In order to download your epayroll pay slip, you first have to log in to the epayroll portal using your credentials. Then you should navigate to the "Payslips" section, select the desired epayroll account slip, and click "Download."

Grab a chance to avail 6 Months of Performance Module for FREE

Book a free demo session & learn more about it!

-

Will customized solution for your needs

-

Empowering users with user-friendly features

-

Driving success across diverse industries, everywhere.

Grab a chance to avail 6 Months of Performance Module for FREE

Book a free demo session & learn more about it!

Superworks

Modern HR Workplace

Your Partner in the entire Employee Life Cycle

From recruitment to retirement manage every stage of employee lifecycle with ease.

Seamless onboarding & offboarding

Automated compliance & payroll

Track performance & engagement

Epayroll vs. Traditional Payroll: Which Is Better For Your Company?

- what is epayroll

- 9 min read

- August 9, 2024

Keeping an ‘E’ in the front of a word signifies that we are doing that digitally, and not traditionally like have been doing that until now! And in this digital world, where you don’t even have to visit a Bank or ATM anymore to collect cash, we don’t need to explain why should we keep the concept of the Epayroll clear, rights?

Because if you would spare some time and look around the ever-changing and upgrading world’s landscape then you will realize how much we need this revolutionary digital solution! And specifically in this post-COVID era, when the mode of work has been changed significantly, it’s so difficult to stick to the traditional method of any kind!

However, there has been a continuous debate between the people who are still supporting traditional payroll and the people who have already accepted the digital payroll for themselves. And for that reason, we are here to solve all the doubts regarding both methods in this blog and will also suggest to you whom to choose, so stay tuned!

What is Epayroll?

We can also call it digital payroll, or electronic payroll because it is getting done through a digital platform that automates the entire payroll process from the very beginning to the end. All this becomes possible, with the utilization of technology, because that is how you will handle everything thing crucial related to payroll like;

- Wage calculations

- Tax deductions

- Direct deposits

- Employee self-service portals

When you do the epayroll portal login, you have selected the option to eliminate the need for paper-based processes. Because e payroll Online comes with a streamlined and efficient approach to managing payroll.

This whole system comes with numerous amazing features such as online salary payslips, e-payroll login portals, and employee access to their payroll information. Hence, when employees get this level of accessibility, even they get a sigh of relief, as now they can view their payslips, tax forms, and salary details at any time, and all these aspects help enhance transparency and employee satisfaction.

How to Use Epayroll Software?

There is no special mantra for utilizing this digital payroll system, but there are some steps for better implementation;

- Setup and Integration: You should start by integrating the epayroll software with your previously working HR systems. Thus, such integration will ensure that employee data is accurately transferred & maintained across platforms.

- Employee Onboarding: After integration, and data transfer, the employees will receive login credentials for the digital payroll portal. Now they can enter their details and set up direct deposit options, and this self-service capability will keep empowering them to manage their own payroll information.

- Data Management: The system automatically calculates wages, gets tax deductions done, and processes payments. It also provides an leave application to manager with access to their epayroll payslip online, reducing administrative burdens.

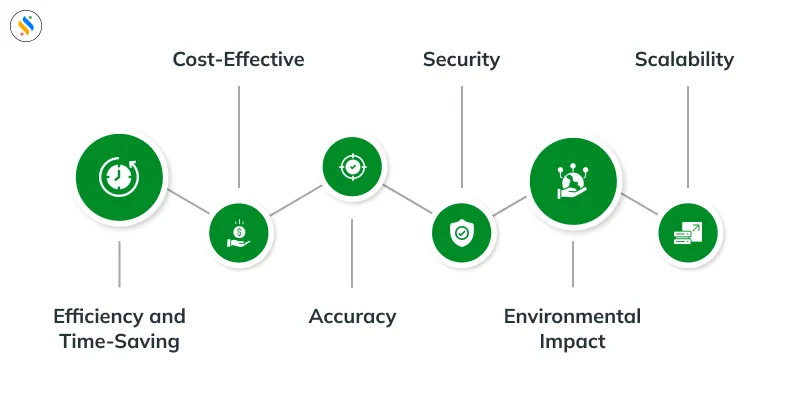

Benefits of E Payroll payslip Online

After getting the answers of what it is, and how to use it, let’s see what benefits this epay payroll brings to us! This system offers numerous advantages for businesses of all sizes:

- Efficiency and Time-Saving: First it automates your routine tasks, then significantly reduces the time and effort required for payroll processing. And by this efficiency, HR personnel can easily focus on more strategic activities.

- Cost-Effective: This digital payroll minimizes the costs associated with printing and distributing physical payslips. Moreover, it also reduces the dire need for manual labor, and that results in long-term cost savings.

- Accuracy: Automated calculations always bring greater accuracy, and also reduce the likelihood of errors in wage calculations and tax deductions. And to be honest, this accuracy is crucial for maintaining compliance with tax regulations.

- Security: After the epayroll portal employee login, data security gets better than ever as now there will be too little use of physical documents. And because of that payroll vendors in India are able to secure sensitive employee information as it is protected through digital encryption and secure login protocols.

- Environmental Impact: By ruling out paper usage, this employee payroll portal supports eco-friendly business practices and keeps contributing more, towards a sustainable environment.

