Grab a chance to avail 6 Months of Performance Module for FREE

Book a free demo session & learn more about it!

-

Will customized solution for your needs

-

Empowering users with user-friendly features

-

Driving success across diverse industries, everywhere.

Grab a chance to avail 6 Months of Performance Module for FREE

Book a free demo session & learn more about it!

Superworks

Modern HR Workplace

Your Partner in the entire Employee Life Cycle

From recruitment to retirement manage every stage of employee lifecycle with ease.

Seamless onboarding & offboarding

Automated compliance & payroll

Track performance & engagement

Compliance Benefits of Using Payroll Services – Switch to Superworks!

- Superworks

- 6 min read

- February 9, 2024

Payroll compliance is an ever-changing area that affects all businesses. Not following the payroll laws and regulations can lead to fines, penalties, or other legal complications. The use of a payroll service can ensure that your company remains in compliance, and does not make any costly mistakes.

If you don’t know what is payroll services, how they help to manage your compliances, then you need to go with this blog.

Within this article, we will also discuss some of the top compliance benefits you can achieve by working with a payroll provider. Let’s find out how online payroll services software can help you with this!

To Read More : How A Payroll Service Provider Can Help Small Businesses Manage Payroll

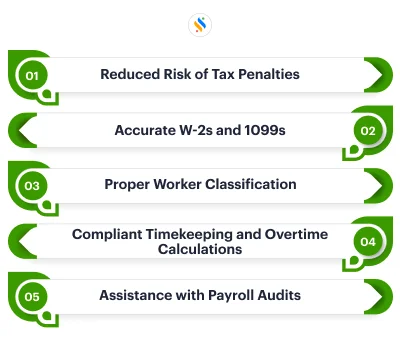

5 Reasons Why You Should Switch to a Payroll Software

There are multiple facts and reasons you need to consider- why you should consider the best payroll services for small business.

1. Reduced Risk of Tax Penalties

The biggest compliance risk for businesses is the tax errors leading to the IRS penalty. Payroll taxes are intricate, as guidelines vary federally, state, and municipal. One simple error can result in penalties for late remittance or filing.

Payroll services have dedicated professionals who know the law of withholding taxes and are aware of changes in this area. They ensure that all tax filings and payments are done for you to eliminate errors. This means that you save time, and there is also an assurance of filing your payroll company taxes correctly.

2. Accurate W-2s and 1099s

Another payroll service compliance requirement involves producing correct W-2s and 1099 for employees, as well contractors. Tax agencies are quick to catch the smallest of mistakes. In the case of payroll providers, they promise that the annual tax statements will be corrected by IRS rules.

Their systems also automatically compute withholdings, deductions, and wages for every employee and contractor. This eliminates errors that cause W-2C c and 1099 corrections in later days.

3. Proper Worker Classification

The classification of workers as employees or independent contractors affects payroll compliance. Incorrect labeling of the employees may cause fines, back taxes, and other penalties.

Payroll services are experienced in worker classification rules. This will make sure you categorize every employee according to their performance and connection with the business.

This will save you from misclassification penalties and audits. Choosing the right HR payroll software can be your key to boosting workplace productivity!

Read more: What Are The Hidden Benefits Of Salary Software? Decoded In 10 Different Ways!

Is your payroll management system reliable? – Check Out Superworks!

Our Super Payroll lets you handle and monitor your payroll data with ease and accuracy.

Find out how Superworks can help you reduce hassle, avoid mistakes, and comply with regulations.

4. Compliant Timekeeping and Overtime Calculations

Overtime calculation is important to track time rigorously and calculate the overtime required for FLSA compliance. They link up with verified time-tracking solutions so that the earnings for a pay period are exact.

Their systems automatically mark up for overtime based on hours worked per week and pay premium overtime rates. This ensures that non-exempt employees are not paid less than what they should be for overtime work.

It also helps in the provision of work-time records necessary to support a wage claim.

Read More – Boost Your Payroll Software Company With 7 Exciting New Trends

5. Assistance with Payroll Audits

But even if you do everything right, your business may be chosen for a payroll tax audit. Payroll providers are specialists in conducting audits on your behalf. They will provide payroll audit checklist with relevant documents, data, and earning statements.

Their ability to meet auditor requirements can speed up the process. In addition, this includes their audit assistance as a regular payroll service.

Stay Compliant to Laws With Payroll Services in India

a. Current Labor Law Compliance

Any challenges in keeping up-to-date with federal, state, and local employment laws are everlasting. Payroll services track labor regulations that affect payroll administration, including minimum wage hikes.

They’ll tailor your practices and systems, as necessary to ensure compliance. In addition, most providers provide employee handbooks HR workflows, and compliance training to reinforce the provision of labor law acts.

Since laws are prone to change, investing in the best payroll services for small business as well as large enterprises is a great idea!

b. Electronic Payroll Tax Payments

Besides tax filings, payroll service providers also take care of timely remittance of taxes on your behalf. They electronically send you your payroll tax from the business bank account according to each period’s liability.

Reliable payroll software India helps you avoid any tax penalties and interest for late payments.

c. Multi-State Tax Compliance

Managing regional payroll taxes is extremely complicated for companies with staff in several states. Localities differ largely in rates and rules. Multi-state payroll providers keep a full understanding of multi-state regulations across their local and regional markets.

Their systems automatically use the right taxes and regulations for each employee depending on her or his location of work. This prevents mistakes and non-conforming payroll processing in different states.

d. HR Support Services

Many leading payroll providers provide add-on human resource analytics services that further enhance compliance. This covers help in developing compliant job postings, employment policies, workplace safety programs, and employee handbooks.

They offer sample I-9s, new hire documents, and onboarding checklists which are linked to payroll. Their payroll in HR knowledge ensures your compliance with both federal and state employment laws.

e. Compliant Payroll Funding

The requirement for adequate funds to cover payroll is regularly missed by firms. The payroll providers will not process your account until it has been properly funded to avoid an insufficient funds problem.

Their automatic reminders and cash flow analysis guarantee that you have full payment of employees according to the regulations. They will also freeze payments in case of fraud suspicion to avoid unfair disbursements.

The payroll providers practice strict procedures that enable them to pass these audits. They can guide auditors throughout their compliant payroll procedures stage by stage.

Conclusion

Internal payroll management exposes your company to considerable compliance risks and operational challenges. Opting for the best workforce management software streamlines your service payroll. It also helps your employees to be more productive. How do business owners find the best way to deal with payroll and tax operations? By switching to Superworks’ payroll software!

Our payroll system is a perfect choice for business owners and employees! With end-to-end payroll services, regular updates, and compliance savviness, you are free to manage your business without worrying about payroll. The peace that comes along with it and the risk reduction is worth investing in payroll service software.

Also see: payroll management services | best payroll software | payroll tool india