Grab a chance to avail 6 Months of Performance Module for FREE

Book a free demo session & learn more about it!

-

Will customized solution for your needs

-

Empowering users with user-friendly features

-

Driving success across diverse industries, everywhere.

Grab a chance to avail 6 Months of Performance Module for FREE

Book a free demo session & learn more about it!

Superworks

Modern HR Workplace

Your Partner in the entire Employee Life Cycle

From recruitment to retirement manage every stage of employee lifecycle with ease.

Seamless onboarding & offboarding

Automated compliance & payroll

Track performance & engagement

A Comprehensive Guide to Salary Payment Rules in India

- Salary Slip

- 6 min read

- November 10, 2023

Introduction

Salary payment is a fundamental aspect of the employer-employee relationship, and it plays a crucial role in the financial well-being of individuals. In this comprehensive guide, we will break down the intricacies of salary payment in simple terms, with a specific focus on salary payment rules in India.

We will also explore the significance of payroll software, with a spotlight on Superworks, an online payroll software solution. Additionally, we will delve into the creation of salary slips and the payroll calculation process. Let’s embark on this journey to understand the nitty-gritty of salary payment.

Understanding Salary Payment

Salary payment refers to the process through which an employer compensates an employee for their work and services. It typically occurs on a regular basis, such as monthly or bi-weekly, and is a significant component of an employee’s overall compensation package.

Salary payment encompasses various aspects, including determining the salary structure in india, adhering to legal regulations, and ensuring accurate and timely disbursements.

Salary Payment Rules in India

Legal Framework

India has a well-defined legal framework governing salary payments. The Payment of Wages Act, 1936, is a key legislation that outlines the rules and regulations related to wage payments in India.

According to this act, wages should be paid in legal tender, and employers must follow the prescribed wage period.

Minimum Wage Requirements

One of the essential salary payment rules in India is ensuring that employees receive at least the minimum wage mandated by the respective state or central government. The minimum wage varies across states and is determined based on factors such as skill level and cost of living.

Income Tax Deductions

Income tax deductions are a significant aspect of salary payment. Employers are required to deduct income tax at source (TDS) from the employee’s salary as per the Income Tax Act, 1961. The amount of TDS depends on the employee’s income and tax-saving investments.

Provident Fund (PF) and Employee State Insurance (ESI)

Another crucial component of salary payment rules in India is the contribution to Provident Fund (PF) and Employee State Insurance (ESI) schemes. Both employers and employees are required to make contributions to these schemes to provide financial security and benefits to employees.HR can also calculate employee PF using ESI and PF software.

The Role of Payroll Software

Unable to manage salary payments seamlessly?

Try Superworks which offers an impeccable payroll solution, Super Payroll. With Super Payroll, managing and processing payroll becomes easier and faster than ever before. You will never regret relying on this software for your payroll management.

Click the button below to experience payroll excellence!

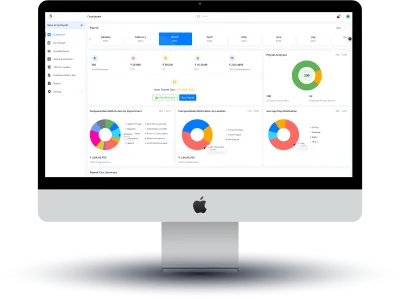

Superworks: A Leading Online Payroll Software

In today’s digital age, payroll management has become more efficient and accurate with the help of payroll software solutions.

Superworks is one such online payroll software that simplifies the entire salary payment process. It offers a range of features, including salary calculation, tax deductions, and compliance with statutory requirements, making it a valuable tool for businesses of all sizes.

Benefits of Using Payroll Software

-

Accuracy: Payroll software eliminates the risk of manual errors in salary calculations, ensuring that employees receive the correct amount.

-

Time Efficiency: It reduces the time and effort required for payroll processing, allowing HR and finance teams to focus on other strategic tasks.

-

Statutory Compliance: Payroll software helps in adhering to salary payment rules in India, such as TDS, PF, and ESI contributions, ensuring legal compliance.

-

Employee Self-Service: Many payroll software solutions offer employee self-service portals where employees can access their salary slips and tax-related information.

Creating a Salary Slip With HR Payroll Software

Components of a Salary Slip

A salary slip, also known as a pay stub or pay advice, is a document provided to employees along with their salary payments. It contains detailed information about an employee’s earnings, deductions, and other financial aspects. The key components of a salary slip include:

-

Employee Information: Name, employee ID, designation, and department.

-

Earnings: Basic salary, allowances (such as house rent allowance and conveyance allowance), and bonuses.

-

Deductions: Income tax, Provident Fund (PF), Employee State Insurance (ESI), and any other deductions.

-

Gross Salary: The total earnings before deductions.

-

Net Salary: The final amount an employee receives after deductions.

-

Tax Calculation: Details of income tax calculation, including taxable income, TDS, and exemptions.

Importance of Salary Slips

Salary slips are essential for both employees and employers. They serve as legal proof of salary payments and are often required for various financial transactions, such as applying for loans or filing income tax returns. Additionally, Application for salary slip help employees understand their financial position and track their earnings and deductions over time.

Read more: What Are The Hidden Benefits Of Salary Software? Decoded In 10 Different Ways!

The Payroll Calculation Process That HR Manager Does

Gross Salary Calculation

The gross salary is the total earnings an employee receives before any deductions. It includes Salary Components in India like basic salary, allowances, bonuses, and other monetary benefits. Calculating the gross salary management accurately is crucial to ensure that employees are paid their rightful earnings.

Deductions Calculation

Deductions from the gross salary include income tax, Provident Fund (PF) contributions, and Employee State Insurance (ESI) contributions. Accurate deduction calculation is vital to comply with salary payment rules in India and to ensure that employees’ financial interests are protected.

Net Salary Calculation

The net salary is the final amount an employee receives after all deductions have been subtracted from the gross salary. It is the amount that is credited to the employee’s bank account. Accurate net salary calculation is essential to avoid discrepancies and maintain trust between employers and employees.

Conclusion

Salary payment is a critical aspect of any employment relationship, and it involves adherence to various rules and regulations in India. Understanding the legal framework, minimum wage requirements, income tax deductions, and contributions to schemes like PF and ESI is essential for both employers and employees.

The use of payroll software, such as Superworks, streamlines the salary payment process, ensuring accuracy and compliance with salary payment rules in India. Additionally, creating comprehensive salary slips and accurate payroll calculations further contribute to a transparent and trustworthy salary payment system.

In conclusion, salary payment is not just about the monetary aspect; it is a reflection of an organization’s commitment to its employees’ financial well-being and adherence to legal obligations. By following these guidelines and leveraging technology, employers can ensure that their employees receive their rightful earnings and benefits in a hassle-free manner, fostering a positive work environment.

Read More: Apps to track expenses india | payroll process in india