PF compliance is one of the statutory regulations set by the Employees' Provident Fund Organisation (EPFO). It is concerning the Provident Fund contributions made by employers and employees. PF compliance is a critical aspect of payroll management that supports employees' financial security and promotes trust in the workplace.

Grab a chance to avail 6 Months of Performance Module for FREE

Book a free demo session & learn more about it!

-

Will customized solution for your needs

-

Empowering users with user-friendly features

-

Driving success across diverse industries, everywhere.

Grab a chance to avail 6 Months of Performance Module for FREE

Book a free demo session & learn more about it!

Superworks

Modern HR Workplace

Your Partner in the entire Employee Life Cycle

From recruitment to retirement manage every stage of employee lifecycle with ease.

Seamless onboarding & offboarding

Automated compliance & payroll

Track performance & engagement

Top 5 Challenges in PF Compliance and How to Overcome Them

- what is pf compliance

- 7 min read

- August 12, 2024

PF compliance in India is not a joke! It is a vital matter for employees as well as employers.

Managing statutory compliance, particularly PF ESI statutory compliances is a critical responsibility for businesses operating in India. Ensuring compliance with these regulations not only safeguards your business against legal penalties. This PF and ESI compliance accuracy enhances employee trust and satisfaction.

However, the complex nature of these ESI compliance regulations can pose significant challenges for businesses. This blog will explore the top five challenges in PF compliance and provide solutions to overcome them effectively.

What Is PF And ESI In Salary?

Provident Fund (PF) and Employee State Insurance (ESI) are two essential components of statutory compliance in India.

PF- Provident Fund is scheme for employee as retirement benefit. It is mandated by the government. Both the employer and employee contribute some portion of the employee’s salary.

This PF in HR scheme is a social security scheme managed by the Employees’ Provident Fund Organisation (EPFO) and aims to provide financial security to employees post-retirement. The scheme is governed by the Employees’ Provident Funds and Miscellaneous Provisions Act 1952, which outlines the eligibility criteria for both employers and employees.

ESI is a scheme that provides financial and medical benefits to employees. This is used for their families in case of sickness, maternity, or workplace injuries.

This scheme is managed by the Employees’ State Insurance Corporation (ESIC), it requires contributions from both employers and employees. The scheme covers employees earning a monthly wage of up to a specified limit and applies to companies with a minimum of 10 employees (or 20 in some states), making it a critical aspect of social security. The ESI Act outlines the detailed eligibility criteria for both employers and employees.

Both ESI and PF compliance are crucial for ensuring employee welfare and require meticulous management to remain compliant with statutory regulations.

Get the payroll software that ensures 100% PF compliance!

Stay compliant and focus the most on growing your business.

Why Is PF Compliance Required For Your Business?

PF compliance is not just a regulatory requirement; it is an integral part of responsible business management. Check the reason why PF and ESIC compliance are necessary:

– It Helps To Avoid Penalties

PF compliance is mandated by the Employees’ Provident Fund Organisation (EPFO) under the Employees’ Provident Funds and Miscellaneous Provisions Act, 1952. Non-compliance can result in significant financial penalties, which can adversely affect your business operations and reputation.

– It Enhances Employee Trust

Compliance with PF regulations helps to maintain employee health and welfare. This can enhance trust and loyalty among your workforce. Employees are more likely to remain committed to organizations that prioritize their financial security and well-being.

– It Ensures Financial Security

The Provident Fund serves as a crucial retirement savings plan for employees, providing them with financial security post-retirement. Ensuring PF compliance means that employees receive the benefits they are entitled to, which is essential for their long-term financial planning.

– It Avoids Legal Disputes

Proper PF compliance helps prevent legal disputes between employers and employees regarding benefits and contributions. By maintaining transparent and accurate records, businesses can resolve potential disputes more effectively and avoid costly legal battles.

