A third-party payroll company is a payroll platform that exists to handle all aspects of payroll processing for other organizations. They calculate wages and withhold taxes, ensure compliance with labor laws, and distribute payments to employees.

Grab a chance to avail 6 Months of Performance Module for FREE

Book a free demo session & learn more about it!

-

Will customized solution for your needs

-

Empowering users with user-friendly features

-

Driving success across diverse industries, everywhere.

Grab a chance to avail 6 Months of Performance Module for FREE

Book a free demo session & learn more about it!

Superworks

Modern HR Workplace

Your Partner in the entire Employee Life Cycle

From recruitment to retirement manage every stage of employee lifecycle with ease.

Seamless onboarding & offboarding

Automated compliance & payroll

Track performance & engagement

The Ultimate Guide For Choosing Right Third Party Payroll Companies

- Third party payroll services

- 8 min read

- June 26, 2024

‘As an employee you keep working in the company, your salary will be delayed for 15 days!’ Sounds like a nightmare, right? And that too a worst one, which you don’t ever want to see for yourself, and even for the person you don’t even like much! Such problems are problems anymore when the employer connects with Third party payroll companies!

But what do these third party payroll services will be offering that will solve the massive payroll problems? This one was the question that you have in mind, right? But stress not because this blog is only about getting those answers! And while providing those answers, we will also be guiding you through the ultimate way to choose the best third party payroll services!

So hang on a little tight, because there’s a bunch of information waiting here regarding payroll management service, that you all should know well! And when it comes to the best third party payroll companies in India, you can get an idea about their growth from the booming third party payroll jobs in India!

Who are Third Party Payroll Companies?

People are looking for a Third party payroll companies these days more often, that can handle their payroll and compliance services away from the organization! And the organizations doing such payroll even from far away are known as third party payroll companies!

If we gonna comprehend formally, then these Third party payroll companies are the external service providers that specialize in managing payroll functions for businesses. These companies handle complete payroll processing services such as salary processing, tax filing, compliance with labor laws, and employee benefits management.

This HR outsourcing is so beneficial we tell you guys because they literally specialize in that particular field! Such a company doing outsourcing payroll is a sample for payroll accuracy. Because they ensure an error-free payroll and compliance throughout the process, with higher efficiency.

Third Party Payroll Benefits

So instead of doing an in-house payroll that is definitely gonna consume lots of time, businesses can focus on their core functions efficiently! So yeah that is how you can utilize all of your team’s time for the core business activities, that before 3rd party payroll was getting utilized for doing payroll.

For getting further benefits please go through this list:

-

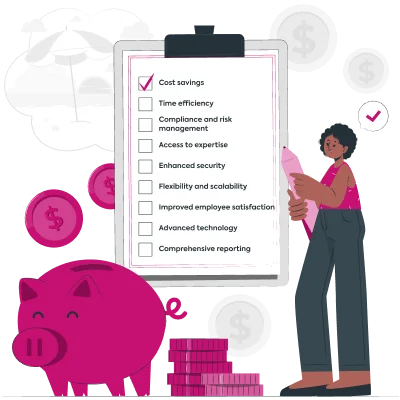

Cost savings

-

Time efficiency

-

Compliance and risk management

-

Access to expertise

-

Enhanced security

-

Flexibility and scalability

-

Improved employee satisfaction

-

Advanced technology

-

Comprehensive reporting

Till now, the difference between company payroll and third party payroll would more probably have been cleared out for you, right? Because once it is done, there are more questions that you should ask and seek answers to!

Furthermore, what is the ultimate way to get the best third party payroll providers for your company? That is the exact answer that we are going to answer in the next section, so let’s explore the measure that can help you choose the company to outsource payroll!

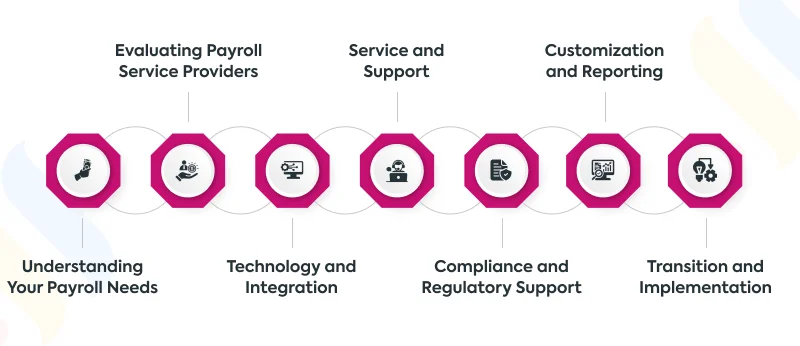

Ultimate Way To Choose A Third Party Payroll Company For You!

Here after getting the answer of ‘why company hire on third party payroll’ let’s move forward towards knowing the secret for hunting the top payroll services for your company!

So, it is a properly aligned way in which you seek what you need in terms of payroll services. At times, doing payroll in a small company gets tougher if you do not select your payroll partner properly to outsource payroll! For that reason stop doing payroll that can damage your time and effort as a whole and put your team far back!

Getting the best third party payroll companies for yourself may not be that easy like swapping your cable provider. Rather you would have to begin with a detailed list of the needs and deeds you are expecting from your payroll management software!

1. Understanding Your Payroll Needs

Before you go diving into the pool of third-party payroll services to seek the best partner for processing payroll, you should specify the payroll needs first! Just like;

-

What specificities should be part of this software, as per your requirement?

-

Which payroll outsourcing would be compatible with the size of your business?

-

On the other hand, How frequently you will need the payroll?

