Grab a chance to avail 6 Months of Performance Module for FREE

Book a free demo session & learn more about it!

-

Will customized solution for your needs

-

Empowering users with user-friendly features

-

Driving success across diverse industries, everywhere.

Grab a chance to avail 6 Months of Performance Module for FREE

Book a free demo session & learn more about it!

Superworks

Modern HR Workplace

Your Partner in the entire Employee Life Cycle

From recruitment to retirement manage every stage of employee lifecycle with ease.

Seamless onboarding & offboarding

Automated compliance & payroll

Track performance & engagement

How to Develop an Effective ESOP Policy With Almost Zero Efforts?

- sample esop scheme

- 8 min read

- September 22, 2023

When we talk about the policy, ESOP policy is one of the hard documents to create.

The ESOP Policy is like a set of rules for employees who can join an Employee Stock Option Plan.

An ESOP policy helps employees understand how they can own shares of the company, what to do with it, and the rules that come with it.

In this blog, we will explain the purpose, benefits, and other things of ESOP policy with a detailed guide.

As the best HRIS software provider, we want to help companies use ESOPs to get and keep their best employees. You can use ESOPs to make employees feel like they own a part of the company and get them more involved with the shares involved.

- What Is An ESOP (Employee Stock Ownership Plan)?

- How Does An ESOP (Employee Stock Ownership Plan)Work?

- Advantages & Disadvantages Of The Employee Stock Option

- What is The Eligibility for Employee Stock Option Plan( ESOP)?

- Maximizing ESOP Success: Best Implementation Practices

- Sample ESOP Scheme Policy

- Which Documents Are Needed For ESOP?

- Why Opt Superworks For Policy & Letters?

What Is An ESOP (Employee Stock Ownership Plan)?

An ESOP is a special policy where employees of a company can own a part of the company in shares. There are many ways to reward employees and it is the one way to make the employee your company part. It’s a way to reward employees and make them feel like they are part owners of the company.

In an ESOP, the company has to mainly invest in its own stock, and it can even borrow money to do this. This can help the company with its financial plans.

The company gives ESOPs to employees depending on their performance, job role, level, and many other factors. However to apply for the employee stock option schemes employees need to understand the policy and rules. This policy can help to understand all the terms regarding company stocks.

It is a benefit plan for employees, and it is good to buy the company shares at a predetermined price. ESOPs help to consider employees’ interests in the company’s success.

How Does An ESOP (Employee Stock Ownership Plan)Work?

An ESOP policy- Employee Stock Option Plan- is a plan that helps employees in a closely held company become shareholders of the company by allowing them to buy company shares.

Here’s How It Works:

- Most of the company set up the stock option plan ESOP and hold the shares in trust for a certain period.

- ESOPs are like savings accounts for an employee, and that company. This money is used to buy company shares, and each employee gets a share of it based on their

salary. This can be very beneficial for everyone in the future. - Employees can use their ESOPs to buy company shares at a price that is predetermined and lower than the market value. The number of shares they can buy, the price, and who gets them are all decided beforehand.

- Employees can cash out their shares from the ESOP scheme when they meet the requirements or when they leave the company. How much they get depends on these requirements.

- If an employee has been in the ESOP for at least 10 years and is 55 or older, they can choose to diversify their ESOP account by moving up to 25% of it into other investments. They can do this until age 60, and at that point, they can diversify up to 50% of their account.

- When employees employee application for leave the company due to disability, termination, death, or retirement, they get the vested part of their ESOP accounts. Most of the time all the employees can receive the shares at once or in smaller payments over time. If they pass away or become disabled, they or their beneficiaries get the vested part right away.

Note: You can download directly from here and edit as per your need.

Advantages & Disadvantages Of The Employee Stock Option

Here we mentioned some of the advantages and disadvantages regarding a number of options in employee stocks, check below.

Advantages Of An ESOP:

Incentive for Retirement

ESOP Shares mean employees are part of the company forever and for that, it helps to give a guarantee for retirement.

Capital Appreciation

Companies can sell their ownership to other persons as well. When this happens the company’s values go up. The owner can sell their company, and get money without paying taxes, still, the owner has the right to the company.

Tax Advantages

There are some conditions regarding the Tax for the ESOP however most of the employees can get relief in tax. Also, owners get relief for the same- They can sell their shares to the ESOP and they don’t have to pay extra taxes. They can sell some or all of the company to employees without extra costs.

Lowering Company Taxes

In this case, companies can reduce their taxes and increase the value of the company by giving shares to employees.

Employees who manage the ESOP need to act responsibly, or they can be held responsible if they do something wrong.

Liquidity

If the company’s stock value goes up a lot, the ESOP or the company might not have enough money to buy stock when employees retire.

Stock Performance

If the company fails, employees could lose their benefits unless the ESOP is diversified in other investments. If the company’s value doesn’t go up, employees might not like the ESOP as much as other plans.

Motivation and Retention

ESOPs make employees feel like they own a piece of the company, which motivates them and makes them want to stay.

Cash Flow

The cash flow helps companies save money because they are a form of employee compensation that doesn’t require cash payments.

Disadvantages Of The ESOP:

Changing Uncertainty

ESOP advantages depend on the company’s stock price, which can go up and down a lot.

Ownership Sharing

ESOPs can result in a decrease in ownership and control as employees become partial owners.

Extra Expenses

ESOPs come with some added costs and can be a bit complicated to set up and handle.

What is The Eligibility for Employee Stock Option Plan( ESOP)?

