The general salary structure of India generally includes everything from basic salary, CTC, house rent allowance, dearness allowance, conveyance allowance, and leave travel allowances to other benefits that include bonuses and medical reimbursements. It might also contain deductions on Provident Fund, ESI, and taxes, including TDS and Professional Tax.

Grab a chance to avail 6 Months of Performance Module for FREE

Book a free demo session & learn more about it!

-

Will customized solution for your needs

-

Empowering users with user-friendly features

-

Driving success across diverse industries, everywhere.

Grab a chance to avail 6 Months of Performance Module for FREE

Book a free demo session & learn more about it!

Superworks

Modern HR Workplace

Your Partner in the entire Employee Life Cycle

From recruitment to retirement manage every stage of employee lifecycle with ease.

Seamless onboarding & offboarding

Automated compliance & payroll

Track performance & engagement

Salary Components in India: The Ultimate Guide For All

- what is the basic salary in india

- 11 min read

- September 18, 2024

Salary is a fixed income an employer pays out to an employee in return for performing certain jobs. Employers and their HR teams must make a thoughtful decision on the salary of every employee, considering working conditions, etc.

In an organization, employees are paid for their services. The salary structure in HRM contains several salary components in India, such as CTC, Net Pay, Gross Salary, Allowances, Perks, Deductions, and the Payslip. These all come under the salary structure in India.

For payroll management, it is necessary to understand the breakup of the salary and the elements in it. It allows the mechanism of arriving at an employee’s compensation in a lucid manner.

Calculate Your Salary With Our Free Salary Calculator!

- Salary Components In India: A Brief Explanation

- Importance Of Salary Structure In India

- What Are The Components Of The Salary Structure?

- Wage And Salary Structure In Salary Slip Example:

- How Can Superworks Help Manage Employee Salary Structure?

- At last,

Salary Components In India: A Brief Explanation

These components of employee compensation make up the company salary structure, which the company predefines and pays every month. While designing an employee’s salary structure, many points are to be decided upon.

From the perspective of an employee, salary components in India show the breakup of elements that make up the total pay package. In essence, it would come up on factors that come into play when understanding the components for the purpose of managing employee payroll.

The components of employee salary structure in India format are to be designed by the HR department, and it may follow one of the two following approaches:

- Top-down

In this approach, the basic components of salary slip -first of all, the basic pay are determined, and the rest of the salary components in India are fitted as a percentage of the basic pay. It helps the company to keep the total compensation within the budget.

- Bottom-up

The minimum salary in India to be given is kept in mind, and then it is apportioned into various salary components in India so that the total falls within the budget.

Before we get into it in more detail, let’s get some of the main terminology:

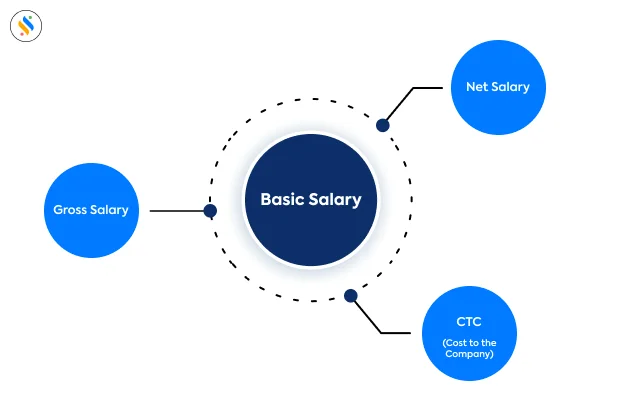

Gross Salary

This is the total earnings before any statutory or non-statutory deductions. It also includes any salary lost due to unpaid leaves or absences.

Net Salary Or Take Home Salary

This is the amount you actually get after all deductions such as PF, ESI, PT, and TDS. It is also referred to as “in-hand” salary.

CTC (Cost-to-Company)

CTC breakup guide reflects the total value in rupees that the employer commits for a whole year. It includes the employer’s PF contribution, gratuity, insurance, and other benefits.

Fixed and Variable Pay

- Fixed pay comprises your basic pay with allowances, as mentioned in the pay slip, which is ensured to be given to you every month.

- Variable pay, on the other hand, is linked to performance or company profits.

The HR departments find it tricky, no doubt, to determine salary structure calculation they need exprties. And for making it easy – HR can use online payroll software.

Make the effort 50% less to manage salary components in India with the Payroll System!

Let Superworks handle every component, from basic pay to taxes.

Importance Of Salary Structure In India

Human resources are always considered the most important resource for an organization.

A well-designed structure of components of salary in India is the backbone needed for growth and development with regard to any company. It not only ensures employee retention by means of engagement but helps in attracting employees too. If the components of salary structure are unfair or poorly managed, serious problems may be caused.