-

What functions do you need with a third party payroll? Such as tax filings, compliance, or employee self-service options.

2. Evaluating Payroll Service Providers

You should further evaluate potential payroll service providers based on their reputation in the market, payroll experience, and customer reviews. These measures will provide you with the details regarding their sales, and how it is and is not good with their customers!

Furthermore, you should look for companies with industry-specific expertise just to ensure they understand the unique challenges of your sector. And while going through such measures there is one thing that you shouldn’t forget, and that is scalability! Because it’s crucial to ensure the provider can grow with your business, or else you will continue to get issues with payroll management.

3. Technology and Integration

One of the crucial measures that can be a real game-changer is technology and further integration. In terms of modern payroll solutions, we are shifting towards cloud-based processing as we get mobile accessibility and real-time updates right there.

So, first check if the payroll provider’s technology integrates seamlessly with your existing HRMS systems, like Superworks, just so you can streamline your HR operations. However, that is a different concept. You won’t need any other assistance if you already have Superworks!

4. Service and Support

Quality customer service is like a pillar, it just has to be there at the location of the best third party payroll companies that we are seeking. For that reason, you should assess the availability and responsiveness of the provider’s support team.

So, look for a dedicated account manager who can make a significant difference in resolving issues quickly and efficiently.

Enjoy 0% error & absolute accuracy with Superworks!

Bid farewell to payroll errors and ensure flawless payroll processing forever!

error-free payroll system designed to save you time and money.

5. Compliance and Regulatory Support

Payroll compliance is indeed complex and that especially varies by location. In this measure, you can easily ensure that the salary provider will keep updating themselves according to whether local, state, or national payroll. Furthermore, rules regarding payroll and compliance continue to change with time, therefore you should choose third party payroll companies that stay vigilant about that!

6. Customization and Reporting

For numerous transactions, a company will require lots of reports to improve decision-making. But where we can get it from? Quite easy it is, you should look for a third party payroll that avails the facility of making customized reports.

So our crucial mantra would be to look for outsourcing epayroll providers that offer customization options to tailor the payroll process to your specific needs. Robust reporting tools are essential for financial planning and analysis, they will allow you to generate more detailed payroll reports as needed.

7. Transition and Implementation

To sustain and conquer the already ongoing transition of this modern, A smooth transition from in-house to third-party payroll services is imminent. That is why you should choose a provider that offers comprehensive training and support during the implementation phase.

So, it’s high time to upgrade with the market-leading Expert! But who is that expert worth mentioning for? What is that marvelous software that continues to top among the free HR software India! Let us inform you guys that in the upcoming segment of this payroll blog!

Superworks- The Best HRMS & Payroll Software

Over the path of helping you choose the best third party payroll companies, we have revealed one of the greatest lists, that up until now were accessible by only a handful of people! But now, once I have revealed that we want to uncover one more secret about the best Payroll and HRMS software for you [like we promised in the last segment].

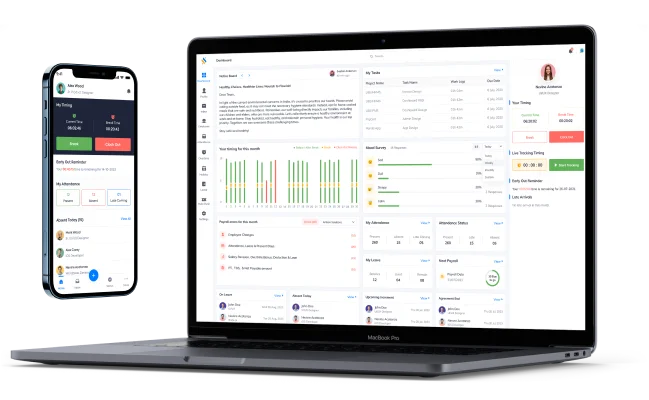

We are talking about Superworks which continues to stand out as the best HRMS & payroll software! And the reason behind that is seamless integration with third-party payroll services to offer a comprehensive solution.

With features like employee self-service, real-time data access, and robust reporting tools, Superworks continues to simplify payroll management. And by doing that it continues to joining report after leave the finest impression on its customers! So that is how Superworks ensures payroll and compliance by enhancing your payroll competence by keeping your data completely secured!

Conclusion!

Here, we have made sure to list out all the information regarding third party payroll. Moreover, we have also availed the ultimate guide for choosing the best one from a list of payroll companies! However, if you still have any kind of doubt, or want to know more about payroll or Superworks, then please connect with our team experts!

Also See: Best personal expense tracker app india | best payroll software | payroll software systems| top payroll software companies | best payroll management software in india | payroll process tools

FAQs

What is a third-party payroll company?

Why do big companies hire on third party payroll?

Big companies have smart managers who hire third-party payroll services to;

- Streamline their payroll processes

- Reduce administrative burdens

- Ensure compliance with complex labor laws.

Such Outsourcing payroll companies make space for the businesses, so they can focus on core business activities! While leveraging the expertise and advanced technologies of professional payroll providers. Plus, it helps:

- Minimizing errors [next to none]

- Improve data security through multiple folds

- Enhances overall operational efficiency

Is Superworks a payroll company?

Yes, Superworks is one of the top comprehensive HRMS software that includes payroll services as one of its key features. With this, it continues to offer a range of solutions designed to streamline HR and payroll processes, making it easier for businesses to manage their workforce efficiently.

What is the top payroll company?

There are several top payroll companies known for their excellent services and advanced technologies. Some of the leading names in the payroll industry include ADP, Paychex, Gusto, and Superworks.