A payroll payslip is a document that has all the details of employee earnings. It is usually issued at the end of each pay cycle and serves as a record of the employee's salary details. Payroll payslips provide transparency and ensure employees understand their compensation via the ESS portal.

Grab a chance to avail 6 Months of Performance Module for FREE

Book a free demo session & learn more about it!

-

Will customized solution for your needs

-

Empowering users with user-friendly features

-

Driving success across diverse industries, everywhere.

Grab a chance to avail 6 Months of Performance Module for FREE

Book a free demo session & learn more about it!

Superworks

Modern HR Workplace

Your Partner in the entire Employee Life Cycle

From recruitment to retirement manage every stage of employee lifecycle with ease.

Seamless onboarding & offboarding

Automated compliance & payroll

Track performance & engagement

Automating Payroll Payslips: Key Benefits and Proven Best Practices

- payroll software

- 7 min read

- July 26, 2024

There are multiple features of HR payroll software that provide multiple benefits. One of the features of the software is generating payroll payslips.

If you are one who consider the manual employee salary slip, then you need to understand why automating salary payslips is beneficial! From making the payslip in Google Docs to printing or mail to employees is daunting – better to just do the payroll payslip login, and download the e-payroll payslip.

Here is the guide, to understanding an employee’s monthly Application for salary slip, how to automate them and what are the benefits of that.

What Is A Payslip?

Payroll Payslips are known as paycheck stubs.

The document with the different salary components, issued by the employer for the employees, is known as a payslip, which can also be accessed as a Payslip Online.

Payslip provides a detailed breakdown of the employee’s earnings, deductions, and net pay for a specific pay period ( mostly monthly). A payroll payslips includes this kind of data:

- Employee Details: Employee name, employee ID, department, and designation.

- Earnings: Basic salary, allowances, bonuses, overtime pay, etc.

- Deductions: Taxes, social security contributions, health insurance, retirement contributions, etc.

- Net Pay: The actual amount the employee takes home after all deductions.

Payroll Payslips are essential for employees to understand their salary structure and for record-keeping purposes. They also serve as proof of income for various financial transactions like applying for loans or credit cards.

Up to 50% on Processing Time- Get Automated Payslips!

Join the businesses that report faster payroll management.

What Is Payroll Payslip Automation?

Payroll payslip automation refers to using software and technology to streamline the process of generating and distributing payslips to employees.

This employee payroll payslips automation replaces manual, time-consuming methods with a digital, efficient salary slip generator system that ensures accuracy and compliance.

Overview of the Process from Data Input to Distribution

- Data Input: Employee details, working hours, bonuses, deductions, and other relevant information are entered into the payroll system.

- Processing: The payroll and payslip software calculates the gross earnings, applies deductions, and determines the net pay for each employee.

- Payslip Generation: The salary slip generator software generates digital payslips, which can be customized to include all necessary information.

- Distribution: Online Salary payslip is securely distributed to employees via email, employee portals, or other digital means.

Key Benefits of Automating Payroll Payslips

There are multiple benefits you can get by adding automated software for payslip generation & HRMS software. Here are some mentioned.

– Time Efficiency

- Saves Time for HR and Payroll Departments: Automating the payroll payslips process significantly reduces the time spent on manual calculations and data entry. HR can focus on more strategic tasks instead of repetitive administrative work.

Companies that have adopted payroll automation report a reduction in payroll processing time by up to 70%.

- For instance, a mid-sized firm with 500 employees saved over 100 hours per month by switching to an automated payroll system.

– Accuracy and Error Reduction

- Minimizes Human Errors: Manual payroll processing is prone to errors, which can lead to incorrect payments and employee dissatisfaction. Automation ensures that calculations are precise, reducing the likelihood of mistakes.

Manual payroll processing has an error rate of approximately 1-2%, while automated systems have an error rate close to 0%.

- A difference between payslips and payroll (automated) can have a significant impact on the accuracy of employee compensation.

– Cost Savings

- Reduces Need for Paper Usage: By automating the salary slips, companies can reduce the need for extensive manual labor and cut down on paper and printing costs.

The initial investment in payroll automation software is quickly offset by the savings in labor costs and improved efficiency.

- Companies can expect a return on investment within the first year of implementation.

– Compliance and Record-Keeping

- Helps Maintain Compliance: Payroll automation software is regularly updated to comply with the latest tax laws and regulations, ensuring that companies remain compliant and avoid penalties.

Automated systems keep 100% records of all payroll transactions.

- It is making it easier to retrieve information for audits and reporting purposes.

– Employee Satisfaction

- Timely and Accurate Payslips: Employees receive their payslips on time and can trust that the information is accurate. It is leading to increased satisfaction and trust in the employer.

