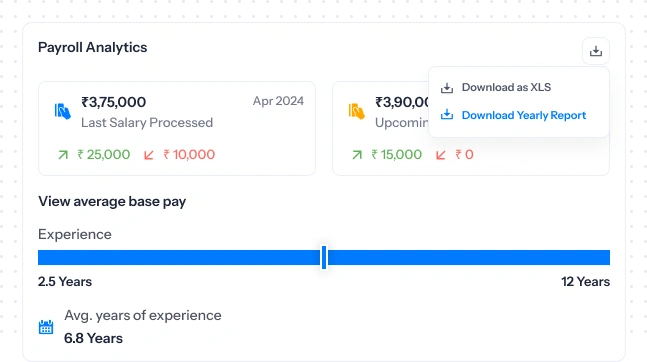

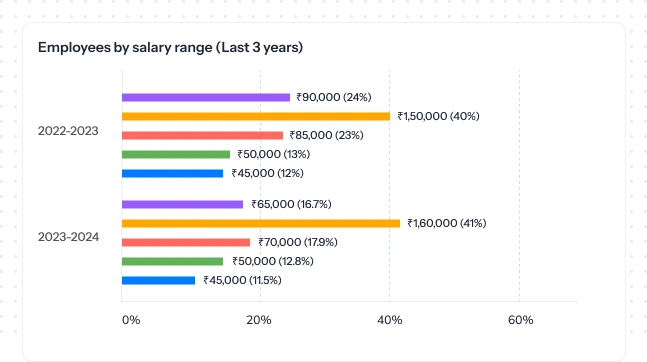

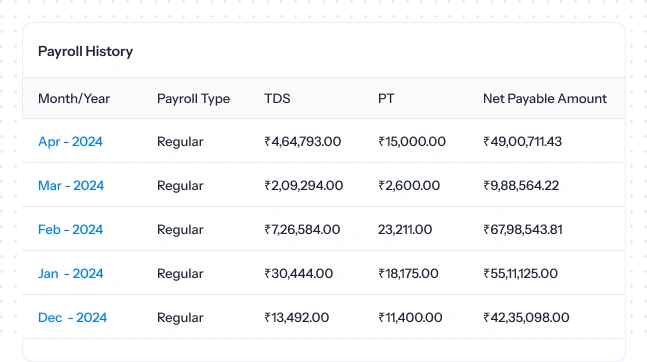

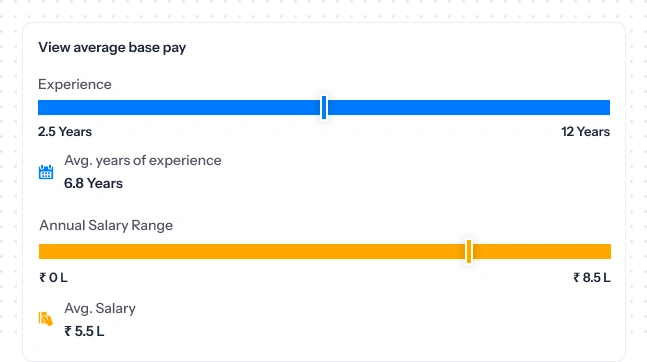

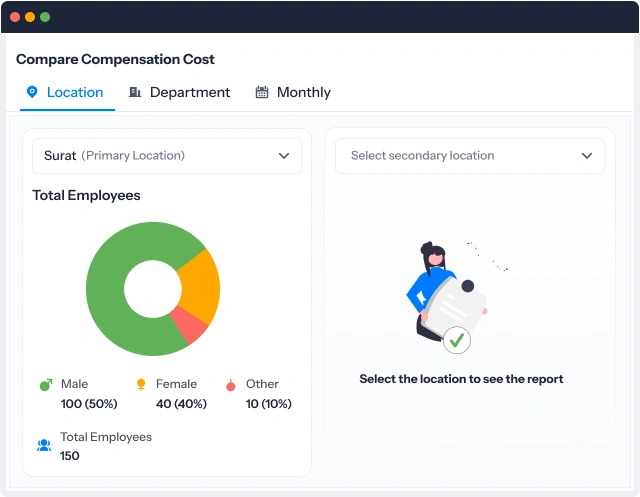

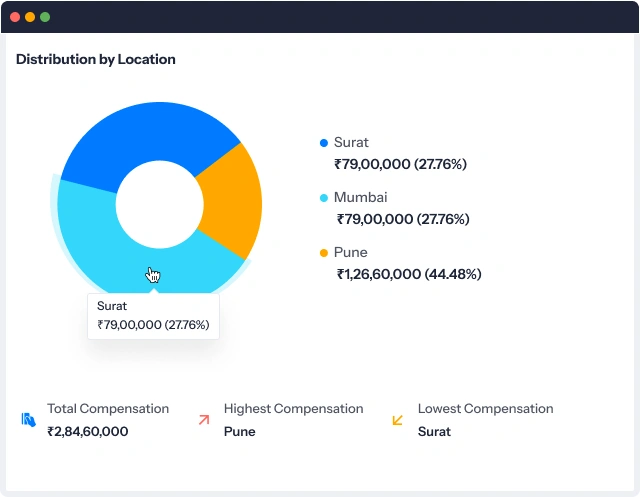

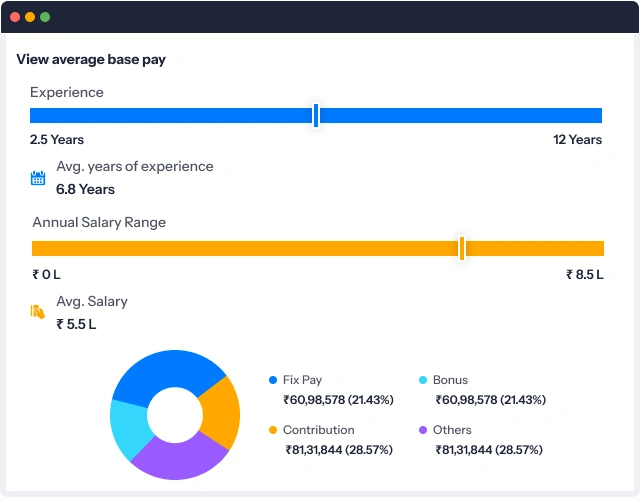

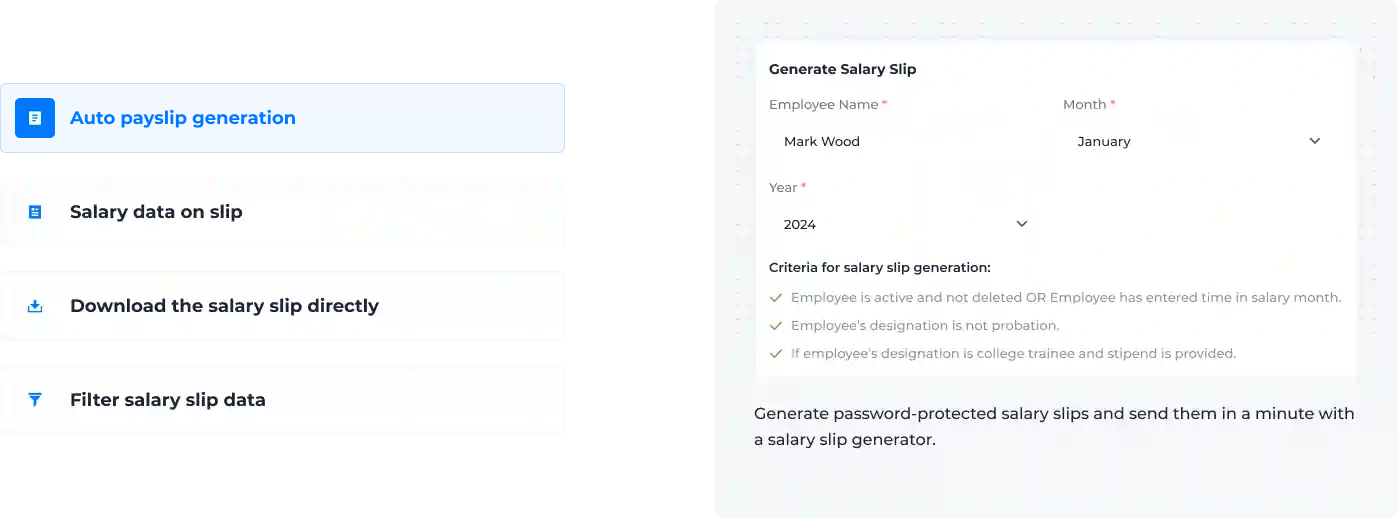

A payroll analysis report gives detailed insights into employee compensation, deductions, taxes, and net pay. Moreover, such reporting and analytics help companies track their labor costs, ensure compliance, and