in certain consumer loans such as personal loans and hire purchase agreements. However, they are less common in mortgage loans and other long-term financing arrangements due to their higher total interest cost.

5. Can borrowers switch from a loan with a flat interest rate to one with a reduced interest rate?

In some cases, borrowers may have the option to refinance their loans or negotiate with lenders to switch from a flat interest rate [which is calculated by a flat interest rate calculator] to a reduced interest rate structure. However, borrowers should carefully consider the associated costs and terms before making any changes to their loan arrangements.

Conclusion:

A Flat vs Reducing Rate Calculator is a valuable tool for borrowers to compare the total interest payable on loans with different interest rate structures. By considering key factors such as the loan amount, interest rate, and loan tenure, borrowers can assess the affordability and cost-effectiveness of various loan options, ultimately making informed decisions that align with their financial goals and preferences.

Maximize Your Investment Potential through Strategic Monitoring

Interest Rate Calculated!