There are several payroll service in India offering excellent payroll software. Some of the top choices include:

- Superworks – Comprehensive payroll and HRMS solution

- GreytHR – Popular for small and medium businesses

- Zoho Payroll – User-friendly and cost-effective

- Keka – Best for growing companies

- RazorpayX Payroll – Ideal for startups and freelancers

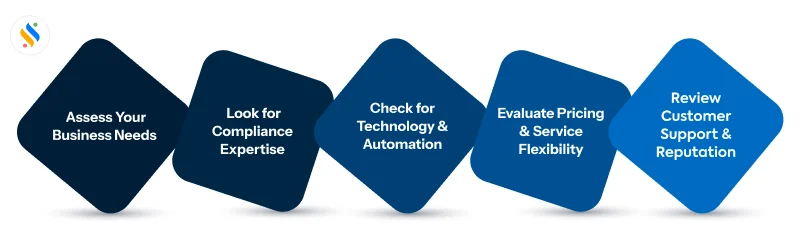

The best software for your business depends on your specific payroll needs, compliance requirements, and budget.