Grab a chance to avail 6 Months of Performance Module for FREE

Book a free demo session & learn more about it!

-

Will customized solution for your needs

-

Empowering users with user-friendly features

-

Driving success across diverse industries, everywhere.

Grab a chance to avail 6 Months of Performance Module for FREE

Book a free demo session & learn more about it!

Superworks

Modern HR Workplace

Your Partner in the entire Employee Life Cycle

From recruitment to retirement manage every stage of employee lifecycle with ease.

Seamless onboarding & offboarding

Automated compliance & payroll

Track performance & engagement

Basic Understanding Of Salary Slip: Meaning, Importance & Other Aspects

- super payroll

- 8 min read

- April 15, 2024

If someone asks about the important terms of payroll such as CTC, salary breakdown, different components of a salary, HRA, and all how do you tell them? Do you know everything about your salary slip?

The salary slip, also known as a payslip, is very important in the payroll process. Each month, employee receive monthly salary slips from the company, detailing essential information such as the company’s name, the employee’s designation, salary breakdown, and bank details.

There are key components in the employee salary slip or payslip generator. Earnings, including basic pay, allowances, and deductions are outlined.

In this blog, we’ll talk about what a pay slip is and why it’s important for your money. We’ll show you how to make a basic pay slip using Excel, which many people use for this. We also have different pay slip templates to make it easy for you to pick one.

What is Salary Slip?

A salary slip is a payroll document issued by an employer to its employees.

This document contains a detailed breakdown of employee salary for a given period. This document can be either mailed to the employees or provided as a hard copy. The employees can download the salary slip format generated by the salary slip generator using the employee self-service portal. Also, a company is legally bound to issue a pay slip periodically as proof of salary payments to its employees. It can be usually done by using HR Payroll software.

When people change their jobs, it becomes crucial to know their salary, so that they can secure a better salary after negotiation at the new office.

How to auto-generate salary slips? – Get an idea from Superworks!

Take the next step to simplify your payroll process and empower your employees.

Don’t miss out on streamlining your payroll with Superwork.

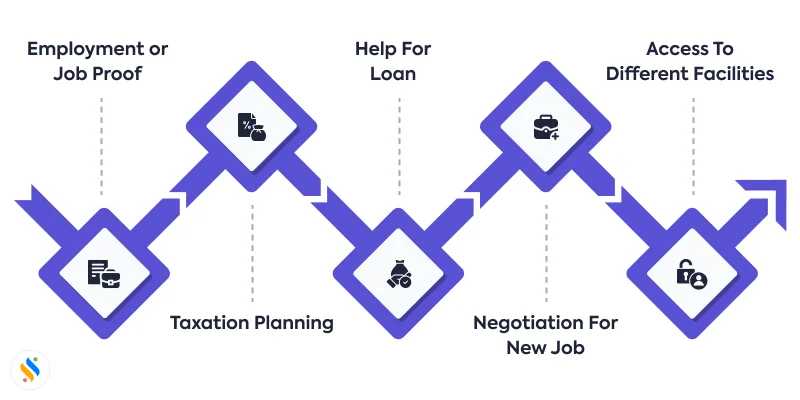

5 Impactful Reasons – Why Salary Slip Is Important?

Pay slips are super important for employees as well as organizations. It is proof of salary. Always keep them safe like you would with other important papers. If you don’t know how important it is, here are some reasons why it is important.

Employment or Job Proof

Only an experience letter doesn’t work for you to show you had a job. Salary slips are required, as they are proof of employment.

This paper shows you had or have a job. When you’re applying for a new job, visa or to study at a university, you might need to give them copies of your salary slip to prove your salary and job title. Salary slips can confirm if you’re currently working and show your job title.

Taxation Planning

Salary slips aren’t just to show your job details; they are used for professional tax planning. epayroll payslip online show what you earn and what’s taken out for things like Professional Tax, provident fund, and TDS This helps you figure out how much tax you need to pay or if you can get some money back.

Your salary is made up of different parts such as basic pay, allowances, and deductions. Each part can be taxed differently. Knowing how much you get for each can help you pay less tax.

Your salary slip is used to work out your income tax. It’s crucial for filing your Income Tax Returns (ITR) to see how much tax you owe or if you’re due a tax refund for the year.

Help For Loan

Payroll payslips have all the details of your pay. These slips help banks check if you can handle borrowing and paying money. So, you need your slip when you apply for a loan. Banks usually want to see your salary slips for the last two to three months when you ask for a loan.

