Grab a chance to avail 6 Months of Performance Module for FREE

Book a free demo session & learn more about it!

-

Will customized solution for your needs

-

Empowering users with user-friendly features

-

Driving success across diverse industries, everywhere.

Grab a chance to avail 6 Months of Performance Module for FREE

Book a free demo session & learn more about it!

Superworks

Modern HR Workplace

Your Partner in the entire Employee Life Cycle

From recruitment to retirement manage every stage of employee lifecycle with ease.

Seamless onboarding & offboarding

Automated compliance & payroll

Track performance & engagement

Features, Benefits & Goals of The Payroll Systems For Your Business

- Superworks

- 9 min read

- January 24, 2024

Many people don’t know the magic of payroll systems!

But, you can help yourself by adopting a payroll system for your business. For people who don’t know what is payroll and how does payroll system works, this blog is for them.

Handling payroll is a tough but very important job for a company. It needs to be done accurately to keep employees happy and avoid legal issues. Every part of payroll, from figuring out salaries to keeping records, has to be free of mistakes so that employees trust the company.

Doing this manually, especially when employees are in different places, can be a big hassle for your team. In this case, your company needs payroll systems. When paying your employees, a payroll system can make this monthly task much easier. It can automate tasks and save time for your HR and payroll team.

One question for you,

-

Do you spend a lot of time manually handling payroll for your staff?

It’s possible for humans to keep up with bills and annual tax filings. But keeping track of everyone’s income, taxes, paperwork, time off requests, attendance records, pay, and bank accounts is tough. Let’s understand what is payroll system, compensation management, loan management software, and many more.

Modern HR payroll systems can help you with even the most difficult payroll processes. Let’s see how payroll software in India works before talking about the benefits of using such a program.

What Can You Expect From Good Payroll Systems?

To address this issue, technology companies have developed payroll apps, providing a straightforward solution for handling tasks related to employee payments.

The payroll software is designed to be automated, streamlining the processing of employee payrolls in a methodical and organized manner that caters to the specific needs of a business.

Read more: 5 Top Challenges in Managing Global Payroll and How to Overcome Them Easily

Don’t want to face payroll challenges? – Try Superworks payroll systems

Boost employee happiness, ensure legal compliance, and enhance your company’s reputation with advanced payroll systems.

Connect with our expert to know more about payroll system software!

When selecting a payroll system, it’s crucial to choose one that aligns with your business requirements. An effective payroll system should possess the following characteristics:

1. Accuracy

Accuracy is a key feature. It should be capable of integrating various working hours for different employees. Upon implementation, the system should accurately record employees’ working hours, reducing errors through an automated Process.

2. Record-Keeping

Record-keeping is another essential aspect. A good payroll system allows for detailed tracking of information and records. These records can be stored in a central database, whether online, on-site, in a recordkeeping facility, or on the cloud. This feature helps in monitoring expenses like overtime pay and employee participation in retirement plans, ensuring compliance with laws, and facilitating preparation for audits or investigations.

3. Deductions

Deductions are not limited to basic pay and hours. A robust payroll system should be equipped to handle more complex functions, such as tax deductions and benefits. This involves considering individual factors like Medicare, social security, and benefit plans for precise calculations.

4. Streamlining

Streamlining is facilitated by an automated payroll system. It serves as a valuable tool in eliminating busywork by streamlining the entire process of record-keeping, scheduling, and payment. Employees can conveniently access their records, print pay stubs, and even request time off through an automated process. Advanced features enable the standardization and streamlining of payroll systems, allowing for automation of alerts regarding overtime pay or exceeding allocated time off.

Good payroll systems, no matter their type, can be made more organized and efficient with clear instructions.

You can also set up systems to automatically tell you when employees are working extra hours for overtime pay or when they’ve used up a specific amount of time off.

Read More – Boost Your Payroll Software Company With 7 Exciting New Trends

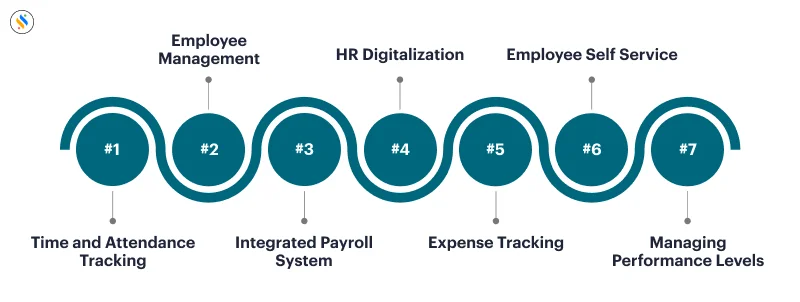

7 Features of a Modern Payroll System That Make the Process Smooth

Progressive payroll management system solutions make payroll processes easy for companies for HR. They also save managers and executives from spending too much time and money on repetitive payroll tasks.

