Grab a chance to avail 6 Months of Performance Module for FREE

Book a free demo session & learn more about it!

-

Will customized solution for your needs

-

Empowering users with user-friendly features

-

Driving success across diverse industries, everywhere.

Grab a chance to avail 6 Months of Performance Module for FREE

Book a free demo session & learn more about it!

Superworks

Modern HR Workplace

Your Partner in the entire Employee Life Cycle

From recruitment to retirement manage every stage of employee lifecycle with ease.

Seamless onboarding & offboarding

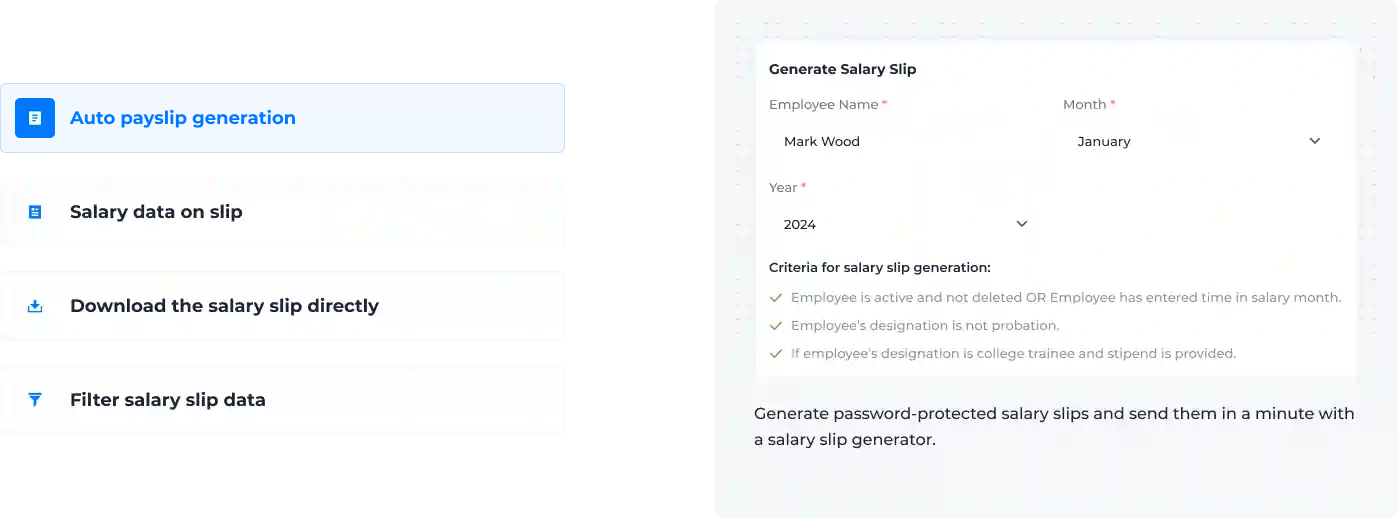

Automated compliance & payroll

Track performance & engagement

Enjoy stress-free payroll processing

No more last-minute payroll hiccups. Reduce manual payroll processing errors and digitize your salary disbursal.

Hear why 200+ HRs choose Super Payroll software

Ease your payroll processing with the best payroll software

Blogs

Stay ahead with the latest industry insights