Negotiation For New Job

Application for salary slip are really useful when you’re talking about your salary for a new job. When you’re discussing pay with a potential new employer, your old salary slips help to manage the company’s budget with compensation management.

They show what you’ve earned before, so you can ask for a fair salary. When you’re starting a new job, the predictive analytics for human resources team might ask to see these slips to check your pay history. This helps make sure everyone is clear and honest during pay talks.

Access To Different Facilities

This slip helps employees get some advantageous services from the government, like medical care or cheaper food.

Salary slips show that you can pay your bills each month. They decide how much credit you can get and if you qualify for different financial products.

What Are The Components Of A Salary Slip?

Here is the breakdown of the pay slip, you can check every

1. Income

– Basic Pay

The basic pay is the main part of your pay, it is around 35% to 40% of your total salary. It’s what other parts of your pay slip are based on and is listed first on the earnings side.

– House Rent Allowance (HRA)

HRA is money given to employees to help with accommodation for their house rent. It depends on where you live ( city) and is usually around 40% to 50% of your basic salary.

You can claim tax exemption on the smallest of these 3 amounts:

-

The HRA amount from your organization./p>

-

Actual rent you paid minus 10% of your salary./p>

-

50% of basic salary (for metro) or 40% (for non-metro)./p>

– Dearness Allowance (DA)

Dearness allowance (DA) is extra money given to employees to help with living costs. It’s typically 30-40% of the basic pay. DA is taxed because it’s considered part of your income.

But, most of the corporate employees don’t get the DA, only government and public sector workers get DA.

– Medical Allowance

The medical allowance helps with health costs for employees. If you get more than Rs.15,000 for medical a year, you have to pay tax on the extra.

But, starting from the 2019-20 financial year, the 2018 Budget changed things.

Instead of separate medical and conveyance allowance, employees now get a standard deduction of Rs.50,000.

– Leave Travel Allowance (LTA)

Leave Travel Allowance (LTA) is money given to employees to help pay for travel on vacation. You don’t have to pay tax on this if you show the actual travel expenses and follow certain rules. You can claim this tax benefit for up to 1 trip in 2 years.

– Bonus Allowance

A bonus is extra money given to employees to motivate them. Bonus allowances are given to cover specific costs. These allowances differ between companies and are subject to tax.

– Other Allowances

Employers might give other allowances to employees for various reasons. These allowances could be listed separately under ‘Other Allowances’ on the pay slip.

2. Deductions

– Professional Tax

Professional tax is a tax based on the employee’s salary level and is only required in certain Indian states. Each state has its own rules for this tax.

– Employee Provident Fund (EPF)

Employees must put a part of their salary into a provident fund account. The employer adds 12% of the employee’s basic salary, and other than that employee has to add. The money the employee puts into EPF doesn’t get taxed as per Section 80C of the Income Tax Act. The employer also adds money to the EPF/retirement fund for the employees.

– Tax Deductible at Source (TDS):

The employer takes out TDS from the employee’s salary for the income tax department.