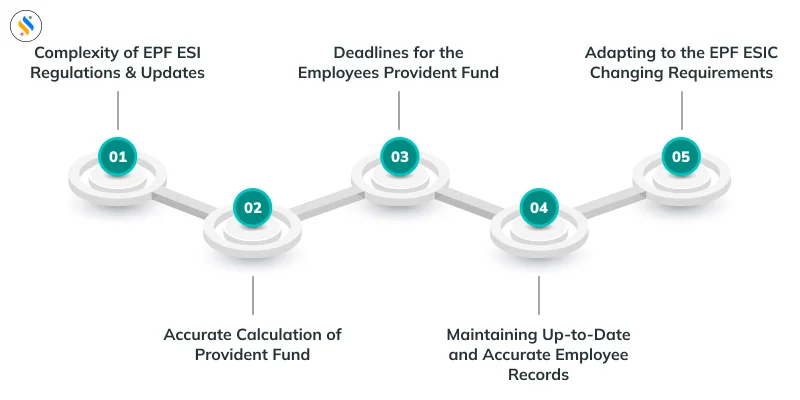

5 Top Challenges Of The PF Statutory Compliance

Despite its importance, PF compliance can be challenging for businesses. Here are the top 5 PF ESI compliance challenges and how to overcome them:

1. Complexity of EPF ESI Regulations & Updates

The constantly evolving regulations surrounding PF and ESI can be daunting for businesses to navigate. Keeping up with frequent changes and updates is crucial for maintaining compliance. Many businesses struggle with understanding these complex regulations, leading to errors in compliance.

Solution:

- Stay informed about the latest updates by subscribing to official notifications from EPFO and ESIC.

- Engage a PF ESIC consultant or an ESI PF advisor who can provide expert guidance. It will help implement payroll changes effectively.

- Invest in PF software that automatically updates with the latest regulations. This ensures compliance without manual intervention.

2. Accurate Calculation of Provident Fund

Calculating PF contributions accurately is essential to avoid potential penalties. Varying employee salaries, allowances, and contributions, ensure precise calculations.

Solution:

- Use PF solutions integrated with your HR payroll software. It can automate calculations and reduce human errors.

- Conduct regular audits to verify the accuracy of PF calculations. This can address any discrepancies promptly.

- Train your HR team to understand the intricacies of PF calculations. It can handle exceptions and special cases effectively.

3. Deadlines for the Employees Provident Fund

Meeting the deadlines for PF contributions and filings is critical to maintaining compliance. Missing these deadlines can result in fines and legal issues.

Solution:

- Implement a robust ESI payroll system that automates reminders and schedules payments. This can help to do well before the deadlines.

- Delegate specific roles and responsibilities within your team. This ensures that PF-related tasks are completed on time.

- Review the PF processes for error-free process.

4. Maintaining Up-to-Date and Accurate Employee Records

Accurate employee records are crucial for PF compliance. Incomplete or outdated records can lead to compliance issues and potential audits. Consider the central employee document management for the same.

Solution:

- Use an integrated HRMS software to centralize employee data.

- Conduct periodic audits to verify the accuracy of employee records.

- Implement a streamlined process in your office.

5. Adapting EPF ESIC Updates

The dynamic nature of EPF and ESI requirements means that businesses must be agile and adaptable. Failure to keep up with these changes can lead to non-compliance and associated penalties. Such as the need to check different acts or updates like- the Miscellaneous Provisions Act 1952.

Miscellaneous Provisions Act, of 1952, outlines crucial aspects such as the establishment of provident fund schemes, pension schemes, and insurance schemes for employees. It mandates contributions from both employers and employees, ensuring financial security for workers. Regular updates to this act reflect changes in social security needs, emphasizing the importance of staying informed to maintain compliance.

Solution:

- Subscribe to industry newsletters and updates to stay informed about changes in EPF and ESI requirements.

- Engage a PF and ESI consultant who can provide ongoing support. This can ensure- your compliance processes are aligned with the latest regulations.

- Regularly review and update your compliance policies. These procedures incorporate changes and best practices.

