Grab a chance to avail 6 Months of Performance Module for FREE

Book a free demo session & learn more about it!

-

Will customized solution for your needs

-

Empowering users with user-friendly features

-

Driving success across diverse industries, everywhere.

Grab a chance to avail 6 Months of Performance Module for FREE

Book a free demo session & learn more about it!

Superworks

Modern HR Workplace

Your Partner in the entire Employee Life Cycle

From recruitment to retirement manage every stage of employee lifecycle with ease.

Seamless onboarding & offboarding

Automated compliance & payroll

Track performance & engagement

The Ultimate Way Of Accurate Salary Calculation with Payroll Attendance Software

- Superworks

- 6 min read

- December 18, 2023

Effective attendance management and payroll guarantee the employees are paid accordingly, on time, and adhering to all compliance requirements.

These factors contribute to ensuring that there is productivity, tracking the performance, and ensuring effective allocation of resources. Good payroll and attendance management enhances the organization’s transparency and accountability.

However, managing payroll and biometric attendance is quite a problem and even more so when done manually. How should payroll and attendance be handled then? Let’s learn more about attendance and payroll along with the use of payroll attendance software.

- The Role of Integrated Attendance Tracking in Payroll Processing

- Why Seamless Integration of Attendance and Payroll Processing is Important?

- 7 Components Your Payroll Processing Should Include

- Challenges with Manual Attendance & Payroll Processes

- 6 Reasons Why You Should Adapt to a Payroll Attendance Software

- Conclusion

The Role of Integrated Attendance Tracking in Payroll Processing

![]()

The HR function involves two major components: attendance and payroll. It involves working together with the HR and finance departments.

You probably already are aware that staff attendance is the record of the presence and absence of an employee. It encompasses recording, following, and noting time devoted to a particular period with vacations, leaves, and absences.

The organization also has to consider time tracking to capture late arrivals, early departures, overtime, etc. Attendance management covers the techniques and methods applied for monitoring and controlling employees’ attendance and performance, as well as leaves and working schedules.

Why Seamless Integration of Attendance and Payroll Processing is Important?

Payroll is a process by which salaries, social security, bonuses, commissions, and other benefits are calculated and paid to an employee for a particular period.

The procedure of payroll management includes a list of the employees entitled to compensation. The payroll best personal expense tracker app India are also tracked for record-keeping and insights.

7 Components Your Payroll Processing Should Include

1. Keeping up-to-date records of all employees on the payroll including direct and indirect employees.

2. Calculating the total pay that each employee will receive, depending on their attendance online records.

3. The computation of payroll and the payrolling of taxes and other statutory deductions e.g. health insurance, PF contributions, ESI contributions, deductions, automated leave management system, benefits, etc.

4. Payment to employees on time and accurately through pay cheques, cash, or direct deposits.

5. Maintaining compliance with all state and central government statutory compliance requirements.

6. Paying all statutory compliance dues in an appropriate authority/government organization within the statute time frame and filing returns as required.

7. Recording and reporting of compensation for employees.

Challenges with Manual Attendance & Payroll Processes

Manual payroll and attendance processing is time-consuming. Many companies will have teams to tackle payroll and fingerprint attendance. The teams spend their productive hours in the busywork and repetitive manual jobs, not the core business areas.

-

Unscalable: Attendance and payroll management by manual and spreadsheet-based systems are not scalable. These methods may work for a business with fewer employees. While they are effective, these methods don’t scale as the number of staff increases as they scale up.

-

Unreliable: These methods are unreliable and involve errors such as errors of calculation, human errors, errors of omission, compliance errors, and so on.

-

Complicated: There are some statutory and other deductions that every employer must make from the salaries. This has separate contribution/ deduction rates, making the process very complicated.

-

Inconsistent: There are different types of attendance system for employees such as white-collar workers, gig workers, temporary workers, contractual laborers, informal workers, and others. Each one of them has different rates for paying and deductions.

