Super Payroll helps employees to submit TDS declarations directly and automatically applies them to payroll. It takes care of smooth approvals, accurate tax calculations, and reduces manual effort.

An all-in-one business management solution for all your business needs!

Book a free demo to know more!

-

Built to scale with your business.

-

AI-powered solution to automate workflow.

-

Cost-effective for growing businesses.

An all-in-one business management solution for all your business needs!

Book a free demo to know more!

Automate and manage your payroll with ease.

Super Payroll automates salary processing, compliance, taxes, and payslips accurately and efficiently.

Automate and manage your payroll with ease.

Super Payroll automates salary processing, compliance, taxes, and payslips accurately and efficiently.

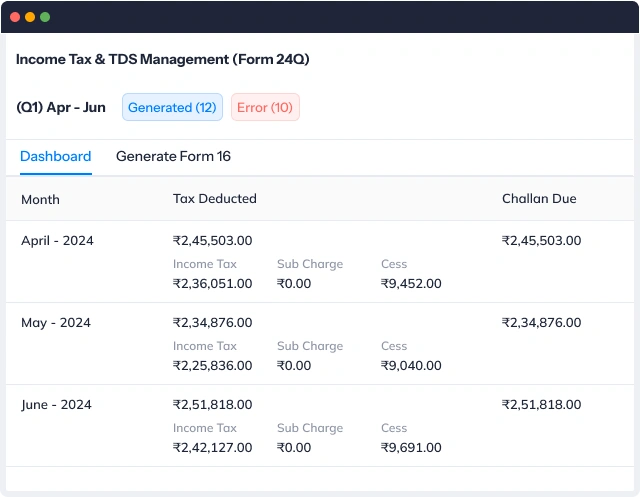

End-to-end tax planning and management

Smart tax planning. Simplified management. Zero last-minute surprises.

