Yes, there are several free payroll software in India that are available to help businesses manage salaries, tax calculations & payslips. There are some popular free payroll software that include HR.my, Excel Payroll Templates, Wave Payroll, and Payroller, but they all come with limited features.

Grab a chance to avail 6 Months of Performance Module for FREE

Book a free demo session & learn more about it!

-

Will customized solution for your needs

-

Empowering users with user-friendly features

-

Driving success across diverse industries, everywhere.

Grab a chance to avail 6 Months of Performance Module for FREE

Book a free demo session & learn more about it!

Superworks

Modern HR Workplace

Your Partner in the entire Employee Life Cycle

From recruitment to retirement manage every stage of employee lifecycle with ease.

Seamless onboarding & offboarding

Automated compliance & payroll

Track performance & engagement

5 Game Changing Features Of Free Payroll Software in India!

- workforce management system

- 8 min read

- April 2, 2024

No matter where you are from, choosing free payroll software in India can be very tricky! Before choosing this option, you simply have to consider all the crucial points accordingly. And for that reason, we are gonna help you choose the right option, the right free HR and payroll software for your company.

But how? To keep up with the modern business needs, companies simply have to know about 5 of the best features of free payroll software in India that simply can be proven as the game changer to lift the HR game.

Because without the given features of HR software, teams can be left with lots of manual work in crucial HR functions, like attendance, paying your employees & many more. Henceforth, through this blog, we are gonna help you make the right decision to purchase the best payroll software for your organization.

What Free Payroll Software in India is All About?

Free payroll software in India directly refers to automation tools that are making payroll operations much easier, and that too without paying a rupee. These software solutions typically automate various aspects of payroll management. And that makes it much easier for businesses to do various business processes, including;

- Calculate employee salaries,

- Withhold taxes,

- Generate payslips &

- Comply with regulatory requirements.

Benefits of Using a Free Payroll Software in India

– Basic Payroll Processing

The best free payroll software India offers core functionalities to calculate employee wages based on hours worked, and salaries.

– Tax Calculations

The free software automatically payrolls and adds taxes in that as well. It mostly includes federal, state, and local taxes, as well as benefits and retirement contributions.

– Payslip Generation

Free payroll solutions provide the ability to generate payslips for employees, detailing their salaries, deductions, and net pay.

– Direct Deposit

Many free payroll options offer direct deposit capabilities, allowing businesses to deposit employee salary directly into their bank accounts.

Cons To Use Free Payroll Software in India

– Limited Users

Free payroll software often restricts the number of users who can access and use the software for attendance and leave management. This limitation can be problematic for growing businesses that need to provide access to multiple team members.

– Restricted to One Location (Lack of Scalability)

Free payroll software typically limits businesses to using the software for one work location. As businesses expand and open new branches or offices.

– Limited Access Time

Free payroll software may offer limited access time, such as a trial period or restricted hours of operation.

– Lack of Cloud-based Features

Free payroll software often lacks advanced cloud-based features that are essential for modern businesses. Cloud-based features allow for real-time data access, automatic updates, remote access, and integration with other software systems.

– Potential Security Breaches

Free payroll software may not offer robust security measures to protect sensitive employee and financial data. This lack of security can expose businesses to the risk of data breaches, and unauthorized access.

See More: How To Find The Best Payroll Software In India

Never compromise on advanced features & risk operational inefficiencies.

Upgrade to Superworks today for seamless payroll management & compliance!

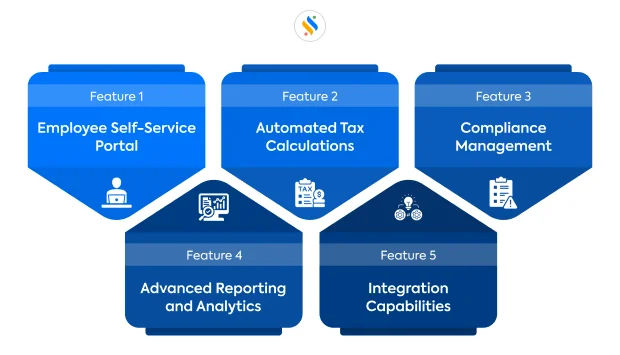

5 Essential Features of Payroll Software in India

Managing payroll efficiently is crucial for any organization as it is a matter of money. Employees are waiting to get their salary on time and to ensure timely and accurate payment it is necessary to add payroll processing software.

With advancements in technology, payroll management has evolved, offering advanced features that simplify processes. Below are some key advanced features that are essential for modern payroll management systems.

1. Employee Self-Service Portal

An Employee Self-Service portal is a fundamental feature that should have in workforce management software – payroll software. This feature allows employees to access their payroll information, view payslips, and manage personal details directly through a secure online portal. This self-service functionality empowers employees by providing them with real-time access to their payroll data, reducing dependency on HR and administrative staff.

This portal also streamlines communication between employees and the payroll department, allowing employees to raise queries, submit requests for changes, and receive timely responses. This feature not only improves employee satisfaction but also saves time for HR professionals.

2. Automated Tax Calculations

Tax calculation is an important feature of process payroll. Automated tax calculations are another essential feature that simplifies payroll & attendance management significantly. With complex tax laws and frequent changes in tax rates, it can be time-consuming, error-prone, and challenging to keep up-to-date.

Advanced payroll management services automate tax calculations by integrating tax tables and rules, ensuring accurate deductions for income tax. This automation reduces the risk of errors, ensures compliance with tax laws, and saves valuable time for payroll administrators.

3. Compliance Management

Compliance management is vital when you are in corporate. Paid 10 best free payroll software India offers built-in compliance management tools that help businesses stay compliant with local, state, and federal regulations.

