Grab a chance to avail 6 Months of Performance Module for FREE

Book a free demo session & learn more about it!

-

Will customized solution for your needs

-

Empowering users with user-friendly features

-

Driving success across diverse industries, everywhere.

Grab a chance to avail 6 Months of Performance Module for FREE

Book a free demo session & learn more about it!

Superworks

Modern HR Workplace

Your Partner in the entire Employee Life Cycle

From recruitment to retirement manage every stage of employee lifecycle with ease.

Seamless onboarding & offboarding

Automated compliance & payroll

Track performance & engagement

A Beginner’s Guide to Statutory Compliance in Payroll!

- statutory compliances in india

- 8 min read

- December 7, 2023

Exploring the complexities of statutory compliance in payroll can be overwhelming. In this blog, we solve the intricacies and give a guide on how you can guarantee compliance with your finance processes and stay away from legal issues.

From understanding expense commitments to interpreting work regulations, we will offer you bits of knowledge about the fundamental parts of statutory compliance. Whether you’re an HR proficient or an entrepreneur, understanding these standards is critical for encouraging a compliant as well as effective payroll framework.

Prepare to leave on an excursion that demystifies statutory compliance, enabling you to explore finance liabilities with certainty!

Let’s dive in and explore everything about statutory compliance!

What is Statutory Compliance in India?

Statutory Compliance In HR directly refers to fulfilling the legal requirements of rules and regulations set by the governing authorities.

Understanding statutory compliance in India is basic for organizations working in this powerful and various country.

India’s administrative scene is complex, incorporating work regulations, tax collection, ecological guidelines, and industry-explicit standards. Exploring this intricate territory is essential for associations to stay away from legitimate implications and guarantee smooth activities.

Labor regulations in India, governed by various Acts like the Industrial Disputes Act and the Minimum Wages Act, set the establishment for employee-employer relations.

Also, tax compliance under the Goods and Services Tax (GST) and the Income Tax Act demands meticulous attention to detail. Environmental laws, such as the Water (Prevention and Control of Pollution) Act and the Air (Prevention and Control of Pollution) Act, mandate adherence to sustainable business practices.

Understanding these guidelines requires persistent checking and transformation to changes, as India’s legitimate system depends on revisions. Neglecting consent can bring about punishments, legitimate questions, and harm to an organization’s standing.

In synopsis, grasping statutory compliance in India is an essential need. It mitigates legitimate dangers as well as encourages a dependable and moral business climate.

By remaining educated and proactive, organizations can explore the intricacies, guaranteeing their tasks line up with the lawful necessities of this energetic and quickly developing financial scene.

To read More: Streamlining Your Business with Salary Management: The Ultimate Guide

What are the Statutory Compliances in HR?

Statutory compliance in HR has a direct meaning in which the people should follow all the legal rules and regulations which is set by the government only. This will include various laws about minimum wages, working hours, health and safety, and tax deductions. Here, let us provide you an example, businesses must adhere to the Minimum Wages Act, which is provided by Employee State Insurance (ESI), and deduct Provident Fund (PF) contributions.

By making sure of compliance, companies can easily avoid legal troubles and efficiently create a fair workplace. And that is exactly what Superworks’ payroll solution does, as it helps manage these compliances easily, ensuring your business stays on the right side of the law.

Importance of Statutory Compliance in HR

Now that you know what is statutory compliances in India, let’s understand its importance!

Guaranteeing legal compliance in HR is in excess of a legitimate commitment; it’s an essential basic for associations. Compliance shields against lawful repercussions, monetary punishments, and reputational harm.

By complying with nearby and public guidelines, organizations establish a safe and moral workplace. Legal compliance in HR envelops a range of variables, from work regulations to working environment well-being, hostility to separation measures, and representative advantages. Past gamble moderation and compliance encourage representative trust and fulfillment. A straightforward and consistent HR structure supports the association’s obligation to moral works, building up its image esteem.

Also, compliance straightforwardly influences the ability to obtain and maintain. Potential representatives look for associations that focus on their prosperity, and adherence to legal standards flags a pledge to worker freedoms and fair treatment. This, thus, adds to a positive working environment culture, improving efficiency and resolve.

In the consistently developing scene of work regulations, keeping up to date with changes is fundamental. Resistance can prompt fights in court, monetary difficulties, and functional disturbances.

Accordingly, putting resources into powerful HR rehearses that focus on legal compliance is an interest in the life span and progress of the association.

At last, the significance of legal compliance in HR reaches a long way past lawful boxes to check — it is the foundation of a strong, capable, and flourishing working environment.

