Grab a chance to avail 6 Months of Performance Module for FREE

Book a free demo session & learn more about it!

-

Will customized solution for your needs

-

Empowering users with user-friendly features

-

Driving success across diverse industries, everywhere.

Grab a chance to avail 6 Months of Performance Module for FREE

Book a free demo session & learn more about it!

Superworks

Modern HR Workplace

Your Partner in the entire Employee Life Cycle

From recruitment to retirement manage every stage of employee lifecycle with ease.

Seamless onboarding & offboarding

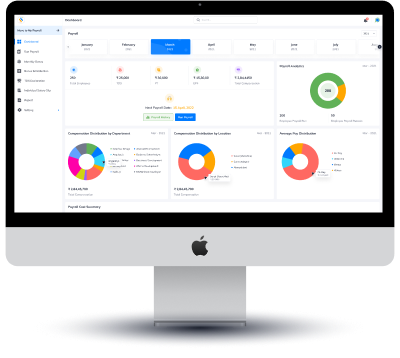

Automated compliance & payroll

Track performance & engagement

Why Startups and SMEs Should Have a Payroll Online Software – 5 Reasons

- payroll online software

- 7 min read

- August 3, 2023

Do you know how many major challenges most small businesses face?

- Lead Generation

- Finding Projects or Customers

- Hiring Talented People

- Managing Workflow &Workforce

- Planning Finance

- Increase Awareness

One of the major concerns is- financial planning & workforce management, even though small businesses have a small workforce.

Both concerns come under the main operation – Payroll processing! – Yes, paying employees with proper net pay, deciding payroll amount or policy, managing business finance, and managing employees come under payroll management.

There is no doubt, only small businesses don’t need systematic payroll management, Medium & large enterprises with a high number of employees definitely need it! Cause, the payroll management software ensures a lower rate of errors.

Let’s understand, what actually payroll software is and why is it necessary for your business.

What is Payroll Online Software?

There are multiple ways to manage payroll such as-

- Handled by HR

- Handled by Accountant

- Payroll Outsourcing

- Web Payroll

- Cloud-based Payroll Software

In these all payroll solution, online payroll software is the most advanced method to handle payroll without any hassle.

Payroll software- or cloud-based software or online software is an automated application, used to manage & automate all payroll operations. As automated payroll software uses some definite programmed functions to calculate pay online and compile on a secured platform.

Furthermore, as a small business owner, you can get more benefits such as – data storage on a cloud system, access with authentication, payroll reports, and many more.

To Read More: 10 Reasons Why You Should Be Using HR Software for Small Business

What Problems Small & Midsize Businesses Face Without A Payroll System?

If you still wondering what are the major payroll-related problems you are facing, or will face in the future then here is the list, we have made.

- Manual payroll processing makes the error rate high. And in small businesses- simple error costs too much.

- Manual payroll processing takes too much time to calculate salary.

- The manual payroll process sometimes misses depositing salary on time and that’s why employees face dissatisfaction.

- Manual attendance tracking, counting single penny, depositing salary, and then making report waste too much time if you need to do rework.

- The mistakes cannot be undone, and the cost of the mistakes is not less, if you need to pay a fine as a penalty for missing statutory compliance.

- You may lose valuable assets – employees if they are not satisfied with your payroll processing.

Now, it’s time to smarten your business by organizing HR & payroll information, processes, and operations.

Join the 500+ satisfied companies list – Get the best payroll software!

As an SME owner, don’t take payroll headache! Save your valuable time and money from manual payroll operations & improve efficiency just like our clients.

Empower your business with our advanced payroll solution.

5 Vital Reasons To Have Payroll Online Software In Your Startup

First of all, Let’s Check How Can Payroll Software Help You:

- No need to count fingerprint attendance manually and it will erase the extra burden of HR services from HR professionals.

- It easily stores employee documents and gives access to authenticated persons.

- It can help to check salary slip through the employee self-service portal.

- It easily helps to be updated with statutory compliance & tax laws.

- SMEs can manage financial data without doing extra effort by using this accounting software.