This kind of payroll software is really helpful for keeping track of paychecks. With a reputable payroll management system, you can watch over things like employee pay rates, deductions, earnings, and more.

1. Time and Attendance Tracking

Besides evaluating payroll, well-integrated best payroll software also supports different attendance methods like swipe cards, attendance software for biometric, and other devices.

![]()

This time and attendance tracking helps keep track of employee’s working hours and ensures they get paid for overtime. A comprehensive cloud-based payroll system also organizes all types of data neatly.

2. Employee Management

Good human resources or payroll software also makes employees and the whole organization more efficient.

Most payroll service management systems collect accurate data to automate business workflows, showing information through charts and graphs.

3. Integrated Payroll System

A good payroll software needs to have a properly integrated solution, which some organizations might overlook. This kind of integration helps improve employee performance, makes tasks simpler, ensures global compliance, and provides comprehensive real-time reports.

4. HR Digitalization

Always choose payroll software that uses the latest technology in everyday tasks. Automating tasks with payroll software is a good idea if you feel overwhelmed with repetitive work. This kind of service can save time and money for business owners.

5. Expense Tracking

This is an important feature of payroll software that helps manage employee expenses related to reimbursement, claims, and approvals. It’s a must-have in this kind of software.

6. Employee Self-Service

Modern payroll systems are smart, allowing employees to find solutions to their questions. An automated payroll solution ensures a smooth process for everyone.

7. Managing Performance Levels

Salary software monitors employee performance, and managers can give feedback based on that. Handling such a large amount of data manually is tough, but a payroll company management system makes it easy.

It also helps with HR functions like promotions and transfers and deals with changes in employee positions, grades, and locations.

Also, See: 8 Best Practices for Managing Employee Payroll – Processing, Taxes, Compliance!

Most Impactful Reasons for Investing in Best HR Payroll Software

– Employees & HR Satisfaction

Paying employees on time makes them happy and satisfied. Late payments make employees sad and can lead to lower performance. So, this is an important reason to get the HR payroll software & Happy employees to work better.

Paying employees consistently and promptly makes them feel secure about their finances, making the overall work environment better.

– Compensation Tracking

Payroll management software is better than traditional systems that make everything regarding compliance and tax easy. It boosts employees’ confidence and is connected to evaluating their performance through the payroll system.

To keep employees, it’s important to offer good salaries and bonus benefits.

– Company Reputation

Well-managed payroll software helps meet financial obligations and builds a stable market reputation for the company. Being a good employer attracts and keeps more talented people.

The best payroll Software for payroll in HR also manages overtime, minimum wages, and termination procedures. Choosing a good solution can be very effective for you in handling these aspects.

– No Fine & Penalty

The Software for payroll ensures adherence to legal requirements. Choosing a reliable solution helps in avoiding fines and penalties associated with non-compliance, making it effective for overall management.

Superworks- Payroll Software In India Promises To:

This Superworks system is not just capable of creating payroll for its employees but also allows them to access all the information they need about their payroll processing, deductions, and leave management faster and with more accuracy. The Superworks payroll system is among the top systems for digitizing payroll methods and is a smart tool to enhance your payroll management.

If you don’t know much about- what is payroll management system, you need to once check the website to learn more. It includes various features like employee details, computation of offered salary, employee portal, investment declarations for IT, TDS calculation based on investment, leave, allowances, travel, etc. The Superworks payroll software simplifies and makes filing employee taxes easier.

With a broad range of functions, it promises to make your payroll system smart, effective, efficient, and, of course, simple.

-

Store your employee’s job title, status, salary structure, probation period duration, basic wage, contract type, dates, and schedules.

-

Enable all employee personal document uploads.

-

Centralize all information about each employee in one place.

-

Track employee data – such as time and attendance.

-

Calculate all deductions related to statutory compliances such as Provident Fund, Professional Tax, and TDS efficiently.

-

Includes an employee portal from which you can directly get the data.

-

It can handle medical report for leave requests and approvals.

-

Provides employees with a contract specifying their hiring date, hourly wage or salary, salary structure, working schedule, etc.

-

Generates pay slip batches for various employees simultaneously, acting like a register holding pay slips of different employees.

-

Generates salary statements.

The Superworks Payroll Software allows you to control and access employee information, define employee contracts, generate pay slips with just a click, and review salary slips for both current and received pay periods.

Closing With Bonus Tip,

As you checked there are multiple benefits you can get from the top-notch epayroll system. However, you can check Superworks – Super Payroll as one of the best payroll systems in India and get the ultimate solution for all your payroll problems.

This software is good for all HR, employees & even CEOs and founders, you just need to check the features and make it customized as per your business needs.

Also See : Expense tracking app india | payroll management services | payroll process in india