In order to calculate the bonus, especially under the statutory bonus rules, you need to go through the guidelines set under the Bonus Act. Super Payroll – the best payroll software – simplifies this process with a handy statutory bonus calculator.

Grab a chance to avail 6 Months of Performance Module for FREE

Book a free demo session & learn more about it!

-

Will customized solution for your needs

-

Empowering users with user-friendly features

-

Driving success across diverse industries, everywhere.

Grab a chance to avail 6 Months of Performance Module for FREE

Book a free demo session & learn more about it!

Superworks

Modern HR Workplace

Your Partner in the entire Employee Life Cycle

From recruitment to retirement manage every stage of employee lifecycle with ease.

Seamless onboarding & offboarding

Automated compliance & payroll

Track performance & engagement

Make your bonus distribution simple & quick

Proceed for 100% stress-free statutory bonus calculation with Super Payroll

Statutory Bonus Calculator

Statutory Bonus is extra profit, so calculate & save it!

Keep Bonus In Check

Process your Bonus Calculations hassle-free

Transform your bonus distribution with the best payroll software

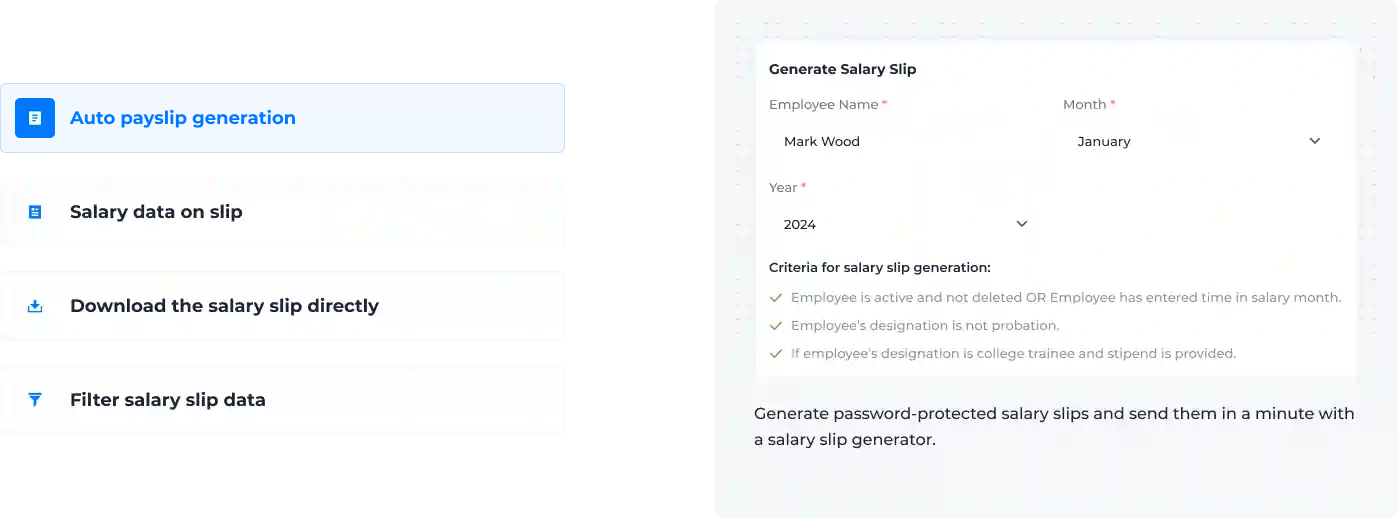

Transparent Salary Documentation for Calculation

Choose whether you want to display the bonus as an 'ADDITIONAL' component in the salary slip or not. You can also decide how you want to consider a particular salary component in financial terms.

Simplify Bonus & Deduction Distribution Process Efficiently

Add recurring as well as one-time bonuses and deductions to streamline calculations and speed up your payroll processing. You can even mention the type and reason.

Pre-determine the approval chain

Select who you want to approve that particular request. You can also skip it if you want to approve it without any approvals, or you can set conditions for multi-level approvals.

Add & deduct incentives directly

Choose if you want to add or deduct any additional earnings or incentives inside or outside payroll. For multiple employees, you can import the sheet and do hours of updates in just a few minutes.

Reward your team effortlessly with the advanced bonus features of Super Payroll!

Hear why 200+ HRs choose Super Payroll software

Ease your payroll processing with the best payroll software

Blogs

Stay ahead with the latest industry insights