That is why designing the appropriate salary structure becomes very important, including components of gross salary in India, net salary, allowances, and others. If an employee is not aware of the components of salary structure in India that make up his or her salary, he or she will not be able to compute the take-home salary or the contributions to the EPF.

Transparency

Transparency in the breakdown of salaries helps employees plan their finances well; thus, this is an important part of the process.

Informing employees of a fixed and variable component in salary instills confidence and trust, not only in potential employees.

Principle of Fairness

A well-established salary structure has the essential effect of ensuring equity across the board. Employees feel that there is a transparent means of establishing their job grade and, hence, their remuneration.

Motivation

Once employees understand the salary components in India of wage structure, it will lead to increased motivation. This will further make for productive discussions about the future with them.

Management Support

It is never easy to discuss the salary components in India of pay structure with a fresher, but a good, well-defined salary scale helps managers make more informed decisions and conduct smoother talks.

Engagement

Employees are more motivated if they know their actual salary structure and salary components calculation in India with career advancement. The remuneration for a post motivates them.

Pay Budgets

Understanding where employees fit within different pay levels helps companies manage their pay budgets more efficiently and get the most from them.

What Are The Components Of The Salary Structure?

Salary can be defined in many ways and can become a little confusing to understand terms and their differences. Let’s outline it clearly:

– Basic Salary

1.Net Salary

Net salary is what the employee receives after all deductions, including taxes and contributions, have been subtracted. This fixed component in salary is referred to as the “in-hand” salary, which is what finally gets transferred to his bank account.

2. CTC

Cost to the Company: CTC refers to the total cost incurred by a company on an employee in one financial year. This, again, would also include all those constituting elements of salary, such as basic pay, Provident Fund, and gratuity payable by the employer.

3. Gross Salary

Gross salary is the total amount a personnel would gain before considering the deductions like taxes and contributions. Income of a person without any deductions having been deducted from the income.

– Allowances

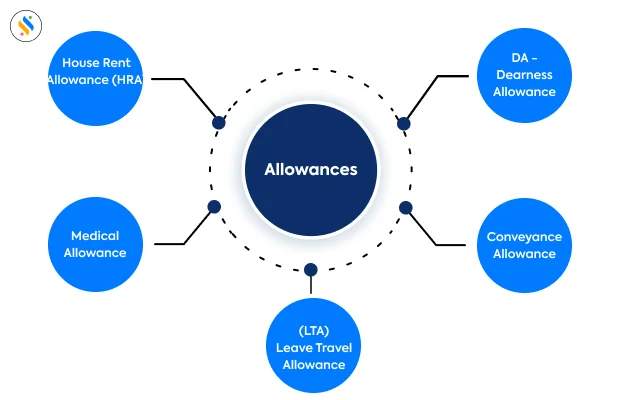

1. House Rent Allowance (HRA)

House Rent Allowance is provided to staff to offset the expenditure towards staying in a rented accommodation. Staff who stay in a house on rent can get total or partial tax exemption under Section 10 (13A) of the IT Act. If they do not stay in a rented accommodation, then the HRA is taxed.

2. DA -Dearness Allowance

DA- Dearness Allowance is the percentage of basic salary granted to public sector employees, government workers, and pensioners to offset the inflation factor. In other words, if DA is 20% of a ₹1 lakh salary, he or she would receive ₹20,000 as DA. DA in its entirety is taxable, and once more, only employees in the public sector are offered this in salary components in India.

3. Conveyance Allowance

Conveyance Allowance, which is popularly known as transport allowance, is given to an employee to meet his daily conveyance expenses. This was kept under ‘Standard Deductions’ in the budget of 2018 and later increased to ₹50,000 per annum. Conveyance allowance up to ₹1,600 a month, i.e., ₹19,200 annually, is not chargeable to tax.

4. Leave Travel Allowance (LTA)

Leave Travel Allowance is extended by the employer to the employee to reimburse his or her travel expenditure during leaves. It relates to domestic traveling by air, train, or other public means of transport. It is exempted under Section 10(5) of the Income Tax Act, 1961, for the actual cost of the journey. It finds its applications both in the public as well as the private sectors.

5. Medical Allowance

Employers can pay a medical allowance towards the medical expenses of their employees. In this, the amount is tax-free up to ₹ 15,000 per year. Some companies treat this as medical reimbursement wherein the company pays the allowance only on submission of medical bills by the employee.