The HR and payroll software tracks the changes in labor laws, tax regulations, and reporting requirements, ensuring timely updates to payroll process and policies. Additionally, statutory compliance management features enable businesses to generate and submit statutory reports as per the salary structures, maintain accurate records, and undergo audits with ease.

4. Advanced Reporting and Analytics

Modern payroll systems, whether it’s a free payroll software in India or else, offer customizable reporting tools that allow businesses to generate detailed reports on payroll expenses, employee earnings, tax liabilities, and more. Advanced reporting and analytics capabilities are indispensable for payroll management.

These reporting tools enable HR and finance teams to analyze data, identify patterns, and make informed decisions to optimize payroll processes.

5. Integration Capabilities

Integration capabilities are essential for any organization’s business operations. This allows free payroll software in India to communicate and share data with other business applications such as HRM, time and attendance, bonus calculation, and loan management software.

Advanced payroll systems offer robust integration capabilities through APIs, middleware, and pre-built connectors, enabling automated data synchronization and streamlined workflows across different departments.

Integration with HRM software facilitates accurate tracking of employee information, wages, and benefits, while integration with time and attendance systems automates timesheet processing and ensures accurate payroll calculations.

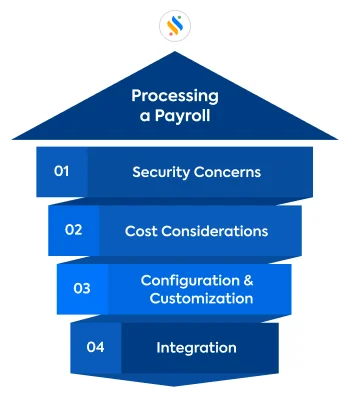

Important Things That Should Be Proper While Processing a Payroll

People forget many important things when choosing the free payroll software in India. Here, we mention some things you need to consider while processing payroll by adding payroll software.

Processing payroll is a critical task that requires attention to detail, accuracy, and compliance with various regulations.

Here are some key considerations:

1. Security Concerns

- Data Protection: Ensure that free or paid HR payroll software in India provides robust security features to protect sensitive employee data ( employee compensation ), such as multi-factor authentication, encryption, and regular data backups.

- Compliance: Verify that the HR payroll software complies with data protection laws and regulations applicable to your region or industry.

- Access Control: Implement strict access controls to limit who can view or modify payroll data.

2. Cost Considerations

- Affordability: Evaluate the total cost of the plan, including upfront costs, subscription fees, and any additional charges.

- Scalability: Choose a payroll software solution that can scale with your business as it grows without additional costs.

- Hidden Costs: Be aware of any hidden costs or fees of free payroll software in India, such as setup fees and implementation costs.

3. Configuration & Customization

- Flexibility: Look for the best payroll software in India that offers customizable features and settings to accommodate your organization’s requirements.

- User-Friendly Interface: Ensure that the software is easy to use, with customizable dashboards and reporting tools.

- Automated Workflows: Opt for software such as Superworks that allows you to automate repetitive tasks and workflows.

4. Integration

- Compatibility: Ensure that the software is compatible with your existing systems, such as HRMS, payroll, and project management software to facilitate seamless data integration and exchange.

- API Support: Check if the software offers robust API support.

- Real-Time Syncing: Choose a payroll solution that provides real-time syncing capabilities to ensure accurate and up-to-date payroll data across.

Important Case Study:

A mid-sized manufacturing company based in India with 200 employees. Initially, they used free payroll software in India to manage their payroll. However, they soon realized that the software lacked several advanced features, including an employee self-service portal, integration with their accounting software, and customizable reporting.

They face these kinds of issues:

– Data Entry Errors: Due to the lack of integration, there were frequent data entry errors and discrepancies between the payroll and accounting records, leading to financial inaccuracies for your business.

– Compliance Risks: The free payroll software lacked robust compliance management features, putting the Company at risk of non-compliance with local labor laws and tax regulations. Henceforth, companies should choose one of the top 10 payroll software in India.

– Limited Insights: The inability to create custom reports made it difficult for the Company to analyze payroll data and identify trends.

Wrapping Up,

All in all, you can get game-changing features in free payroll software in India; however, the free version has some limits. So, if you want to grow your business and need software that helps to make your business process much smoother, you need to go for the paid version of payroll software.

Because in the paid version, you can be assured with better security, better services, and seamless integration with various HR payroll software tools! Henceforth, according to experts, it’s an initial investment that you should make to get better returns.

For that reason, no matter what, the ultimate goal should be business growth & if you invest in software, ultimately, you are gonna get a high ROI. Book a free demo and get more information now!

FAQs

Is there any free payroll software?

Is Superworks free?

Superworks is a great platform that offers seamless HR & payroll management solutions, but to be honest, it is not entirely free. Superworks is offering a free demo for all the companies in the world, where they help them understand all their key features, and even after subscription, they continue to feel free assistance around the clock!

Is Excel payroll free?

Yes, Excel payroll templates are a free solution that can be used to calculate employee salaries, deductions & taxes manually. However, these completely free Excel-based payroll lacks automation, compliance tracking & integration with other HR tools, making it suitable for very small businesses only.

How to make payslips online free?

To answer this question, we want to let you know that you can create free online payslips using tools like:

- Superworks (with pre-designed templates)

- Zoho Payroll (Free Plan for Small Teams)

- HR.my (Cloud-Based Free Payroll & Payslip Generator)

- Wave Payroll (Limited Free Access)

- Excel Payslip Templates (Manually input details and generate a PDF)

With the help of these tools, you can easily input salary details, deductions, and tax components & generate downloadable payslips in an instance.

What is the cost of PF ESI software?

The cost of PF (that stands for Provident Fund) and ESI (that stands for Employee State Insurance) software depends on the provider & the number of employees.