Grab a chance to avail 6 Months of Performance Module for FREE

Book a free demo session & learn more about it!

-

Will customized solution for your needs

-

Empowering users with user-friendly features

-

Driving success across diverse industries, everywhere.

Grab a chance to avail 6 Months of Performance Module for FREE

Book a free demo session & learn more about it!

Superworks

Modern HR Workplace

Your Partner in the entire Employee Life Cycle

From recruitment to retirement manage every stage of employee lifecycle with ease.

Seamless onboarding & offboarding

Automated compliance & payroll

Track performance & engagement

Payroll 2.0: The Next Generation Payroll Software for Small Business Success

- payroll software for small business

- 8 min read

- June 26, 2023

From old methods to modern ones, every small operation needs version 2.0. In that case, if we are talking about small businesses, it should be a much better version. Why? Because small businesses have their own struggles and challenges that demand innovative solutions. One such solution is the advent of advanced payroll software for small businesses.

Focusing on the particular issue – Payroll, it is a concern for any small business owner.

Gone are the days of manual calculations, piles of paperwork, and time-consuming processes. Small business owners now have the opportunity to leverage the best payroll software that streamlines their financial operations and empowers them to focus on what truly matters: GROWING THEIR BUSINESS.

Payroll 2.0- means uplifted payroll- payroll with automation– represents a paradigm shift in how small businesses approach payroll management. It harnesses the power of automation, accuracy, and efficiency, enabling entrepreneurs to break free from the constraints of traditional payroll methods. This new generation of software offers a comprehensive suite of features tailored to the unique needs and constraints of small businesses, revolutionizing the way they handle employee compensation.

In this blog, we will explore the exciting world of Payroll 2.0 and its transformative impact on small business success. We will delve into the key benefits and features that make this software indispensable for small business owners. From simplified calculations and streamlined tax compliance to robust reporting and intuitive user interfaces, we will uncover the secrets to unlocking the full potential of Payroll 2.0.

Join us as we embark on this journey of discovery, where we will demystify the complexities of payroll management and reveal how embracing the next generation of payroll software can be a game-changer for small businesses.

Get ready to revolutionize your financial operations and pave the way for success in the dynamic and competitive business landscape of today. Welcome to Payroll 2.0!

How To Process Payroll Using Payroll Software for Small Business?

There are multiple ways to process payroll, if you are considering manual calculations and disbursement! However, if a small business owner considers – Payroll Automation- Payroll Software- Cloud Based Online Payroll Systems- you just have to consider a one-click payroll operation. With just a few clicks, you can accomplish what used to take hours or even days to complete.

To process payroll using payroll software, you simply need to follow a few straightforward steps.

-

First

Ensure that all employee data is accurately entered into the system, including their pay rates, deductions, and any additional benefits.

-

Next

Check the automated working hours calculation from a time-tracking system if integrated. Then the payroll company software will automatically calculate the gross pay, taxes, and deductions based on the entered information and the applicable tax laws.

-

Finally

Review the generated pay stubs and make any necessary adjustments before finalizing the payroll. Then just run the payroll to direct deposit.

The user-friendly interfaces of payroll software make the entire process intuitive and straightforward. Even if you are not a payroll expert, you can quickly grasp the functionality and navigate through the payroll software with ease.

Read More: Unveiling Hidden Costs Why HR Payroll Software Essential

Struggling with payroll issues as a small business owner? – Let’s fix it!

Join the ranks of satisfied small business owners who have revolutionized their payroll operations with Super Payroll.

Get started today and supercharge your small business with the ultimate payroll software.

Things You Should Check to Get Payroll Software for Small Businesses

You know what are the key advantages of payroll software, but what’s the major concern about small business payroll operations?

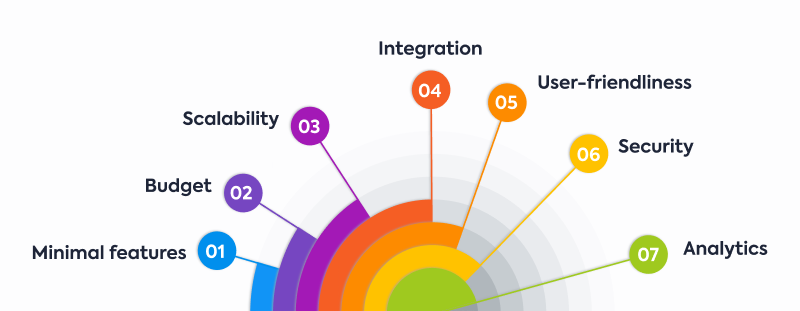

Utilizing payroll software for small businesses needs some considerable factors:

-

Minimal features

So, most of the time small businesses don’t need much configuration or complexity. In that case, minimal features are most welcomed- just like- as payroll calculation, processing & Statutory compliance.