The reasons are listed below,

1. Payroll Software Helps To Save More Than 50% Of Time

In small businesses, if you need to handle too many payroll operations, you just need to hire an HR professional for the same. Because this is big and it actually needs one different person to make it easy for your business.

Small and midsize businesses actually can’t afford to waste time on payroll counting. As payroll is a complicated process and it is a vital process of the business. So if there is payroll software, you can easily make the payroll on autopilot and save time.

As payroll software easily automates these operations,

- Employee attendance online tracking

- Employee document management

- Expense reimbursements

- Tax calculations

- Benefits management

- Payroll compliance

Time-saving of the HR and employees or other managers means, they can utilize the time in other tasks and so that ultimately the efficiency of them will be increased.

So, switching from manual to automated actually benefits you!

2. Payroll Software Helps To Reduce Calculative Workload

Basic payroll operations such as – attendance management, expense management, tax laws regularization, and direct deposit are actually daunting if you prefer to do them on your own.

Most small and midsize businesses use these online payroll services as they calculate payroll & retrieve financial data and reports with few clicks.

There is no fear of any error, fine, or penalty so it actually lessens the workload.

3. Payroll Software Is Used For Better Accuracy & Enhanced Security

1 mistake and you need to face some major issues! – Who can afford this?

Nothing is worse than – you have already a tight budget and need to pay for silly mistakes. Payroll software is preferred for accuracy & security as well.

From tax filing to statutory compliances- it provides a complete solution.

One more thing- the security of payroll or employee data is vital because it is very sensitive. The payroll service data such as name, address, birth dates, account numbers, and other information should be protected.

The best online payroll software provides state-of-the-art security to protect all payroll data. So, this is a good reason to go for the payroll software.

4. Payroll Software Means No More Errors In The Payment Process

The payroll online software is actually designed to eliminate errors in the payroll process. Among all the payroll solutions, automated, cloud-based payroll software is very good to run payroll easily. Errors in the payroll result in losses for SMEs.

So, whenever it is time to count pay, consider payroll tax liabilities, check pay rates, deposit on the right bank account, and keep pay periods in the loop- all should be error-free at all.

An online payroll system can help to do all these operations without an error.

5. Ultimately Payroll Software Helps To Save Money

If the above operations are done with the online payroll system, then actually the major cost is saved. Because, if time is saved, if errors are solved, if there is utmost accuracy and security, efforts are saved then what remains to save your business money?

You don’t need to hire a professional to handle the complicated payroll process. Also, payroll data is sensitive and it should be protected to save major issues and thus money.

The automated payroll system can save money because it can be put to greater use in every payroll aspect of your organization.

Super Benefits Of Having Payroll Software For Your Business

If your employees are dissatisfied, your business may be at risk. Overlooking the morale within your workplace might lead your top employees to seek alternatives and leave.

Embracing online payroll software enhances operational efficiency and minimizes the chances of errors. This relieves you of unnecessary concerns & issues that ensure that your valuable workforce remains intact.

Adopt payroll software to get the major benefits by having advanced payroll features such as

- Automated attendance management

- Time tracking integration

- Performance management

- Talent management

- Tax-related features

- Benefits administration

and many more.

The payroll software simplifies one of the challenging tasks of startups and medium-sized businesses- payroll processing.

The user-friendly nature of payroll online software streamlines the payroll process, making it accessible to employees with diverse skill sets. As a result, you can assign payroll responsibilities to anyone such as HR personnel, cutting costs and enabling cross-training opportunities.

Summary

Ensuring the happiness of your employees is crucial for your own contentment as a small business owner. So if you are one to reduce risk of the errors and want to enhance business then you should definitely go for the online payroll software.

This not only alleviates your concerns but also helps retain your top-performing workers within your organization.

Superworks – is one of the best online payroll software, eliminating the need for specialized training. This online payroll system offers ongoing support, regular upgrades, and error-free payroll for your employees. This not only ensures smooth operations throughout the year but also facilitates seamless payroll functioning & benefits to all kinds of businesses.

Also see: hr outsourcing companies in india | payroll software online