Yes, it is a great solution that allows you to configure flexible salary payments tailored to individual employees, ensuring compliance with organizational policies.

Grab a chance to avail 6 Months of Performance Module for FREE

Book a free demo session & learn more about it!

-

Will customized solution for your needs

-

Empowering users with user-friendly features

-

Driving success across diverse industries, everywhere.

Grab a chance to avail 6 Months of Performance Module for FREE

Book a free demo session & learn more about it!

Superworks

Modern HR Workplace

Your Partner in the entire Employee Life Cycle

From recruitment to retirement manage every stage of employee lifecycle with ease.

Seamless onboarding & offboarding

Automated compliance & payroll

Track performance & engagement

Corporate Clients

Industry Served

Active Users

Productivity Growth

“Superworks is the go-to solution for all your HR requirements. For small teams like ours that are looking to grow fast.”

- Neeraj Singal -

“Super tool for automating business processes. For a small team like ours it helps automate most business processes from HR to Ticketing and more.”

- Gaurav Bhawnani -

What makes Super Payroll the preferred software over other solutions?

Get your hands on amazing features, modules, and much more

Quick Calculations

Facilitates easy, accurate, and fast payroll computation.

Enable Payroll Compliance

Simplified compliance management makes you worry-free

Happy Employees

Timely and error-free payroll helps to keep your workforce happy & satisfied

Instant Report Generation

Generate concise reports in less than 10 minutes

Hassle-Free Payroll

Calculate, review, and process payroll in a tap

No More Paperwork

The centralized location for complete payroll data

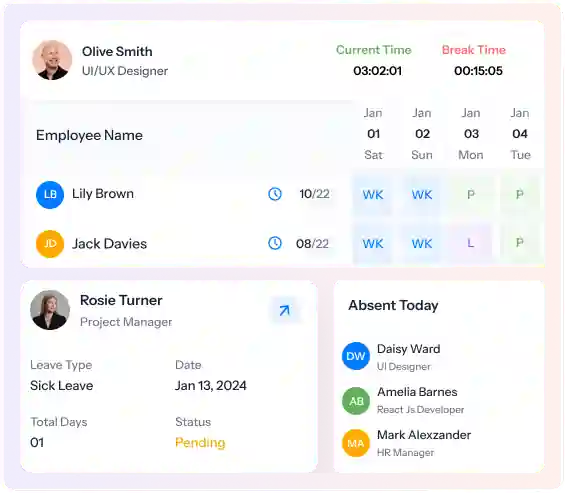

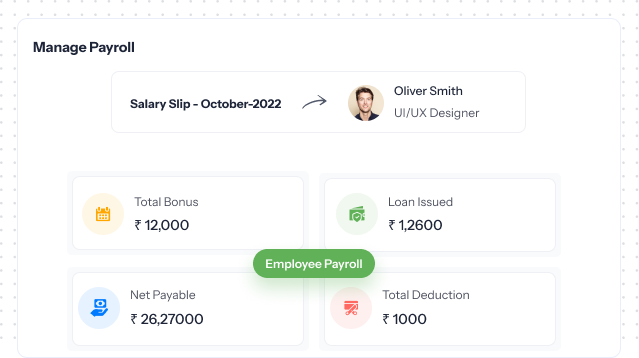

Supercharge your payroll with automation

Never miss a salary slip or lose an employee due to poor payroll management

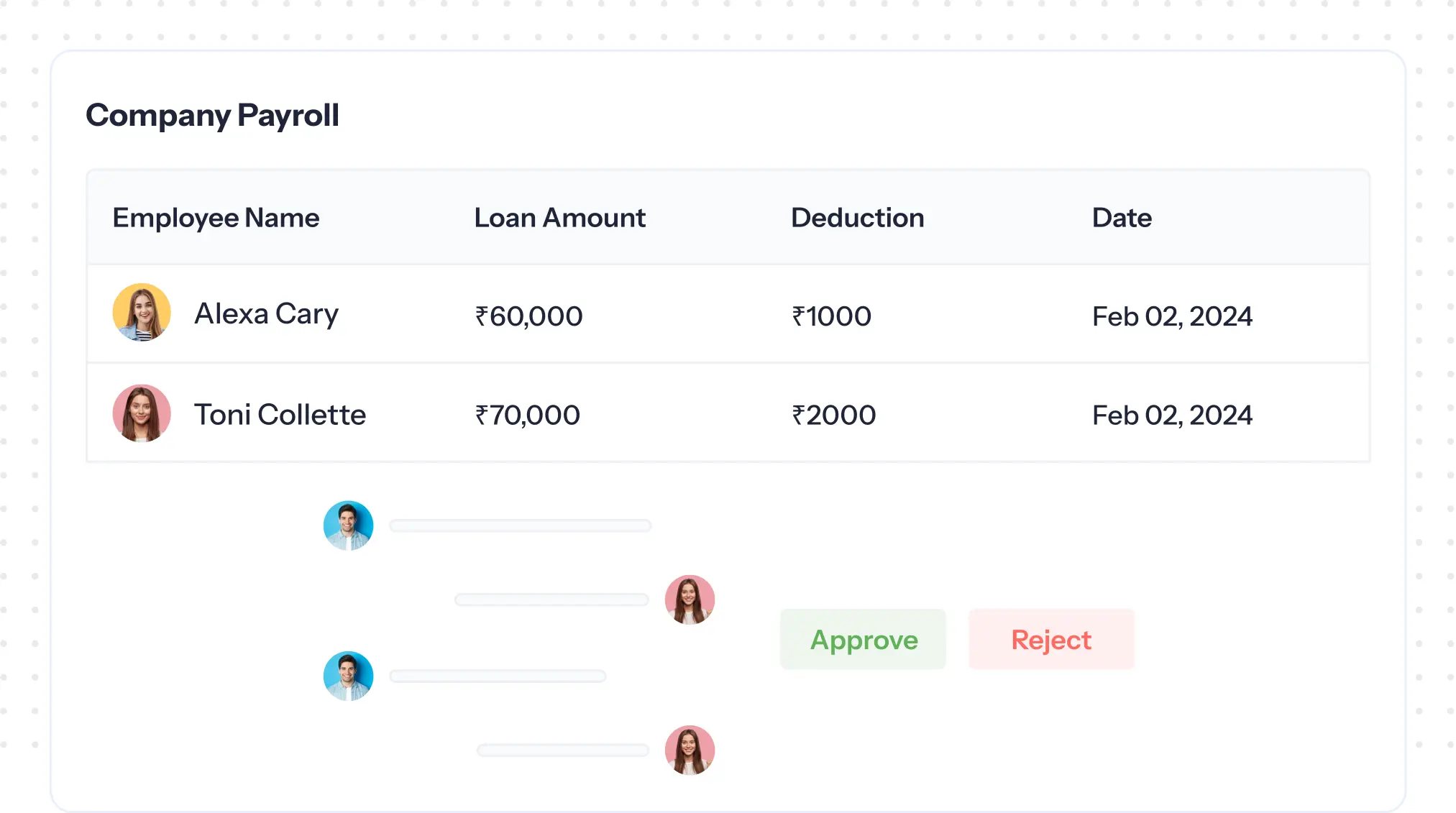

Manage loans at your fingertips

Skip the manual system and make the whole loan management process a cakewalk with our payroll processing software.