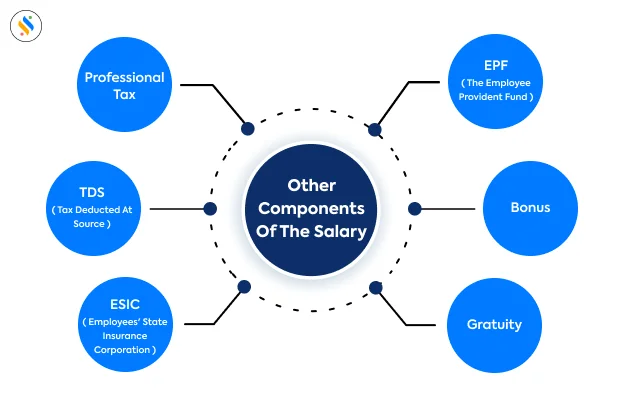

– Other Components Of The Salary

1. The Employee Provident Fund (EPF)

We have earlier dealt with allowances and benefits applicable to employees. We shall now look at some of the common deductions that apply to salaries earned by employees in salary components in India. If you are working in an establishment that employs 20 employees or more, you are liable to pay an EPF.

You and your employer contribute 12% each of your basic salary and dearness allowance per month to your EPF account. The EPF aims to provide a long-term saving policy that is supposed to give the employees of the private and public sectors some form of financial security after retirement.

2. Bonus

It is a fixed sum of money paid to employees who complete a year in service.

3. Gratuity

Gratuity is a one-time compensation given to the employees at the time of their retirement or at the end of 5 consecutive years of service. It is an exempted income as per the payment of gratuity act if it’s received at the time of retirement, superannuation, or termination.

4. ESIC ( Employees’ State Insurance Corporation )

ESIC is an insurance benefit for those employees whose gross salary received per month is less than ₹21,000. If the number of this kind of employee exceeds 10, a company is liable to deduct ESIC from the salaries of such employees.

5. TDS ( Tax Deducted At Source)

Basically, TDS means a fraction of your income tax deducted by your employer from your monthly salary. This, in a way, reduces your burden of paying taxes at the end of the year and helps you meet the advance obligation of paying a certain amount of tax during the year. The rate of TDS is 10% for standard cases, and if your total tax liability is more, you pay more. Correspondingly, you will claim a refund if it’s less.

6. Professional Tax

Professional tax varies from state to state. But it is ₹2,500 per year maximum all over India.

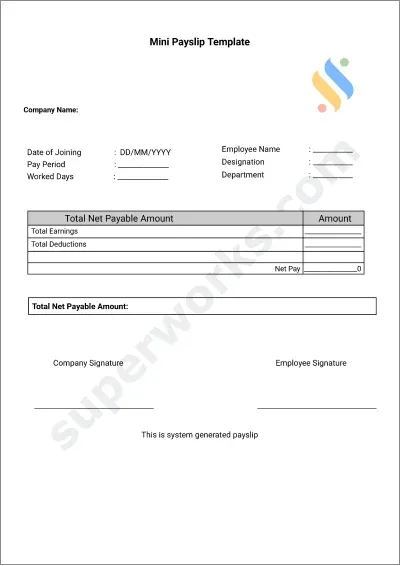

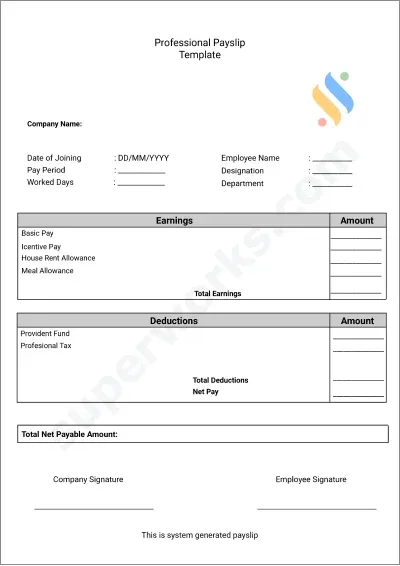

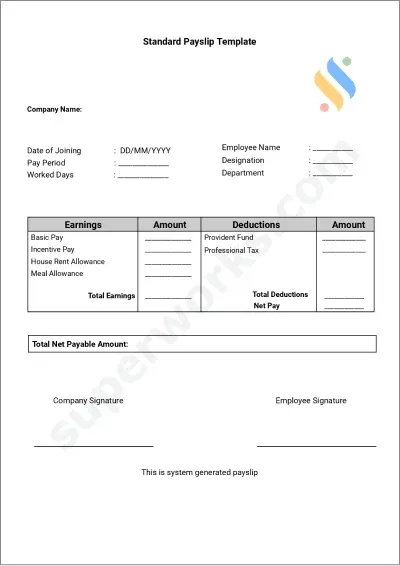

Wage And Salary Structure In Salary Slip Example:

It is important for an employee to understand how their salary is constituted to enable them to make informed decisions. A free salary structure has both direct and indirect parts, which are basic pay, allowances, and other benefits. The structure or salary components in India can be defined in the payroll payslip sample.