-

Budget

Always consider the budget when selecting payroll software for small businesses. You need to evaluate the pricing structure, including any monthly subscriptions, additional fees for extra features or users, and potential implementation or training costs.

-

Scalability

Small businesses have chances to be scalable in the future. So choose Payroll 2.0 as per the scalability of the business. If you’re considering outsourcing employees, look for payroll software that integrates smoothly with external services. Additionally, consider the potential implementation of the payroll software. Compare different options and choose the software that offers the best value for your specific business needs

-

Integration

If payroll software does not have integration with other modules then it may have a problem. Whether you have 5 employees or 50 or 500 employees, to count their attendance or working hours you need payroll software integrated with HRMS.

-

User-friendliness

You need to consider payroll software that is user-friendly and intuitive. The interface should be easy to navigate, allowing you to quickly access the features you need without extensive training. Look for payroll software with clear documentation, tutorials, and responsive customer support to assist you in case of any questions or issues.

-

Security

Payroll data contains very confidential information, including personal bank details, social security numbers, and salary slip generation information. So, whether it is small, medium, or enterprise prioritizing the security features of the payroll software is necessary. Consider data encryption, access controls, and regular data backups for Payroll 2.0. Choose a reputable provider like Superworks- Super Payroll- with a strong track record in data protection.

-

Analytics

Robust reporting capabilities are essential for gaining insights into your payroll data. Look for payroll software for small businesses that provides comprehensive reporting and analytics features, allowing you to analyze data & generate customized reports, and track payroll expenses. This data can inform your financial decision-making and help you optimize your payroll processes.

By embracing payroll software for small businesses and harnessing the benefits of automation and cloud-based systems, they can transform your payroll operations.

Instead, enjoy the efficiency, accuracy, and convenience that come with one-click payroll operations. Join the ranks of savvy small business owners who have unlocked the power of HR Payroll Software and watch as your payroll processing becomes a breeze.

Also, See: 5 Top Challenges in Managing Global Payroll and How to Overcome Them Easily

How Much Does Small Business Payroll Software Cost?

The cost of small business payroll software can vary depending on various factors such as the features included, the number of employees, the software provider, and any additional services or support offered.

Here are some common pricing models for small business payroll software:

-

Subscription-based Pricing

Many payroll software providers offer monthly or annual subscription plans based on the number of employees in your organization. Superworks has this kind of pricing plan.

-

Per Employee Pricing

Some payroll software providers charge a flat fee per employee per month. This pricing model is beneficial for small businesses with a limited number of employees.

-

Flat Monthly Fee

Certain payroll software for small business providers offers a flat monthly fee regardless of the number of employees. This can be advantageous for small businesses with a larger number of employees, as it provides cost predictability.

-

Additional Costs

It’s important to consider any additional costs beyond the base subscription or per-employee fee. You need to ask the payroll software provider if they provide add-on features at an extra charge. You need to ask them for their services. Features are like time and attendance tracking, direct deposit processing, tax filing services, or dedicated customer support. Implementation of training fees may also apply in some cases.

It’s worth noting that pricing structures and packages can vary significantly among different payroll software providers. It’s advisable to research and compare multiple options, taking into account your specific business needs, the required features, and your budget. Many providers offer free trials or demos, allowing you to assess the software’s suitability before making a commitment.

Lastly, be mindful of any long-term contracts or cancellation policies associated with the payroll software. Understand the terms and conditions before finalizing your decision to ensure it aligns with your business requirements.

Remember, while cost is an important consideration, it should be balanced with the software’s functionality, ease of use, support, and overall value it brings to your small business.

Read More – Boost Your Payroll Software Company With 7 Exciting New Trends

Which is the Best Payroll Software for You?

Once you check all the features regarding payroll software, that can help you with the small business payroll processes, you can integrate them with your business processes.

No matter how many payroll software you have checked, choosing one of the best payroll software needs too much research. So, cutting the crap, Superworks got your cover back.

When it comes to payroll software for small businesses, Super Payroll by Superworks rises above the rest. With its intuitive interface, robust features, and exceptional customer support, it provides everything you need to streamline your payroll operations. Automate calculations, manage taxes, offer direct deposit, and generate comprehensive reports with ease. Super Payroll ensures accuracy, compliance, and efficiency every step of the way.

What sets Super Payroll apart is its attention to detail and commitment to your success!

- Embrace the power of Super Payroll to simplify your small business payroll management.

- Unlock more time to focus on growth.

- Take your business to new heights of success with Super Payroll by Superworks.

- Experience the difference for your small business.

With personalized support and a user-friendly experience, implementation is a breeze. Say goodbye to manual payroll calculations and save your valuable time.

Also see: online hr payroll software | payroll tools for small business