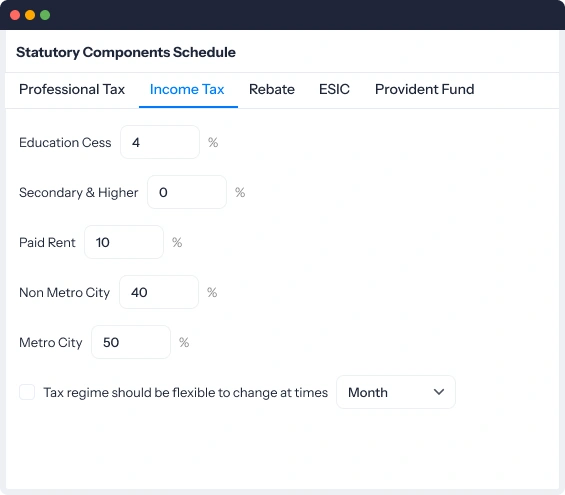

Reliable admin controls for statutory complaince

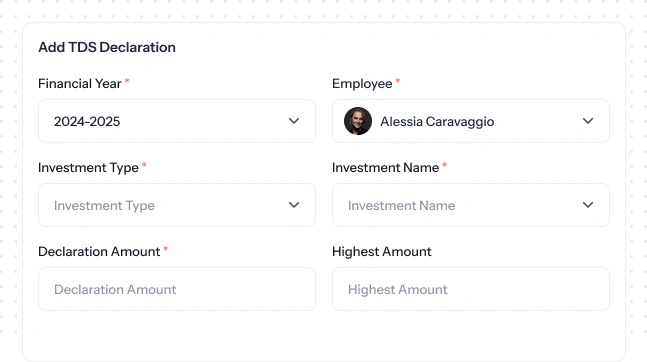

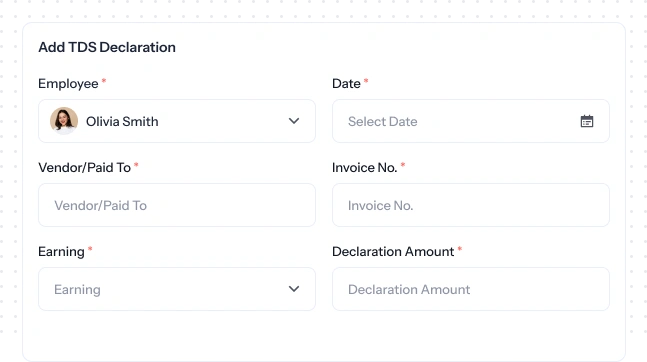

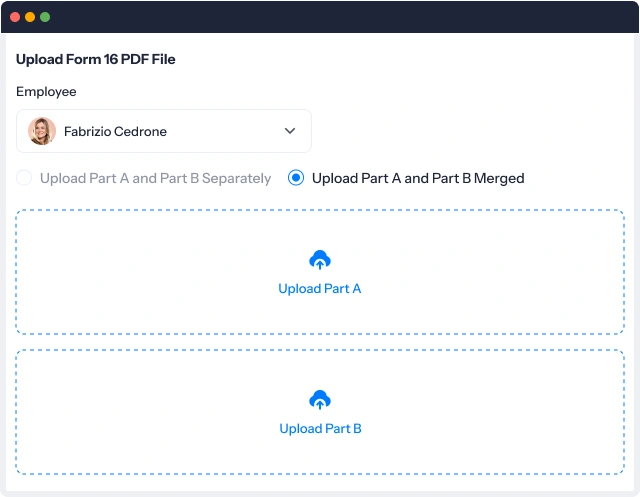

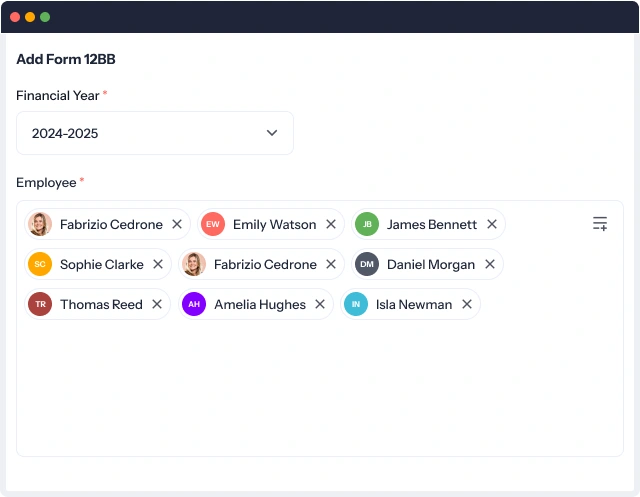

Let your HR and payroll admins get full control over employee tax declarations. Customize key statutory components based on the company’s policies and set clear deadlines for employees to submit their TDS investment proofs and 12BB declaration. Switch to clean audit trails and verified claims.

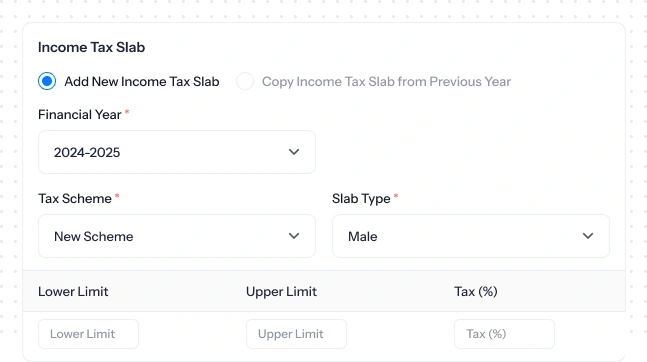

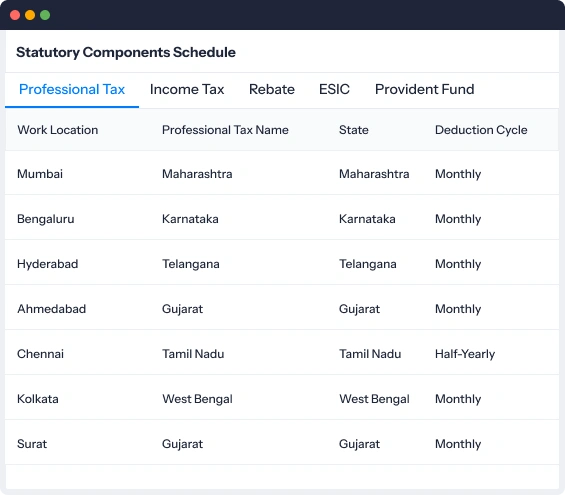

Location-wise tax structures

Handle taxes across multiple locations with ease. Whether it’s a branch in Gujarat or a unit in Uttar Pradesh, each location can have its own professional tax rule, be compliant with state laws, and proceed with accurate monthly deductions according to regional regulations.

Hear why 500+ HRs choose Super Payroll software

Ease your payroll processing with the best payroll software

Blogs

Stay ahead with the latest industry insights