This is very different from the advance salary. Arrears meaning in salary refer to the overdue payments that are owed to an employee for a previous period. This results from delays or corrections in salary.

Grab a chance to avail 6 Months of Performance Module for FREE

Book a free demo session & learn more about it!

-

Will customized solution for your needs

-

Empowering users with user-friendly features

-

Driving success across diverse industries, everywhere.

Grab a chance to avail 6 Months of Performance Module for FREE

Book a free demo session & learn more about it!

Superworks

Modern HR Workplace

Your Partner in the entire Employee Life Cycle

From recruitment to retirement manage every stage of employee lifecycle with ease.

Seamless onboarding & offboarding

Automated compliance & payroll

Track performance & engagement

What Are Salary Arrears? – Definition, Calculations & Processing Guide

- what is arrears in salary

- 8 min read

- September 5, 2024

Most employees and even HR people are confused about; “what is arrear salary? ”

Now, if you are a layman then you need a guide for the same. Here in this blog, we will explain the “arrear salary meaning” and many more.

This guide will delve into the concept of salary arrears, provide insights into its calculations, and explain how to process them efficiently using HR and payroll software like Superworks. Let’s dive into this!

What Is Arrears?

Arrears is the amount due as compensation to an employee or any other entity, for which payment has not been made.

In the context of payroll, arrears are received mostly on salaries that are due but not paid. This might be because of a variety of reasons such as administrative oversight, amendment to salary structure, or revision in salary regarding performance appraisals.

To explicate, an arrear is a sum of money that has not been paid on time and which ought to have been paid in an earlier period. If applied to salaries, arrears shall insinuate that the salary being paid to an employee for the previous month rather than the current one.

For example, if an employee receives an increment in June effective from April, then he or she will draw an increased salary for April and May along with the month of June. The receipts for April May are known as arrears.

Payroll software can reduce arrears calculation time by up to 40%!

Don’t let arrears disrupt your business, get Superworks.

What Is Arrears In Salary?

Arrears in salary meaning is – The salary refers to the due amount of an employee for some period that has not been paid. It is the part of salaries that a staff is supposed to have received but was delayed or taken forward for a future date or payroll period.

This usually happens in cases where employees experience delays in salaries, or there are changes in the salary rate, or any correction in the previous salaries. Afterward, if the salary is increased, then the arrear for the previous months is paid as the difference between the former salary and the increased salary.

For example, if there is an increase in salary for an employee, applied from a retroactive date, the difference thereof for the previous months would be recorded as salary arrears.

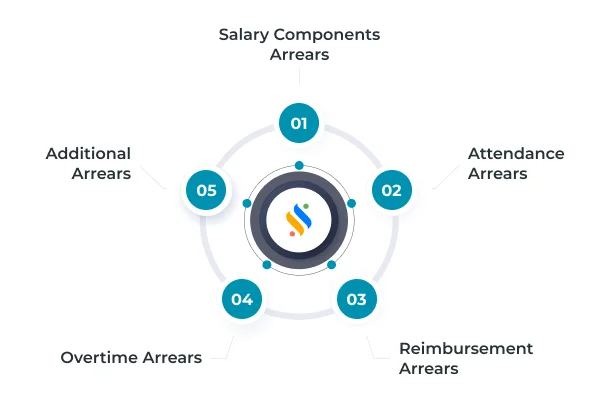

Different Kinds of Situations & Scenarios Of Arrears Of Basic Salary

There can be a lot of reasons why there are salary arrears. In this regard, it is important to know the respective cases involved in payroll management. These situations might be consequences of mere human errors in payroll processing, delays in payroll procedures, or problems emanating from document mismatches.

The company may withhold the amount involved as protection against possible abuse of those errors, and give it in the form of arrears.

Following are some of the scenarios when employees can get salary arrears:

1. Salary Components Arrears

Answering the question: what is arrears in salary slip? – When the amount is due in salary, it will be paid in the form of different components called salary component arrears. These arrears are paid in the form of allowances, regarding housing or transport, etc. Sometimes, this keeps on happening in cases when employees are not paid a certain salary component that they are entitled to under law and policy.

2. Attendance Arrears

In case there are errors in attendance calculation that result in underpayment, this may need arrears. For example, when records of attendance are corrected and some more days become payable, the difference will be paid as arrears in the succeeding payroll.

3. Reimbursement Arrears

The reimbursement arrears are related to a delay in the reimbursement of expenses incurred. The reimbursement can be medical or travel claims, which are caused by some discrepancies in documentation or due to processing delays. In this respect, when payables have accrued, these would form arrears that are payable in the next available pay cycle.

4. Overtime Arrears

In the case of overtime hours, if these were reported after the payroll date set for payment or after a certain period has passed. The arrears should be paid in the next payroll cycle without any arrear salary deduction. The delay in overtime payments disappoints the workforce, while its arrears are meant to restore that confidence.

5. Additional Arrears

When arrears occur, these are usually approved bonuses, incentives, or increases in performance that happen after payroll has been processed. These are paid in arrears to pay the difference for the previous months so that the employees receive their full compensation.

With the timely resolution of these issues and compensating employees through arrears, you can satisfy the whole workforce.

Arrears Of Salary Payments Processing

A number of activities together lead to arrears of salary payment processing. As per the application for arrear salary, HR needs to provide the right amount to the employees. General steps in how one can process arrears of salary are outlined below.

- Identification of Cause of Arrears: The first step in verifying arrears is knowing for what reason they occurred: due to revision of salary, error correction, or additional payments.

