Most of the time the maximum limit for leave encashment is 300 days. The leave encashment received by the employee can be a maximum of 300 days of leave during their employment period.

Grab a chance to avail 6 Months of Performance Module for FREE

Book a free demo session & learn more about it!

-

Will customized solution for your needs

-

Empowering users with user-friendly features

-

Driving success across diverse industries, everywhere.

Grab a chance to avail 6 Months of Performance Module for FREE

Book a free demo session & learn more about it!

Superworks

Modern HR Workplace

Your Partner in the entire Employee Life Cycle

From recruitment to retirement manage every stage of employee lifecycle with ease.

Seamless onboarding & offboarding

Automated compliance & payroll

Track performance & engagement

The Essential Elements of a Leave Encashment Policy You Should Include

- leave encashment policy in india

- 10 min read

- September 20, 2023

Who doesn’t love to get the money for their rights?

In the case of leaves, what if you don’t use and get the money as per the leave encashment policy of your organization? It seems pleasing right?

As per the Indian Labour Law, every salaried employee in the private company gets the leaves and also gets the money for the unused leaves. The exact number of paid days off can vary between different companies. It will be encashed or it will be carried forward.

- What Are The Types of Leaves In India?

- What is Leave Encashment?

- What Is Leave Encashment Policy In India?

- Leave Encashment Calculation To Add In Policy

- What Are The Taxation Rules On Leave Encashment?

- Benefits of Leave Encashment For Employee Can Avail Of From Company

- HR Policy On Leave Encashment

- Key Takeaway

What Are The Types of Leaves In India?

To get the money for your unused leaves, you need to understand which kind of leaves are there in most private companies.

Let’s check which leaves are there in private companies. Whether it is in the category of encashment or not.

Privilege Leave

When you work for a company, you definitely get the leaves, but to know whether you are eligible for leave encashment is essential. If you don’t use all your leave and you decide to quit your job, the company might give you money for the unused vacation days. However, the rules for this can vary from one company to another. For government employees, the rules are the same everywhere. But in private organizations, each company decides how much money you get for your unused leaves. Understanding privilege leave calculation is important to determine your total leave entitlements and potential encashment benefits.

Casual Leave

This is the most common type of leave for any casual work that employees use. The length of casual leave varies, but most companies allow at least 7 to 10 days. You have to let your employer know when you want to take casual leave and when you’ll be back. If they approve it, you can get paid for these days. In contrast, earned leave is accrued over time and typically requires different notice and approval procedures.

Sabbaticals Leave

This is one kind of paid leave and it is provided as if any employee wants to learn new skills or wants to do courses suggested by the organization or any higher authority. These leaves can be converted into money if the organization allows.

Maternity Leave

Pregnant females are allowed to take maternity leaves whether it is paid or unpaid. These leaves have a duration of 12 to 26 weeks, but it depends on the company’s policy. It can’t be turned into money, and any extra time off isn’t paid.

Sick Leave

If you’re sick you can take sick leave, sometimes it is considered casual leave as well. You don’t need to tell your employer about it before taking the leave. You can apply after you come to work again. The number of sick leave days allowed depends on the company, but really long medical leaves usually can’t be turned into money.

Holiday Leave

Holiday or Vacation leaves are also paid leaves, and you don’t lose any money from your salary when you take them. Some organizations do convert them into money some don’t prefer to.

So, if you want to cash in your unused leave days, make sure to understand the rules for each type of leave your company offers.

What is Leave Encashment?

As per the labor law of India, the employer has to do two things: either carry forward employee leaves to the next year or money for their unused leave days.

Encashment means that employees can either get paid for their leave after a period of time, time of retirement or resignation, quit their jobs, or keep working. When an employee leaves the company, their unused leaves are part of the final payment they receive from the company.

According to the law, any remaining leave days and bonus must be settled and paid to the employee by the 7th or 10th of the month after they leave the company, according to the 1948 Factories Act. However, different companies have different rules about leave policy and leave encashment.

What Is Leave Encashment Policy In India?