plan budgets effectively. You can have a look at the listed pictures to see an example of a payroll report.

Grab a chance to avail 6 Months of Performance Module for FREE

Book a free demo session & learn more about it!

-

Will customized solution for your needs

-

Empowering users with user-friendly features

-

Driving success across diverse industries, everywhere.

Grab a chance to avail 6 Months of Performance Module for FREE

Book a free demo session & learn more about it!

Superworks

Modern HR Workplace

Your Partner in the entire Employee Life Cycle

From recruitment to retirement manage every stage of employee lifecycle with ease.

Seamless onboarding & offboarding

Automated compliance & payroll

Track performance & engagement

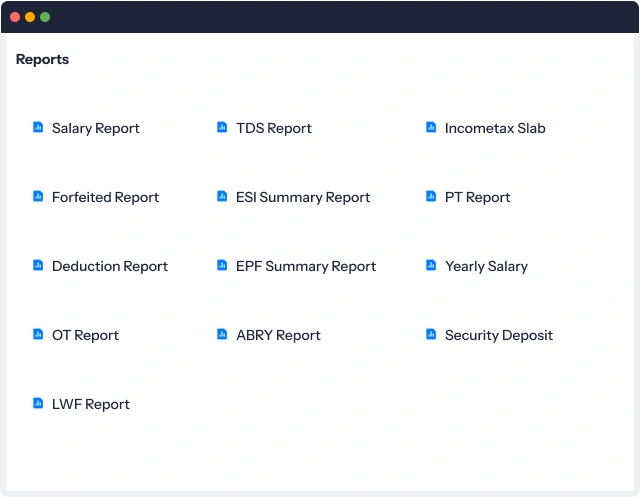

Make confident payroll decisions with data that matters

Access detailed, accurate, and ready-to-use reports that simplify every payroll choice.

Smart payroll reporting. Everything you need in one dashboard

Access real-time reports directly from your analytics hub. All the clarity, none of the chaos.