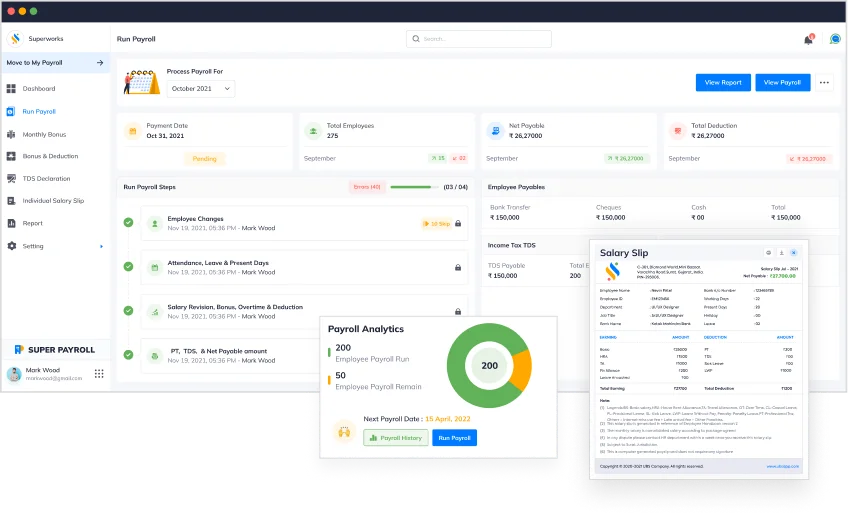

Payroll Software Role For Easy ESI PF Compliance Management

Payroll software such as Superworks plays a vital role in simplifying PF and ESI compliance management. Here’s how payroll software can facilitate easy compliance management:

1. Centralized Data Management

Payroll software integrated with HRMS software centralizes all employee-related data. It makes it easier to maintain accurate and up-to-date records. This centralized approach facilitates efficient data management. This is ensuring that all compliance-related documents are readily accessible for audits and inspections.

2. Automation of Calculations

HR Payroll software automates the calculation of PF contributions and deductions. This payroll automation helps businesses meet compliance requirements without the need for manual intervention.

3. Timely Reminders

Advanced payroll software solutions can schedule payments and filings automatically. This sends timely reminders to ensure that deadlines are never missed.

4. Regulatory Updates & Alerts

Payroll software is made to get regular updates. This feature ensures that businesses are always up to date with new rules. This is reducing the burden on HR teams.

5. Comprehensive Reporting and Analytics

The HR and payroll software offers comprehensive reporting and analytics features that generate detailed compliance reports. It provides valuable insights into compliances.

6. Integration with HRMS Systems

By integrating HRMS with payroll software, you can manage all aspects of employee data, from recruitment to retirement. This integration ensures seamless coordination between HR and payroll departments.

7. Enhanced Security and Data Protection

With advanced security features, HR and payroll software ensures that sensitive employee data is protected against unauthorized access. This security is crucial for maintaining compliance with data protection regulations and safeguarding employee privacy.

Final Thought

In short, PF compliance is important for employers as well as employees. It helps to meet their legal duties and protect employees’ financial interests. By understanding and following PF rules, employers can avoid fines, legal problems, and damage to their reputations. Prioritizing PF compliance also shows a commitment to employees’ welfare and financial security.

PF compliance is an integral part of running a successful business in India. While it presents several challenges, understanding these challenges and implementing effective solutions can help you navigate them successfully.

Moreover, by leveraging technology such as Superworks- HR and payroll management software, you can ensure that your business remains compliant.

FAQs

What Is PF Compliance?

What Is The Compliance Of PF?

The compliance of PF involves several key responsibilities, including

- Calculating the correct contribution on employee wages,

- Ensuring timely deposit of contributions to the EPFO,

- Filing monthly and annual returns,

- Maintaining accurate employee records.

Compliance also includes staying informed about any changes in regulations.

What Is The Limit Of PF Compliance?

The limit of PF compliance typically refers to the salary threshold up to which PF contributions are mandatory.

Employers and employees need to contribute 12% of the employee's salary. As of now, the statutory limit for PF contributions is ₹15,000/ month.

What Is The Basic Rule Of PF?

The basic rule of PF involves mandatory contributions from both the employer and employee, calculated as a percentage of the employee's basic salary and dearness allowance. The employer and employee each contribute 12% towards the Provident Fund. The PF system is designed to provide financial security to employees after retirement.

What Are PF & ESI Rules?

PF and ESI rules encompass the regulations governing Provident Fund and Employee State Insurance contributions and benefits. PF rules require both employers and employees to contribute towards the retirement savings fund, while ESI rules mandate contributions towards medical and social security benefits for employees.