The salary slip is the document given by the employer by using an online payroll portal, explaining elaborately the salary components in India elements of an employee’s salary.

Below are some a sample structure of a Salary Slip in India:

1. Mini Payslip Template

2. Professional Payslip Template

3. Standard Payslip Template

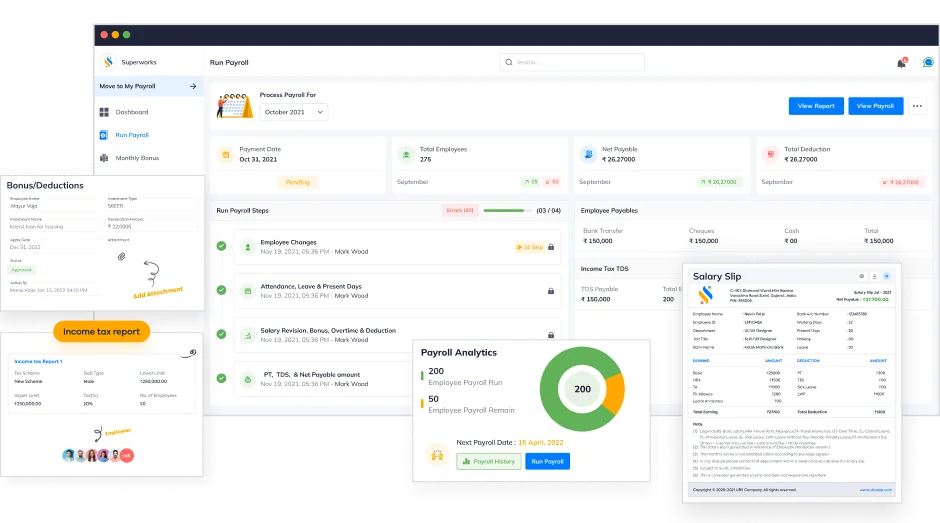

How Can Superworks Help Manage Employee Salary Structure?

Manual maintenance of salary components in India is time-consuming and error-prone. Superworks, as one of the leading HR payroll software, helps in managing the whole salary structure with an effortless attempt to maintain compliance, accuracy, and employee satisfaction.

Key Features Of Payroll Software India Include

Automated Payroll Processing: With cloud payroll software, payroll calculation is much easier as it automates deductions like Provident Fund, TDS, and Professional Tax, along with allowances and bonus payments. Custom salary structures can be designed using software, enabling the employer to accommodate an individual or group-specific need in their payroll, hence ensuring flexibility.

Compliance with Laws: Most of the payroll vendors in India will follow all Indian Labor Laws to save the employer from penalties or additional litigation matters. However, we are aware of all laws and automated with the payroll accounting software.

Payslip Generation: Through the HR and payroll software payslips can be generated quickly and efficiently, recording all elements of salaries in an easy-to-understand format.

Salaries, Bonuses, and Deductions: The platform will go a long way in providing the important details required for a report that will make audits and financial planning less challenging.

Overall, the integration of us into your business system will save time, reduce errors, and maintain compliance by the employer while keeping both employees and employers happy.

At last,

These elements constitute the cost of the salary structure, which is predefined by the company and paid every month. While designing the salary structure of an employee, many points are to be decided upon.

A salary structure, from the employee’s perspective, represents a breakup of elements comprising his or her total pay package. In essence, it would come up on factors that come into play when understanding the salary components in India for the purpose of managing one’s finances and availing full tax benefits.

Before we get into it in more detail, let us take a look at some of the main terminology.

Also see: payroll process in india

FAQs

What Is The Best Salary Structure In India?

What Is The Basic Salary In India?

Basic salary is the fixed thing of an employee’s salary. This excludes allowances, bonuses, or other benefits. It forms the foundation of the salary structure, and other components as well.

How Is Salary Determined In India?

While fixing the salary in India, the usual considerations would relate to standards of the industry that the employee is being recruited for;

- His/her experience and skill;

- The budget of the company;

- And the role he/she is being assigned to.

The market conditions, regional pay scale, and previous salaries of employees are also taken into consideration by the employers.

Is There Any Rule For Salary Structure In India?

Salaries in India have to be framed in the light of various labor laws, namely the Minimum Wages Act, Payment of Wages Act, and other tax laws given under the Income Tax Act. Formulation of salaries within the purview of the above-cited statutes is required, with PF and ESI contributions at the employer's obligatory liability and deduction of proper TDS on time.

What Are The 4 Elements Of Salary?

The four main components of salary are:

Basic Salary, Allowances, Bonuses and Incentives & Deductions.