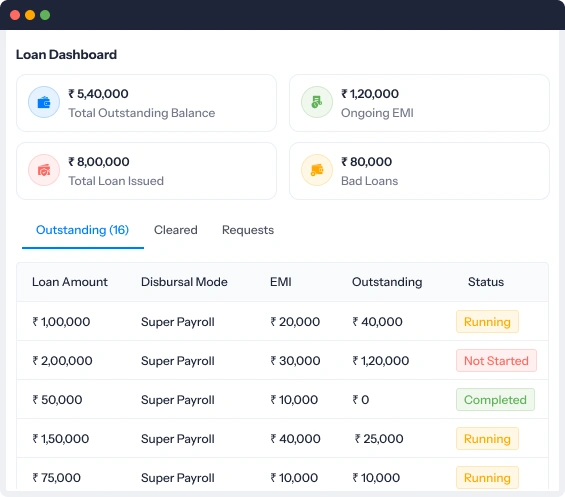

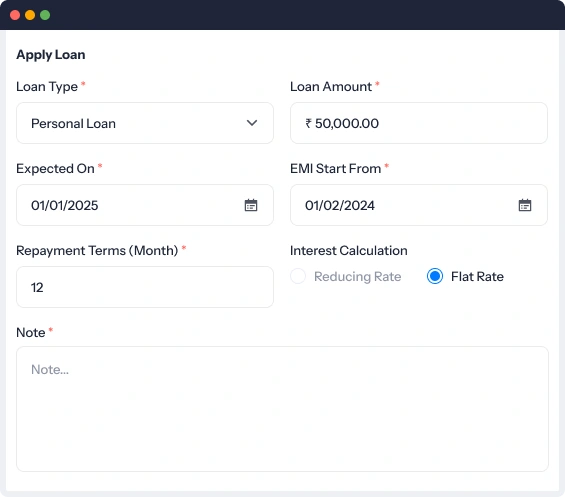

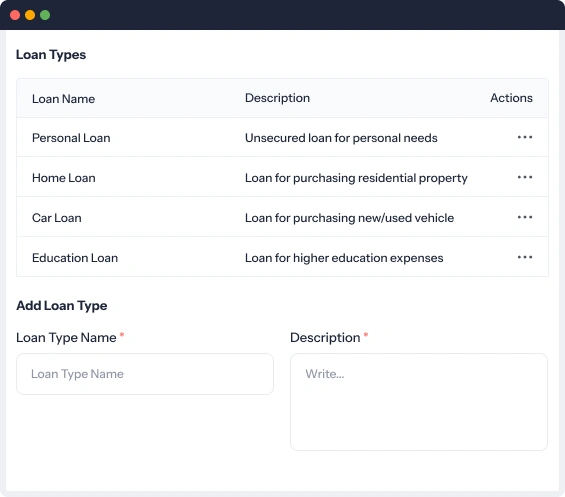

By using Superworks built-in employee loan management system, you can simply assign, track, and manage different loan types from payroll software integrated with hrms software. Using it, you can automate the EMI schedule and decrease the errors faced in manual tracking.

An all-in-one business management solution for all your business needs!

Book a free demo to know more!

-

Built to scale with your business.

-

AI-powered solution to automate workflow.

-

Cost-effective for growing businesses.

An all-in-one business management solution for all your business needs!

Book a free demo to know more!

Automate and manage your payroll with ease.

Super Payroll automates salary processing, compliance, taxes, and payslips accurately and efficiently.

Automate and manage your payroll with ease.

Super Payroll automates salary processing, compliance, taxes, and payslips accurately and efficiently.