68% of employees find payroll software interfaces user-friendly and easy to navigate.

- Transparent and reliable payroll practices help build a positive relationship between employees and the company.

How To Automate The Payslips- Steps To Follow

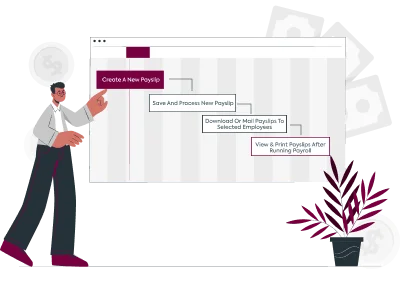

There are some steps included that make it easy to understand an automated “payroll and payslip difference”! Check the below steps from checking the employee payslip sample to generate.

1. Create A New Payslip

Creating a new payslip begins with gathering all necessary employee data. Data such as employee ID, salary details, working hours, and applicable bonuses or deductions should be added to the payslip online format. This data is then input into the free payroll software with payslips.

The software uses this information to accurately calculate the employee’s gross earnings. Apply the relevant deductions, and determine the net pay.

2. Save And Process New Payslip

Once the employee data is accurately entered, the next step is to save and process the new payslip by selecting the proper payroll payslip template. This involves running the payroll process through the free payroll report generator, which calculates the earnings, deductions, and net pay for each employee.

The software performs these calculations quickly and accurately, eliminating the risk of human error.

3. Download Or Mail Payslips To Selected Employees

After processing the payroll, the system generates digital payslips in a secure format. Review or “Payslip download” are the options, by clicking that employee can download the payslip by using the employee self-service portal.

The next step is to send the payroll payslips to the selected employees. This can be done via email, or the payslips can be uploaded to an employee payroll portal where employees can securely access their payslips.

4. View & Print Payslips After Running Payroll

Once the payroll has been run, employees can view their payslips through a secure portal. This portal allows employees to check their earnings, deductions, and net pay at any time. Additionally, email notifications can be sent to employees with their payslips attached for easy access.

This flexibility in viewing, emailing, and printing payslips ensures that all employees can access their payroll information.

Also See: Steps in payroll process

Best Practices For Automating Payroll Payslips In The Company

Here we provide the best practices regarding automating payroll payslips, check below.

– Choosing the Right Software

When selecting payroll management software, it is crucial to consider several factors to ensure it meets your business needs. Look for software like Superworks – HRMS Payroll software in India that offers comprehensive features like integration with HRMS systems, customizable payslip templates, and compliance with local tax laws.

Additionally, the software should be user-friendly and provide robust customer support.

– Data Accuracy

Data accuracy is main vital thing in payroll processing. Regular audits and reconciliations can help identify and correct any discrepancies.

Keeping the payroll system updated with the latest tax laws and company policies. It is also vital to ensure compliance and prevent errors.

– Security Measures

Payroll data contains sensitive information, making security a top priority. Implementing robust security protocols, such as encryption is essential to protect this data.

Conducting regular security audits and updates can ensure that your system remains secure against evolving threats.

– Configuration

Configuration is key to meeting specific company needs and regulatory requirements. Your payroll automation software should allow for customizable payroll payslips formats, including the ability to add or remove fields as necessary.

This ensures that all relevant information is clearly presented and compliant with local laws.

– Training and Support

Proper training and ongoing support are critical to the successful implementation of payroll automation software.

Ongoing support and maintenance are equally important to address any issues that arise and keep the software running smoothly.

To Wrap Up,

Automating payroll payslips offers numerous benefits, including increased efficiency, accuracy, and cost savings. By following best practices and choosing Superworks- payroll software, companies can streamline their payroll processes and enhance employee satisfaction.

FAQs

What Is Payroll Payslip?

How Do I Create a Pay Slip In Payroll?

To create a payslip in payroll, input the employee's earnings and deductions into payroll software. After the process, the data, and generate the payslip. The software calculates the net pay by considering all deductions and earnings. Finally, review the payslip for accuracy before distributing it to the employee.

What Is HR Payroll Salary Slip?

An HR payroll salary slip is a document issued by the HR department. The salary slip outlines an employee's salary details, including earnings and deductions. It serves as a comprehensive record of the employee's pay for a specific period.

How Do I Check My Payslip Salary?

You can check your payslip salary by viewing the payslip issued by your employer. The salary slip has details regarding your gross pay, deductions, and net pay.

How To Download Payslips From Payroll?

To download payslips from payroll, log in to the secure employee self-service portal provided by your employer. Navigate to the section labeled "Payslips" or "Payroll." Select the relevant pay period and click on the download option, typically marked as "Download Payslip" or represented by a download icon.