- Scalability: Epayroll online systems are quite easily scalable, making them ideal for businesses that are seeking growth. Because with time as your company expands, the system will accommodate accordingly, and that too without significant adjustments.

Challenges of EPayroll

While there are benefits of this amazing system, there are also some crucial challenges that we can’t overlook, let’s see what they are:

- Initial Setup Costs: Implementing an e payroll Gujarat or any other such system would surely require an initial investment in software and training. However, these costs will soon seem nothing, as long-term savings often offset them.

- Compliance: Staying updated with the ever-changing tax laws and regulations can be quite difficult. However, many e payroll systems are working on that and offering automated compliance features that help businesses remain compliant.

- Technology Dependence: E payroll relies heavily on technology, which can be a barrier for those users who mark themselves as Tech-expert. Hence, there should be proper training for that and needed support should be given for successful implementation.

What is Traditional Payroll?

Traditional payroll is completely the opposite of the digital one as we have been reading about! Here, all the needed processes are done manually, like;

- You will manage employee payments through the old paper system

- Will save your password manually

- Will provide the employee payroll payslip on paper [as there is no e-payroll slip]

- Will have face-to-face interactions with payroll personnel.

And as you can see this method will heavily rely on human intervention, which can lead to multiple errors and inefficiencies. But here, we are going to provide complete details of this method, hence let’s also explore the benefits and drawbacks of traditional payroll.

Benefits of Traditional Payroll

Other than the perks of the e payroll system that you get such as getting an online salary payslip, this traditional payroll also has its benefits! So, let’s take a leap over that, and keep counting those benefits!

Personal Interaction

Traditional payroll allows for personal interactions between employees and payroll personnel, like an employee payslip sample can be directly collected from that payroll personnel. This method fosters better communication and builds trust, because here the employees may feel more comfortable discussing payroll issues in person.

Established Process

Here you don’t have to ask questions from people like ‘How to login epayroll,’ as many businesses here have well-established traditional payroll processes. And those already established processes that have been in place for years, continue to provide a sense of familiarity and comfort.

Flexibility

Manual processes can often be more flexible in handling unique payroll situations that can be difficult to handle in digital systems like the newly came epayroll pay commission! Here unlike the new epayroll login, the payroll personnel can make quick adjustments to address specific employee needs.

Payroll Automation is loved by 100% of Employees

Super Payroll makes payroll easy and fast, and employees love it!

Drawbacks of Traditional Payroll

After listing the benefits of this traditional payroll, we are moving to understand its drawbacks. Because, unlike the payroll accounting software, there will be various aspects where this system may fail to comply as needed, so let’s go through those aspects one by one!

Time-Consuming

Manual payroll processes are often time-consuming and need way more administrative effort, which can lead to some unavoidable payroll inefficiencies. Here, the HR staff just have to dedicate substantial time to process payroll, because of which they fail to perform other crucial tasks.

Prone to Errors

Human involvement substantially increases the possibility of making errors in calculations and leads to potential compliance issues and employee dissatisfaction. And these payroll errors can directly result in incorrect payments and employee frustration.

Lack of Transparency

Traditional payroll processes may lack transparency, as employees have limited access to their payroll information and one can’t even collect his/her e-payroll salary slip sample format! Hence, they just have to rely on payroll personnel to collect small updates like that! This lack of transparency can easily become the root of misunderstandings and can substantially decrease employee satisfaction.

E payroll vs. Traditional Payroll Which One’s Better

Without choosing the sides we have presented all the needed information required for both the HR payroll software and the traditional one. And that is why, for further clarification, it’s time to compare both of these methods and see which is indeed works! So, first, let’s begin with cost implications!

Cost Implications

These digital systems often result in long-term cost savings due to reduced administrative work and paper usage. While the traditional payroll can cause companies to pay higher costs over time due to manual labor and printing. The cost-effectiveness of the digital payroll makes it an attractive option for businesses looking to optimize their payroll processes.

Scalability

Digital systems are easily scalable, accommodating business growth without significant adjustments. While with the traditional payroll, one may struggle to keep up with a rapid expansion and increased complexity, as here one can’t even collect his/her epayroll salary slip! E payroll software can seamlessly integrate new employees and handle the complexities of larger organizations.

Compliance and Regulation

Digital systems often include automated compliance features and help ensure businesses stay up-to-date with tax laws and regulations. While in the traditional payroll, we have to keep doing manual updates and adjustments, which substantially increases the risk of non-compliance. The automated compliance features of e payroll make it easier for businesses to adhere to legal requirements.

Which is Better for Your Company?

The answer to ‘which payroll system to choose’ is loud and clear, because you may not want your staff to do everything manually for doing while keeping all the crucial core business work aside! And still, if you are confused then connect with our expert at Superworks and they will help you understand the core benefits of Digital payroll, and how it can give your payroll system a much-needed upgrade!

FAQs

How to Download Epayroll Payslip?

How to Add New Employee in Epayroll?

In order to add a new employee to the epayroll systems like Super Payroll, firstly you should have admin access to the dashboard and select "Add Employee." Then you can enter the employee's details, including name, contact information, and salary details.

How to Update Token Number in Epayroll?

In order to update the token number in epayroll, you should log in to the portal first and then reach the "Employee Details" section. There find the employee whose token number needs to be updated and then update it, in Super Payroll it is much simpler, and you should really try it!