-

Immeasurable: The payment for platform gig workers, including drivers, and delivery persons, among others, is based on the number of rides or deliveries. Hence, all their trips and hours worked out must be measured to arrive at their total weekly/ monthly payout. Their TDS and social security deductions will be computed based on this payout.

-

Inflexible: They are inflexible and not agile. It is difficult to update employee data, add or remove employees, etc. manually and via spreadsheets.

Read more: Streamlining Your Business with Salary Management: The Ultimate Guide

Finding attendance & payroll tracking difficult? – Superworks is the answer!

Transform your attendance and payroll processes with our feature-packed and effective software.

Eliminate the stress of attendance and payroll management and enhance your HR operations with us.

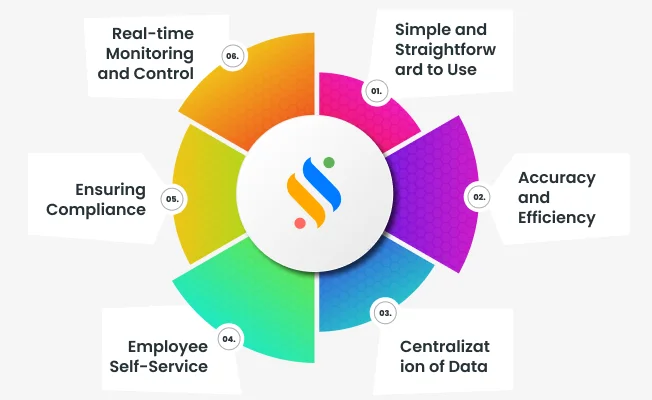

6 Reasons Why You Should Adapt to a Payroll Attendance Software

One of the best ways of managing attendance and payroll is to use reliable attendance and payroll software. It allows employers, irrespective of their size, to accurately monitor and manage payroll and attendance management processes. From attendance tracking to leave management, keeping employee records is easier with dedicated attendance software for biometric!

1. Simple and Straightforward to Use

Online payroll software allows you to automate the process with its advanced technologies and analytics to enhance efficiency, accuracy, and cost-effectiveness. It becomes much easier and simpler even for smaller businesses and even individual households to handle their payrolls and time and attendance.

2. Accuracy and Efficiency

Payroll attendance software ensures optimum accuracy and effectiveness. Automation lets your internal team avoid tedious and time-consuming paperwork. payroll software monitors attendance and calculates salaries, payouts, and deductions using pre-defined parameters with minimal human involvement. You can scale it, and make it flexible, and agile, which grows with you as your organization adapts to the changing regulatory environment.

3. Centralization of Data

Employee data at different locations gets integrated through payroll attendance software. For instance, platform workers such as delivery men, runners, and drivers can be found in different parts of the city and country. The employer can monitor and track all the movement and work of the gig workers centrally. This limits the potential for errors and inaccuracies. Centralized data improves collaboration between various payroll and attendance departments.

4. Employee Self-Service

This feature is characteristic of the best payroll attendance software. The employees can check their attendance, benefits, deductions, payments, and other relevant details. Firstly, it enhances transparency thereby creating a level of trust among employees and employers.

5. Ensuring Compliance

Employers can comply with all necessary statutory requirements regarding payment and epayroll. These requirements include timely salary/wage payments, deductions depositing, preparation of reports, and filing without problems. Payroll attendance software can help you with compliance as well!

6. Real-time Monitoring and Control

Payroll attendance software allows for real-time monitoring and recording of attendance, productivity, absences, etc. over a timeframe.

Conclusion

HR payroll software facilitates the generation of accurate and comprehensive reports and intelligence about employee attendance, absence, payroll, productivity, etc. With the help of these insights and reports, employers can budget properly, take steps to improve productivity, formulate appropriate policies, and more!

At Superworks, we offer you the best-in-industry tools for quick payroll calculation for hassle-free payrolls. Our feature-packed HR payroll software India can be your key to clocking in with confidence!

Also See: payroll process in india