Fill out the details & apply for a loan

Get an overview of the payable amount

Select the installment amount

Get a provision of auto-deduction

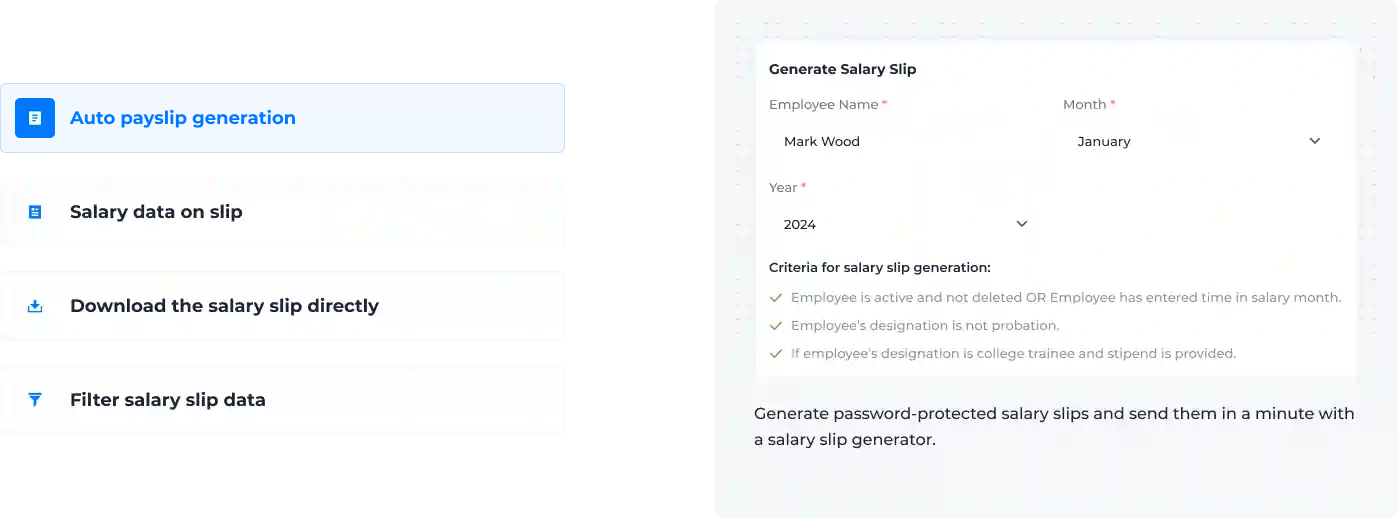

Generate automated payslips online

Create salary slips from the payroll history and filter them by employee name, month, and year.

Two-step payslip generation

Readily available payslip templates

Quick glimpse of employees

Individual payslip generation

Follow compliance requirements

Do all your payouts and taxation systematically, ensuring accurate payroll and statutory compliance