The maximum age of an employee should be 21 as per the IRS ( Indian Revenue Service ). Moreover, the employee must be eligible for ESOP while joining. Moreover, the employer can restrict the eligibility of the employee in 2 years of service if their plan has immediate vesting.

If you don’t know more about the ESOP policy India rules, or you cannot make an ESOP policy draft you can check the ESOP scheme sample template below to understand more. Superworks has made different kinds of templates and samples to help HR management.

Who Can Get ESOPs?

As per the Companies Act, 2013, and the Securities and Exchange Board of India (Share Based Employee Benefits) Regulations, 2014, these people can get the ESOPs. ESOPs cannot be issued to advisors, consultants, or contractors- those who are not employees of the company. However, the company can issue equity shares to non-employees with certain conditions.

- ESOPs can be issued to employees who have company holdings. Also, people who have company subsidiaries. However, they must meet the eligibility criteria specified in the ESOP scheme.

- ESOPs can be issued to all employees of the company. The first right of the ESOP scheme is of their permanent employees. This also includes employees who are working in India or abroad. The company can also issue ESOPs to its directors, but that can be dependent directors, not independent directors.

- Employees who are also members of the promoter group can take ESOPs.

Read more: The Essential Elements of a Leave Encashment Policy You Should Include

Want to increase the efficiency of business? – Get free templates

Discover the ultimate way to supercharge your business efficiency and productivity. Grab our complimentary templates today, and watch your operations soar to new heights.

Don’t miss out on this opportunity to boost your profits – get started now!

Maximizing ESOP Success: Best Implementation Practices

- First of all, you need to check what is the worth of your company and then you can consider the shares with the exercise price. Then check how much you’ll need to put into the ESOP trust. This often involves market research to see if it’s possible.

- Decide why you want to have ESOPs. Either it is for employee engagement or sometimes it is for tax benefits. You can give it to motivate employees or other rewards.

- Always make your company’s rules for the ESOP scheme. So for that, you need to make an ESOP policy sample and change rules when needed as per the IRS.

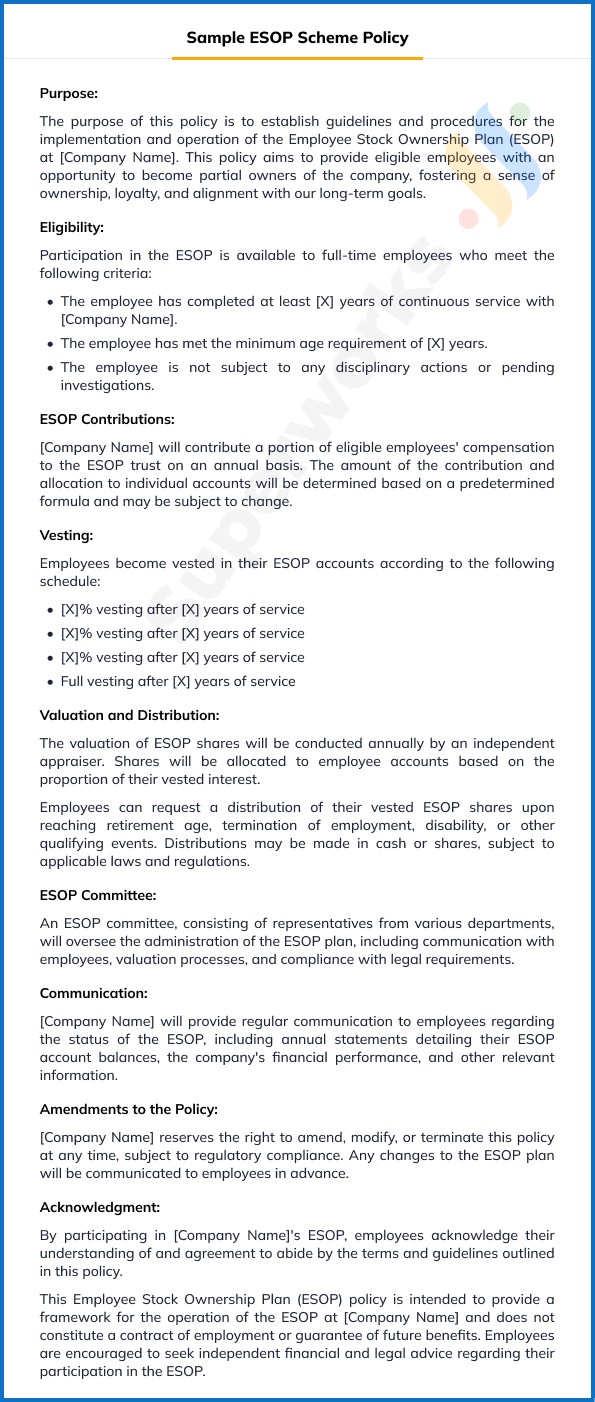

Sample ESOP Scheme Policy

Which Documents Are Needed For ESOP?

- Register of ESOP

- Board meeting request

- General meeting request

- Board report

- MGT-14, PAS-3

- Resolution regarding approval of ESOP

Is ESOP Beneficial?

Yes, ESOP is beneficial for the company as well as employees.

A company might give its employees the chance to buy company stock as a way to encourage them. This can make employees work harder because they’ll make money if the company’s stock goes up.

Why Opt Superworks For Policy & Letters?

No matter what, you need HR documents, right? If you need any kind of the ready to use templates or letters you can go through the HR toolkit of the Superworks. Not only ESOP policy but you can get many more from us.

Now no worries to for making the letters, emails, and forms, Check the utmost qualitative templates for your company. Moreover, you can streamline whole HR management as we provide HRMS software. Check our other modules as well.

Also See: Apps to track expenses india