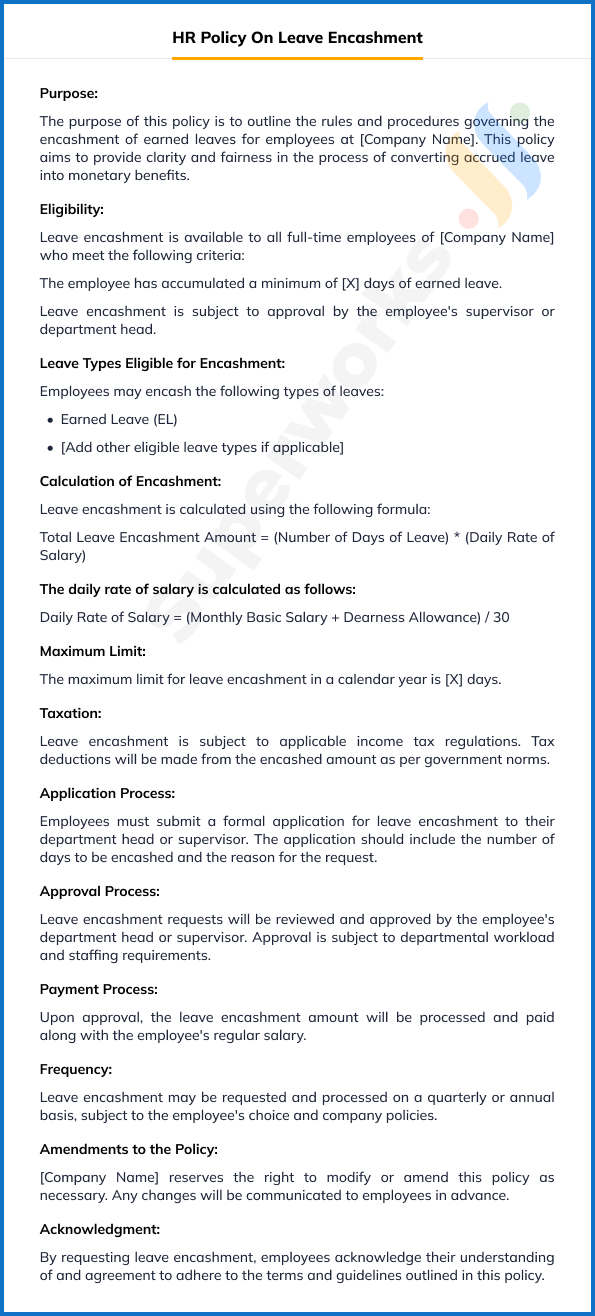

A leave encashment meaning- money for extra, unused leave, however, a leave encashment policy is a document that has leave encashment rules. This encashment policy usually includes information on who is eligible for how leave encashment is calculated, who is eligible, the maximum number of days that can be encashed, the process to request employee leave encashment, the tax deductions, and so on.

The leave encashment policy from HR toolkit is often a part of the leave and absence of the employee. This can outline the employer’s overall approach to managing employee leave. The purpose of a leave encashment policy is to provide expectations to employees and to ensure consistency and fairness in the process of encashing leave days.

When you work for a company, you definitely get the leaves, but to know whether you are eligible for leave encashment is essential. If you don’t use all your leave and you decide to quit your job, the company might give you money for the unused vacation days. However, the rules for this can vary from one company to another. For government employees, the rules are the same everywhere. But in private organizations, each company decides how much money you get for your unused leaves. Understanding privilege leave calculation is important to determine your total leave entitlements and potential encashment benefits.

When you leave or retire, if you still have some days left, you can get paid for those days. The same goes if you leave your job for any reason. But if you get fired, you can’t use your vacation days. Instead, you’ll get paid for them according to the rules. While you’re working, you can take a break using your earned leave, but you can do this only once a year.

Leave Encashment Calculation To Add In Policy

Most companies prefer the encashment calculation as below:

- Your CTC: ₹40000.

- Assume working days are: 25 days in a month.

- Daily Wage Rate: ( ₹40000/ 25 )= ₹1600.

- If the employee has 30 unutilized leave days.

- Leave Encashment Amount: (₹1600 x 30) = ₹48,000.

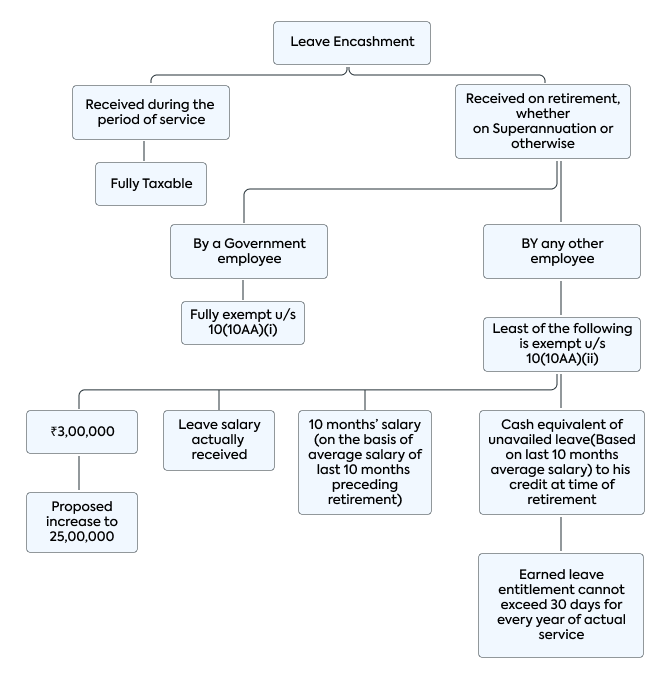

What Are The Taxation Rules On Leave Encashment?