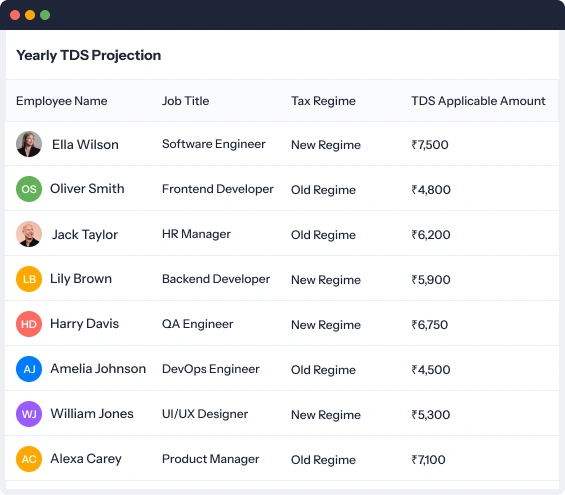

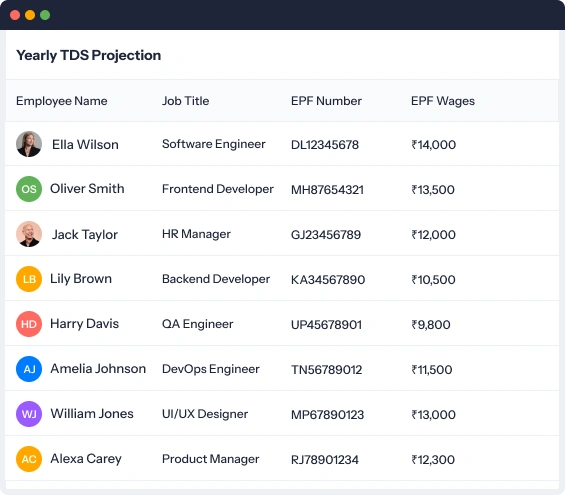

Yearly TDS projection made simple

Track employee-wise tax estimates and streamline your compliance in one place. You can even auto-generate projections for every employee, and easily view claim amounts and total tax in real time.

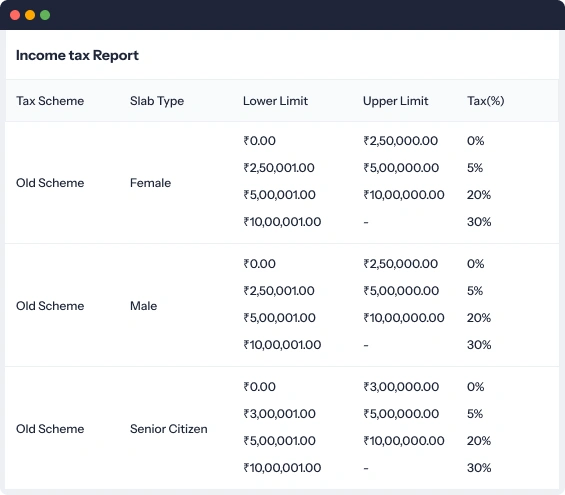

Income tax slab report

You can easily keep up with new tax regimes and seamlessly compare slabs with no worries. All you have to do is look over updated income tax slabs, categorized by gender, tax scheme, and year, all from one dashboard.

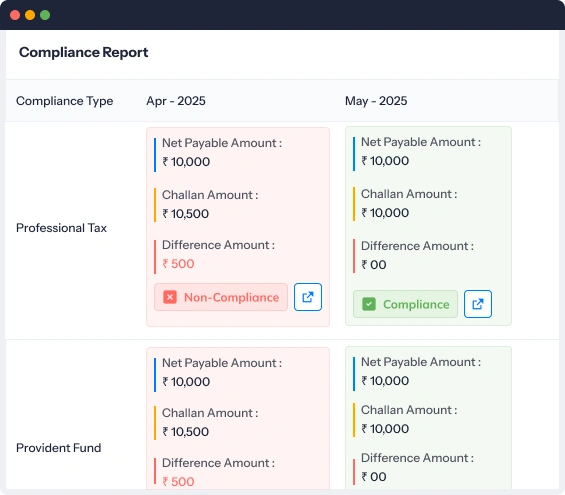

Stay audit-ready with compliance reports

Get clear, accurate updates on your organization’s statutory compliance—Professional Tax, Provident Fund, and ESIC in one view. This way, you can easily avoid penalties and even identify gaps in compliance status.

Track ABRY contributions without manual errors

Get clear visibility into employer contributions under the Atmanirbhar Bharat Rojgar Yojana (ABRY)—all in one place. Moreover, you can always see the breakdown by employee, location, and job title.

Why 200+ Businesses Count on Our Payroll Analytics

Whether it's compliance, cost control, or salary breakdowns, our customers love how easy & insightful reporting has become

Blogs

We are here to help you find a solution that suits your business need.