Generate real-time compliance reports

Let employees declare their own investments

Auto-deduct TDS for employees

Several statutory setting

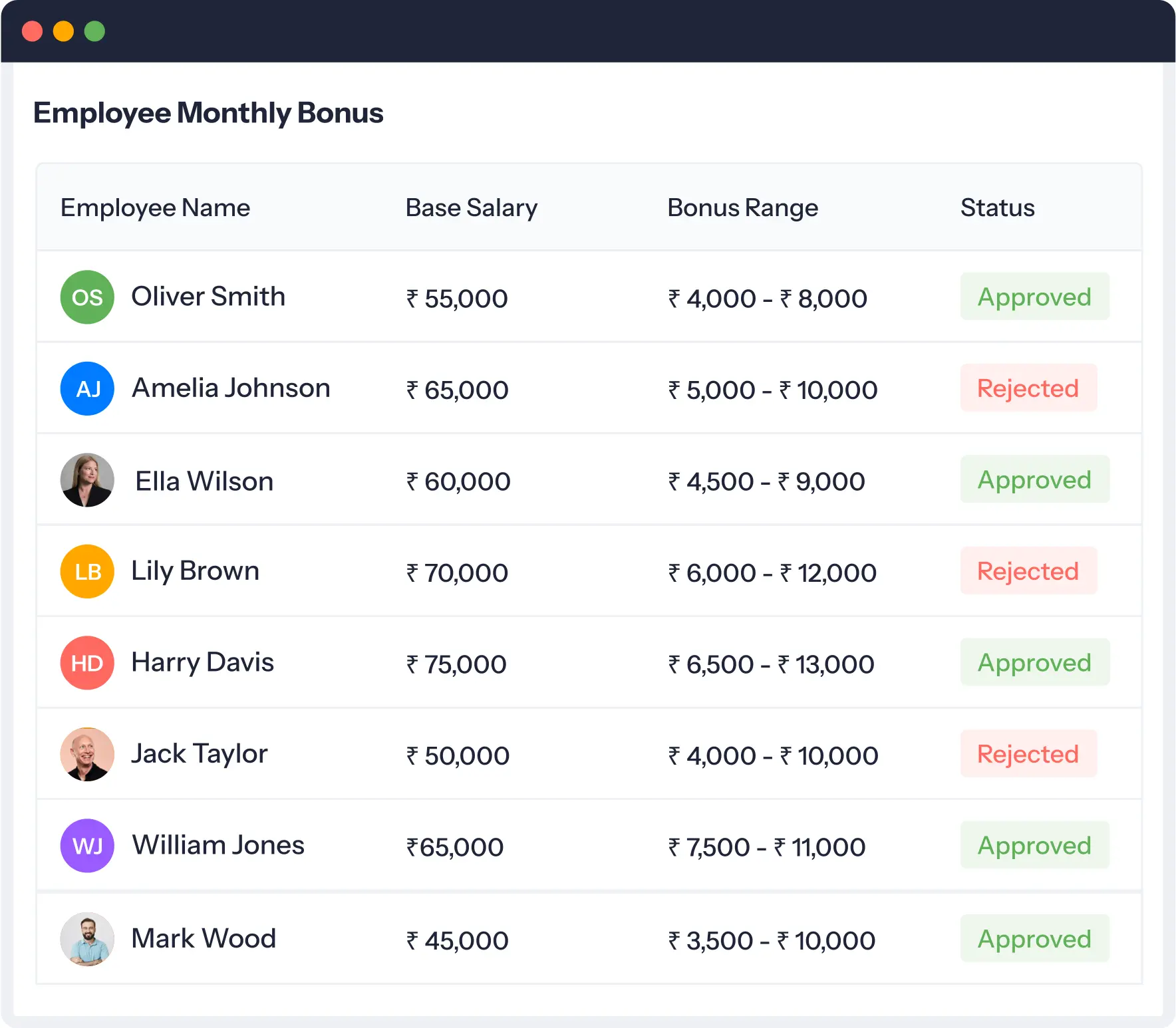

Manage employee bonus like a pro!

View, calculate bonus & approve or reject bonus applications of employees from a single window

Access to bonus details

More transparency

Easy bonus application process

Option of filtering out

Streamline salary structures

Say goodbye to the time-consuming process of creating salary structures and create salary structures automatically.

Auto-calculate CTC of new employees

User-friendly and simple interface

Choose a wide variety of components

Customizable salary structures

Get payroll analytics in a blink

A listicle view of all the employees and their salary details at a centralized place to avoid unnecessary confusion and mistakes.

Easy-to-understand representation

Check out employee activities

Get real-time payroll insights

Mail reports effortlessly

Have complete control over employee compensation!

Plan and budget your employee compensations systematically with our super-intuitive payroll software.

Track revision cycles

Get Compensation analytics

Error-free reimbursements

Complete overview of compensation

Opt for perfect salary disbursement solution

Disburse salary with direct deposit to employees’ accounts after proper payroll calculation.

Directly deposit to account

Easy bank transfer

Deductions and variables

4 clicks easy payroll

Normalize one-click payroll in your organization!

Eliminate all the complicated payroll procedures & refine your cumbersome operations!

- Better efficiency

- Enhanced teamwork

- Easily customizable

Super Payroll is the ultimate SAVIOUR

It’s time to take the payroll burden off your team’s shoulders!

Why 200+ Companies Switched to our HR Payroll Software?

Hear from the people who love & trust our employee payroll software