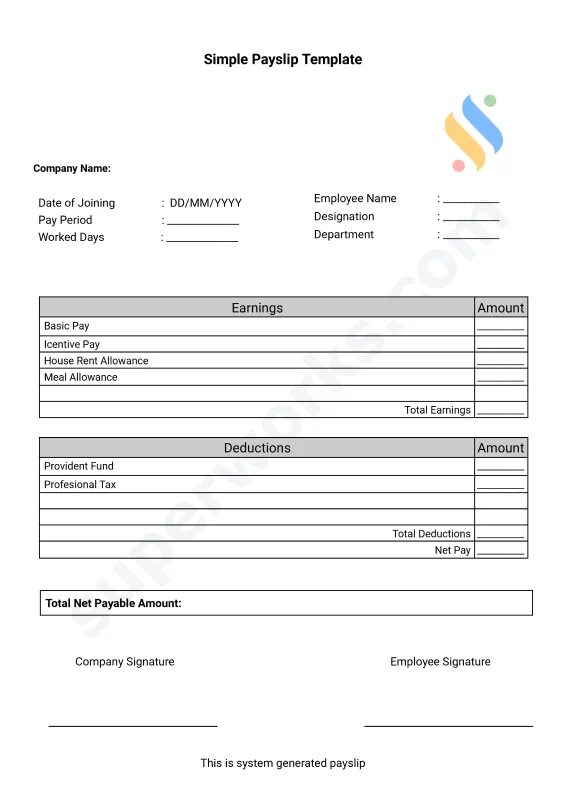

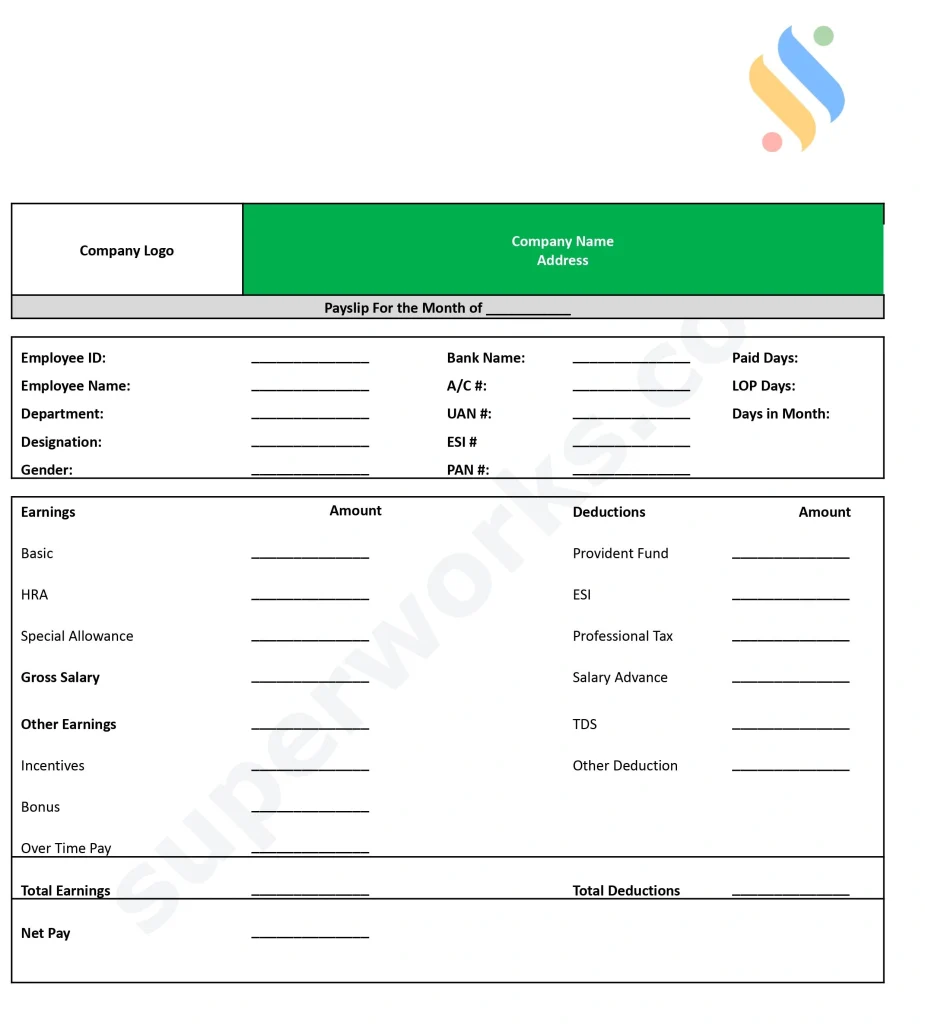

What Is The Format of Salary Slip?

Employees get their pay details in PDFs or in the mail every month, but understanding all the parts can be tough. It’s not just for new jobs or getting loans; it’s really important for managing expenses. So, it is the responsibility to create a particular monthly salary slip of HR or the organization.

So as an HR if you don’t know “How to make salary slip”, then here is the guide to making the perfect salary slip without taking the help of online payroll software – auto slip generation feature.

A pay slip can look different depending on the company.

Here’s what a basic one might have:

-

Month and year of the pay slip

-

Company name, logo, and address

-

Employee name, code, job title, and department

-

Employee PAN/Aadhaar, bank account number

-

Total days worked, days off taken

-

EPF and UAN numbers

-

Detailed list of what you earned

-

Detailed list of what was taken out

-

Total and take-home pay in numbers and words

Check the 2 examples of payslips generated by Superworks- Cloud payroll software:

Bottom Line

Salary slips are really important for companies as well as employees. But, many Indian employees don’t have them because they work in informal jobs. Superworks have loan management software, and workforce management software that helps employers give their workers salary slips, along with PF & ESI and many more compliances.

Employees can download these slips from the HRMS software. Don’t wait, get the Superworks to get the feature “Salary slip download” from salary slip software!

Also see: salary components calculation in india