- Arrears Calculation: From the reason for the arrears, calculate the amount that should be paid. This is mainly the difference between what should have been paid and what has actually been paid.

- Payroll Record Update: Update the payroll record to show arrears. This ensures that future payments are correct and according to change.

- Inform Employee: Learn “how to show arrears in salary slip” and as per that notify the employee of arrears, explaining the cause, calculation, and amount that shall be paid.

- Process Payment: Take the arrears on to the next payroll cycle or do a separate payment per company policy.

- Update Income Tax Return Records: Check once, if the arrears of salary is taxable or not! If yes or not, the tax records need to be updated with regard to the payment made in arrears.

For example, if the salary of an employee was increased from ₹ 40,000 to ₹ 50,000 in the last salary cycle, but due to some error it did not happen. Then this month he is entitled to get a salary of ₹ 50,000 plus the hike of ₹ 10,000 as arrears. Hence, the net salary this month will be ₹ 60,000.

How To Calculate Arrears Of Salary?

Arrear salary calculation involves determining the difference between what an employee was paid and what they should have been paid.

As per the arrear salary format, calculate the difference between the paid amount and the revised amount for each affected month.

For example, if an employee’s salary was increased from ₹50,000 to ₹55,000 effective from January but was only paid the increased amount from March, the arrears salary for January and February would be ₹10,000 (₹5,000 per month).

Add up the arrears for each affected month to get the total arrears salary amount. If there are any bonuses, incentives, or reimbursements that contribute to the arrears, include them in the total calculation.

Consider the income tax saving and get the relief under section 89; calculate the tax on arrears of salary and deduct it from the total arrears amount.

Salary Arrears In Income Tax Returns

Salary arrears can impact an employee’s taxable income, and it’s essential to account for them correctly in income tax returns. Here’s how to handle arrears in your income tax returns:

- Form 10E for Arrears: The employees have to provide Form 10E for the purpose of claiming tax relief under Section 89 (1) on account of salary arrears. This form acts as a worksheet to determine the tax relief by spreading the arrears over the years.

- Tax Relief Calculation: The tax relief shall be calculated as the difference between tax payable on total income including arrears for the current year and tax payable on total income excluding arrears.

- File With Income Tax Return: Learn – how to fill Form 10E for arrears of salary. Then after filling out Form 10E, it needs to be filed along with your income tax return. Make sure the arrears are declared in the correct section of the income tax form.

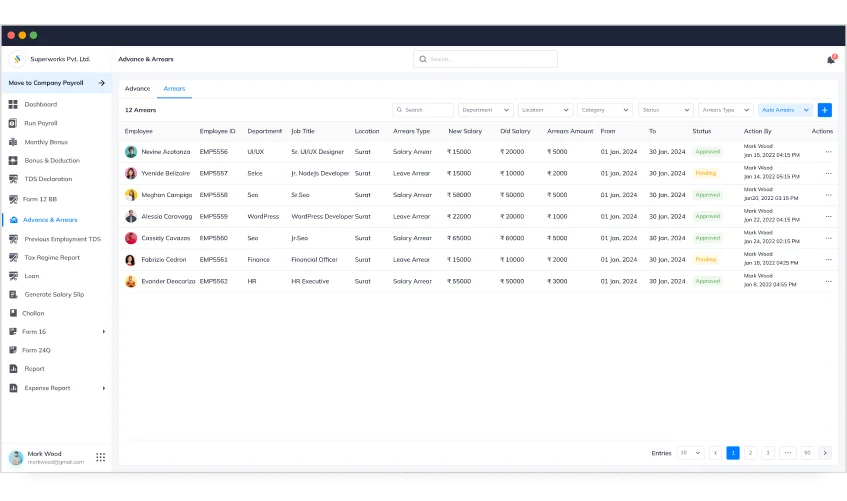

Arrear Calculation With Salary Software – Superworks

Paying salary arrears in India, therefore, becomes simpler with HR payroll software in India like Superworks. Here is how we can help in providing the arrear salaries of employees:

- Automated Calculations: It can automatically calculate salary arrears by applying the revised salary certificate format to past payroll periods. This helps to minimize errors and enhance accuracy.

- Tax Calculations on Arrears: Automatic computation of tax on arrears based on prevailing tax laws includes relief under Section 89 (1).

- Arrear Calculation Reports: Superworks generates a detailed report on arrear calculations, bringing to view various calculations, tax deductions, and final payoff amount. This brings transparency in all respects concerning employees’ accounts.

- Seamless Integration: Superworks gets integrated with other payroll components at appropriate places.

Some of the customizable settings that can be used include personalization of salary structures, arrear calculations, and payment schedules.

At Last,

Salaries in arrears are a common payroll management feature resulting from revision, delayed payments, or even correction in the salary structure at later stages.

These, if equipped with the right tool like Superworks, can be streamlined for correctness and timeliness.

Also See: Salary Components in India

FAQs

What Is The Meaning Of Arrears Of Salary?

What Does Pay Of Arrears Mean?

Pay of arrears means the payment made to an employee for a period where the salary was not paid on time.

What Is Salary Arrears Income?

Salary arrears income is the additional income that an employee receives as arrears. This is not as like an advance salary.

What Is An Example Of Arrears?

An example of arrears is when an employee’s salary is increased from August, but the increase is only reflected in the October salary. The arrears for August and September would be paid in addition to the October salary.

How To Request For Salary Arrears?

To request salary arrears, an employee should formally write to the HR or payroll department, explaining the discrepancy in salary and providing details of the periods affected.