List of Statutory Compliances in India

Making yourself acquainted with every one of the material legal compliances is fundamental. So you want to be familiar with Indian compliances. You want to guarantee you approach all compliances applied to Indian organizations.

-

The Minimum Wages Act, 1948

-

The Professional Tax Act( PT) 1975

-

The Payment of Wages Act, 1936

-

The Child Labour Act, 1986

-

The Payment of Gratuity Act, 1972

-

Shops And Commercial Establishments Act ( S&E)

-

The Employees Provident Funds- 1952 ( EPF)

-

The Payment of Bonus Act, 1965

-

The Employees State Insurance Corporation Act ( ESIC), 1948

-

The Equal Remuneration Act, 1976

-

The Contract Labour Regulation & Abolition Act- 1970 ( CLRA)

-

The Factories Act, 1948

-

The Employees Compensation Act, 1923

-

The Apprentice Act, 1961

-

The Industrial Employment Act 1946

-

The Employment Exchange Act- 1959

-

The Industrial Disputes Act, 1947

-

The Industrial Establishment Act, 1963

-

The Trade Unions Act, 1926

Assuming that you deal with these compliance acts, you won’t fall into any issues.

Unable to meet compliance needs on time?

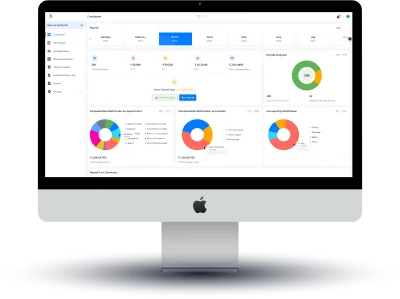

Worry not– just rely on Superworks! Superworks offers the best payroll solution in India namely Super Payroll. Super Payroll makes payroll and compliance management much easier and faster for businesses.

Click the link below and learn more about Super Payroll!

Why the Statutory Compliances Are Needed For Indian Payroll?

These are legal circumstances that organizations need to follow for their finance activities in India. There are several benefits of statutory compliance laws mentioned below:

TDS:

Each business needs to take TDS under section 192 of the ITAct 1961 assuming that the representative’s compensation is higher than the tax collection limit. There are a few factors that influence TDS, for example, trip remittance, investments, training recompense, exceptional stipend, HRA, and clinical stipends. Payroll software like Superworks gives HR the autonomy to complete the TDS cycle in a tap or so.

Gratuity:

It’s a sum to be given to representatives who have worked for at least 5 years in any organization.

Minimum Wages Act:

This act requires fixing negligible compensation costs for unskilled and skilled workers. This act guarantees compensation for negligible endurance and deals with their schooling, clinical, and different necessities. In India, this act ought to be compliant with the utilization of finance programming. Don’t stress, Superworks– the best payroll software India has, will deal with it.

ESI and PF Fund Deduction:

PF is the required commitment of a worker for future purposes after retirement, and ESI is appropriate for that large number of representatives whose pay is 15,000 INR or less each month. It tends to be directed according to compliance.

Professional Tax:

PT is a state-based duty, and it is the legal derivation from a worker’s gross pay prior to figuring charge.

These are some legal compliance you want to deal with as an HR or business or worker. If you would rather not do it physically then you can consider it to get the best finance the board programming.

How Superworks Can Help You?

Superworks is one of the best HR payroll software in India. It offers the best payroll solution namely Super Payroll that can deal with all the aforementioned legal compliance conditions in India for organizations, everything being equal. The product permits you to deal with your worker’s PF, ESI, and TDS and compute finance subsequent to regularizing these.

Does your organization observe the guidelines and guidelines? If as a HR you are bombing in this, you should go for the best framework that assists you with wiping out these mix-ups from now on. We’re fearful about the various regulations that are continued in India. Simply get the right situation.

Bottom Line

As we close this guide for all the beginners out there who are just new to these legal terms, we hope you’ve acquired important bits of knowledge into the many-sided universe of lawful guidelines encompassing finance processes.

Furnished with information about charge commitments, work regulations, statutory compliances in india and other basic parts, you’re currently better prepared to guarantee compliance and productivity in your finance framework. Keep in mind, that remaining educated and proactive is vital to staying away from entanglements and lawful difficulties.

Embrace the continuous educational experience, remain refreshed on administrative changes, and consider counseling experts when required. With a strong comprehension of legal compliance, you can unhesitatingly oversee finance liabilities, adding to the smooth working and progress of your association. Make the payroll management process easier today with the right online payroll system!

Also see: online payroll software demo | best payroll management software in india