As per the Income Tax Act, the taxation on the leave encashment policy is primarily dependent on whether you opt for it in your working journey or not.

Superworks is going to talk about how they tax the money you get for your unused leaves in different situations. Let’s get started.

Leave Encashment For Vacation Days While Still Working

If you decide to get money for your leaves even if you are working then the money is part of your regular salary. The taxation of leave encashment is dependent on your income range. But there’s a rule as encashment leave policy under (section 89(1) of the Income Tax Act, 1961) that can help reduce the tax you owe in this case.

Leave Encashment of Retirement Or Resignation

When you get money for your leave encashment at the time of retirement or resignation, the tax you pay can vary. It might be fully free from tax exemption or only partially taxable. It depends on whether you work for the government or a non-government company.

Government Employees

Whenever you work in central or state government, the encashed leaves are fully tax-exempt.

Non-Government Employees

If you work for a non-government company, the rules are a bit different. How much tax you pay depends on various factors, like how much salary you have, how many days you’re getting paid for, and whether you’re still working or in the company.

Legal Heirs of Deceased Employees

Even if the employee has passed away, the money their legal heirs get for leave is not taxed.

If you are still thinking about whether leave encashment is taxable or not, mostly it is calculated based on your 10 months salary, and its maximum limit is set at – 3,000,000 by the government. For every year you work, you get paid for a certain number of days, up to a maximum of 30 days.

Read more : Unveiling the Secrets to a Successful Leave Policy for Employees

Want to Streamline Your HR policies? – Get Free HR Policy Templates!

Access our comprehensive library of HR policy templates completely FREE. These templates are designed to save you time and ensure compliance with the latest HR regulations.

Don’t miss out on this valuable resource for HR professionals. Click the button below to download!

When people work in jobs, whether it’s for private companies or the government, they get different types of leave, like casual leave, sick leave, earned leave, and many more. Some of these leaves can be saved and used in the next year, but not all of them. Employees can avail of leave salary encashment if they want.

The rules about how much money they get and whether they get it while still working or when they retire are decided by the people in charge of taxes.

Benefits of Leave Encashment For Employee Can Avail Of From Company

- If you get money for your remaining leaves, while you’re still working, you have to pay taxes on that leave encashment.

- It doesn’t matter if you work for a private or government company. Whether you leave your job because of retirement or you resign, you can get leave encashment for your unused leave.

- The Leave Encashment Policy you get for your remaining leaves is considered as income from salary, and they tax it based on how much you earn depending on HR policy for leave. It’s like the regular taxes you pay.

- The leave encashment at the time of retirement from a government job (either state or central government), you don’t have to pay taxes on the money you get for your leaves.

- If someone passes away and they have money coming for their leave, their family doesn’t have to pay it back.

Let’s say you retire and get Rs. 5 lakh for your unused leave days. In the 10 months before you retired, you were earning Rs. 40,000 per month, which adds up to Rs. 4 lakh. The most you can get as a tax exemption in this case is Rs. 3 lakh (that’s the limit). So, you’ll be taxed on Rs. 2 lakh (Rs. 5 lakh – Rs. 3 lakh). - If leave encashment received in previous years and got some tax exemptions, that amount will be subtracted from the Rs. 3 lakh limit.

- Some employees, even if they resign or retire, don’t have to pay back the money they got for their unused leaves.

HR Policy On Leave Encashment

Key Takeaway

Mostly the Leave Encashment Policy offers employees the opportunity to convert accrued leave days into monetary benefits. However, privilege leave provides financial flexibility by allowing employees to take paid time off for genuine personal reasons, ensuring they have support when they need a break. If you have any doubts and want total clarification then our HRMS software can help you to guide everyone to streamline HR processes.

Explore this policy to understand the rules regarding leave salary calculation, calculation methods, and taxation aspects, empowering you to make informed decisions about your leave application benefits.

Make top-notch documents to make employees happy and engaged!

FAQs

What is the limit of leave encashment?

Is leave encashment mandatory in India?

No, it is not mandatory to provide leave encashment in India. But most of the government and private sectors prefer to give leave encashment for the remaining leaves, though it depends on types of leaves.

Is annual leave encashment mandatory?

Typically the leave encashment is provided after a certain period of working of employees as per the days of paid leaves and counted on basic salary. So, annual leave encashment is not mandatory for everyone. It is typically required when an employee leaves their job, whether through resignation or retirement.

Is leave encashment taxable?

Yes, leave encashment is taxable. However, the taxation rules can vary depending on the rules of the government and employee leave policy.

How is leave encashment calculated?

Leave encashment is calculated with this formula: