Grab a chance to avail 6 Months of Performance Module for FREE

Book a free demo session & learn more about it!

-

Will customized solution for your needs

-

Empowering users with user-friendly features

-

Driving success across diverse industries, everywhere.

Grab a chance to avail 6 Months of Performance Module for FREE

Book a free demo session & learn more about it!

Superworks

Modern HR Workplace

Your Partner in the entire Employee Life Cycle

From recruitment to retirement manage every stage of employee lifecycle with ease.

Seamless onboarding & offboarding

Automated compliance & payroll

Track performance & engagement

Payroll And Statutory Compliance In India A Complete Overview

- statutory compliance in payroll

- 10 min read

- May 20, 2024

Without any rules and regulations, any business can fall apart, and no one can say no to that! Every organization in India invests lots of their crucial time, effort, and money, just to ensure the payroll and statutory compliance can be done as per the law of the land. If not done properly, there can be fines, and punishments from the government.

More than the fines and the punishment given by the state, there can be far more worrisome issues a company may face for not doing payroll and compliance properly. For this reason, there can be a large list of aggressive employees, or angry unions revolting their way up to the employer for instilling proper payroll systems [like Superworks]!

However, we are not blaming such companies for their inability for not doing payroll statutory compliance under the act of the land. Rather, we are here to share a highly efficient HR payroll and compliance software with you readers, after you have understood all the needed details of statutory compliance in India.

So, let’s go through this highly informative blog that will consistently enlighten you about HR compliance in India!

What is Payroll and Statutory Compliance?

The questions we will be answering today…

‘What is payroll?’

‘What is statutory compliance?’

‘Why do we need them both?’

‘How does staying compliant help organizations?’

‘Why are they both crucially important for both the employee and the employer?’

As an organization ‘You are doing payroll’ means you are paying your employees their fixed salary [as discussed]. But doing payroll [the payment of wages] can never be that simple, as you have to calculate wages, tax deductions, bonuses calculation, and the delivery of payments.

And the other factor, statutory compliance in payroll, deals with the numerous labor and taxation laws imposed by the government. Moreover, if you are doing business in some other country, you will have to comply with their norms for payroll and statutory compliance.

These laws are designed to ensure that employees are treated fairly and that employers meet their legal obligations in terms of payroll and statutory compliance. Under the act of payroll statutory compliance the employee and the employer both are safe from any potential fraud that can happen! So now for the sake of doing business by the law, you have understood the what’s whys! And by keeping these in mind you will be ensuring,

- Whether the payment of bonus has been delivered or not!

- The payment of wages has been give or not? Like the minimum wage and the assigned one!

- Is the payment of gratuity- given or not?

- The demands from trade unions have been met or not?

- Was the overtime calculation correct?

- Have the tax deducted at source as per the tax regime?

- What about the employees state insurance?, and more…

The Role of Payroll and Statutory Compliance

The role of payroll and statutory compliance is a must as it works as one of the few strong pillars on which the organizational work rests. Because of that, only the employees are getting paid correctly and on time, with LWF meaning in pay slip to indicate relevant deductions or contributions.. Based on the last drawn salary the employees keep themselves motivated and continue to work satisfactorily within the workspace.

The role of payroll audit checklist or payroll statutory compliance is multi-dimensional because apart from doing payroll by the law, it also keeps accurate records! It is crucially important for both internal management and external audits.

Other than Ensuring Payroll And Statutory Compliance requirements, it also promotes trust and transparency within the organization. It also helps to create a safe space for employees, where they can trust their employer.

Why is Statutory Compliance Important?

For employees based on the payment of wages [which is given by the employer], a salary is the fruit of their efforts. And as soon as they get access to the salary slip generator, they feel satisfied as of now, because their efforts have been valued.

As per the rules and regulations, let us show the importance of the payroll statutory compliant process line by line:

Legal Protection: Payroll and statutory compliance with labor laws keeps the organization safe from legal troubles. Furthermore, it ensures that the company continues to operate within the framework of the law.

Employee Welfare: Payroll and statutory compliance ensures the employee’s benefits, such as minimum wages, timely payment, and various other entitlements.

Avoiding Penalties: Non-compliance can lead to heavy fines and legal penalties and we have understood pretty clearly, right? And furthermore, ‘under section of labor act,’ helps employees to grow and helps maintain the financial health and reputation of the organization!

Operational Efficiency: Other than providing social security Following statutory guidelines helps in maintaining a systematic payroll process, leading to better operational efficiency.

Ample times here, we have mentioned above ‘as per the laws,’ ‘based on the rules and regulations,’ but what are those laws? Worry not! Because the next section exists to enlighten ourselves with the fresh knowledge of the Acts [made by the Indian government]! So let’s go through them, at once.

Payroll Laws You All Should Know

What is statutory compliance in HR? And about the HR statutory compliance in India, we have learned quite a lot from the above sections. But away from the statutory compliance HR and compensation management in HRM, there are laws for payroll, with more than enough benefits for the employees.

Here are some of the key payroll laws every employer in India should be aware of:

The Income-Tax

this act applies to all the people who are earning money in the great nation of India, and as per the specific slabs of earning people have to pay their taxes. And surely there are various exemptions as per the income, loan, and various other factors. The government of India continues to make changes in every financial year so it can be better and continue to bring betterment for the citizens.

Employees Provident Fund Act

It was created for the better future of the employee. Because here, the amount of money an employee earns every month, his/her employer will have to pay a certain percentage to the employees provident fund account. And through this process of labour compliance, the employee at the time of retirement will get a lump sum amount to live peacefully by the age of retirement.

The Minimum Wages Act 1948

‘This minimum wage is to be paid by the employer to each employee.’ As you can see this act ensures that every employee should receive a minimum wage for their labor. It is applicable to all workers to keep them safe from exploitation by the employer and ensures fair pay for their workers.

Payment of Bonus Act 1965

This act applies to all establishments where at least 20 or more employees are working. This act ensures a minimum bonus of 8.33% of the wages. However, it applies to employees whose salary is below a certain threshold. And it is made so the employee can share its profit with employees.

Thinking about complex payroll, and how to do them?

Lose your stress as Superworks is there for the solution! Use it and make your payroll and compliance management much better, smoother, and faster!

Try once to complete even the complex payroll with ease!

Payment of Gratuity Act 1972

As per the payment of Gratuity Act 1972, the employer will pay the gratuity amount to the employees in the form of gratitude. But only employees who have completed a continuous service for at least 5 years are entitled to gratuity. It acts kind of a retirement benefit, and it will be calculated based on the employee’s last drawn salary and the number of years of service.

Equal Remuneration Act 1976

This act of the law book ensures equal pay for men and women at the same time for the same or similar work, with no differences. ‘Both to be paid equally, regardless of their gender,’ this became possible only after this law came into action, and has ended gender-based discrimination in terms of wages.

The Industrial Disputes Act 1947

This act stands to ensure harmony among the employer and the employees, so every possible dispute can be avoided firsthand. Here, the person can access a legal framework for the investigation and settlement of industrial disputes, preventing strikes and lockouts, and ensuring the continuity of production.

Employees State Insurance Act 1948

The Employee State Insurance (ESI) Act ensures the worker’s health insurance. And it applies to factories and other establishments where the number of workers is 10 or more. It covers medical and cash benefits for the employees and their dependents in case of sickness, maternity, or employment injury.

Labour Welfare Fund Act, 1965

As the name states, it is for laborers and ensures their welfare by providing various facilities and amenities. As per the act, the funds will be contributed by both employers and employees and be used for the betterment of labor conditions and welfare activities.

Payment of Wages Act 1936

This law ensures the ‘Timely payment and no unauthorized deductions’ to certain classes of employees. And here as per the law created by the Indian government, the Employers must pay wages as per the agreement, on the given date, and without any deductions except those authorized by law.

Stay Updated on Changing Acts and Policies

All of the above-listed laws are to be respected, and every organization should comply with them. So, all the employers in the please go through the list of statutory compliance in detail, and continue to stick with that. And we appeal to all the people [whether you’re an employer or employee] to stay up-to-date with the updates of these consistently changing Acts and policies, before doing payroll and statutory compliance.

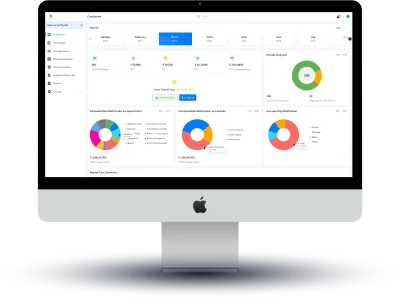

The Best Cloud Payroll Software- Superworks

Reading all these laws may not be the topic of your interest, and to be honest, it is completely normal. But still, we have to comply with these laws for doing error-free payroll and statutory compliance. So, before you begin to search for the best…

- HR payroll software

- Workforce management software

- Payroll management software

- Cloud-based payroll software

- Attendance Software

- best HR software

- HRMS software

- Compensation software

Let us introduce you to the Superworks! An ultimate payroll software, because of which doing payroll and statutory compliance as per the law has become one of the easiest tasks ever. Because here with Superworks, you can do quick and accurate payroll calculations and create instant reports right away.

Stay tuned, as our next blog regarding Payroll and statutory compliance will be soon here., in which we will be talking about the amazing features of Super Payroll [statutory compliance software of Superworks]!

Also see: departure report for earned leave | Labour welfare fund | payroll process in india | payroll tool india