A SaaS payroll system is simply a cloud-based platform that bears the responsibility of automating payroll processing. And allowing various businesses no matter how small or large to manage employee compensation, tax compliance, and benefits administration online.

Grab a chance to avail 6 Months of Performance Module for FREE

Book a free demo session & learn more about it!

-

Will customized solution for your needs

-

Empowering users with user-friendly features

-

Driving success across diverse industries, everywhere.

Grab a chance to avail 6 Months of Performance Module for FREE

Book a free demo session & learn more about it!

Superworks

Modern HR Workplace

Your Partner in the entire Employee Life Cycle

From recruitment to retirement manage every stage of employee lifecycle with ease.

Seamless onboarding & offboarding

Automated compliance & payroll

Track performance & engagement

SaaS Provider for Payroll Processing: 6 Helpful Tips From Experts

- top saas payroll

- 8 min read

- August 27, 2024

When you have a look at the modern business working, you will definitely be awestruck! Because today, the way of doing business and operating the workforce has changed drastically! Unlike before, in the business environment, the management of payroll has become so critical and different, and still plays the most critical role to the success of any organization.

For that, the role of SaaS provider for payroll processing has come forward as the most critical one! And the reason behind that is a notable one, where SaaS payroll services assist businesses of all sizes with a cloud-based solution that simplifies and streamlines payroll operations!

This simplification and streamlining of the payroll was much needed for a long time, and it undoubtedly makes it easier for businesses to manage crucial components like;

- Employee compensation,

- Tax compliance, and

- Benefits administration.

But how this one software can be so helpful that it continues to do all the payroll-related work by itself? And another question that may come to your mind would be ‘How can we get the most use of this SaaS HR payroll?’ And to answer that only, we are here with this blog, because here we will explore;

- What SaaS provider for payroll processing is!

- The key features of payroll & HRMS SaaS to look for and share with others!

- 6 expert tips to help you get the most out of your SaaS payroll solution.

What is a SaaS Provider for Payroll Processing?

A SaaS provider for payroll processing ensures to keep delivering the payroll services through a cloud-based platform. In normal English, it means that the payroll software is hosted on the provider’s servers [which can be anywhere in the world]! And from there it will be accessed via the Internet, so the businesses can manage payroll and HR works from anywhere, at any time.

Unlike traditional on-premise payroll systems, your payroll solutions here will offer greater flexibility, scalability, and ease of use. In a nutshell, these are particularly beneficial for businesses that are looking to reduce IT costs and want to streamline their payroll operations.

With SaaS payroll software, the struggle of doing payroll whether small businesses or big ones can end, quite easily! Because here you need to understand one thing by getting access to automation, numerous payroll work can be done in an instant! Whether it is calculating wages, withholding taxes, or the crucial task of generating pay stubs.

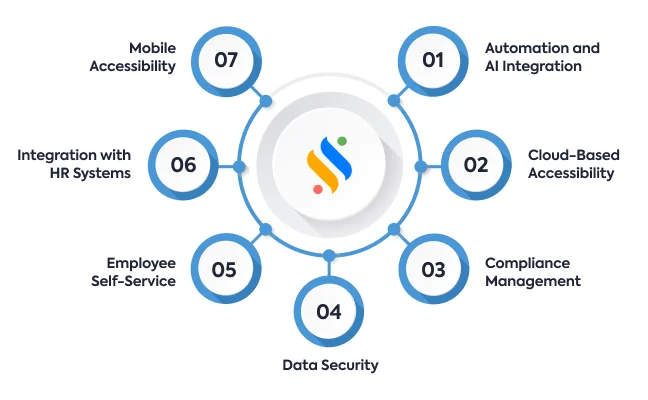

Features of SaaS Provider for Payroll Processing

Not an easy job to run payroll seamlessly without the best payroll software, and that is why we will need HRMS and payroll solutions with great features! However, after knowing what is saas payroll, what feature should we seek here? See below;

Automation and AI Integration

Based on practical experience, this automation is really a game-changer in SaaS provider for payroll processing. Because it ends the need for manual data entry, minimizes errors, and speeds up processing times. Furthermore, it also handles complex calculations, and even complicated tax compliance.

Cloud-Based Accessibility

One of the biggest advantages of cloud-based payroll solutions that you need to understand is the ability to access payroll data from anywhere, at any time. This feature of the software as a service is particularly useful for businesses with remote or hybrid workforces.

Compliance Management

Payroll compliance is complex and quite difficult to manage, but a good SaaS payroll solution can manage it properly. Because with this software, payroll taxes and compliance management have been never easy!

Data Security

With cyber threats and other potential security risks on the rise, data security is more important than ever. That is why it’s crucial to ensure global payroll saas services and have a SaaS provider for payroll processing that offers robust security features, such as;

- encryption,

- multi-factor authentication, and

- regular security audits.

Employee Self-Service

Empowering employees to access their payroll information through self-service portals is one of the most efficient things done by Payroll SaaS India! Because that is how we can substantially reduce the administrative burden on HR and improve employee satisfaction.

Integration with HR Systems

Apart from the feature to process payroll and direct deposit of money into the employee account, there also can be seamless integration with HR and accounting software! And believe us, it is crucial to ensure that payroll data flows smoothly between systems, just so there can be low redundancy and errors.

Mobile Accessibility

With time and recent trends, more and more employees are working remotely or on the go, and that is why we need a mobile-friendly payroll processing SaaS application! Because that is what can help managers and employees access payroll information from their smartphones or tablets at any time and from anywhere.

6 Ultimate Tips for SaaS Payroll Solutions

After understanding the crucial features of the SaaS provider for payroll processing [that we crucially need], it’s time to get some expert tips from our side on the same! So, let’s keep looking through all the expert tips one by one and expand the horizon of our knowledge!

1. The Power of Automation and AI in Payroll

Automation and AI are those two words that you will continue to listen to every place you visit, whether offline or online! Hence, here too you can also witness the AI-driven tools that can further enhance accuracy by identifying anomalies and ensuring compliance with tax regulations.

So, make sure to seek SaaS cloud payroll solutions that have implemented AI in their SaaS provider for payroll processing! Because that way, you can experience at least a 30% reduction in processing time, with more efficient operations.

2. Cloud-Based Payroll Services

To streamline your regular payroll and even the paid time off PTO, you should move to cloud-based solutions that show no signs of slowing down. Furthermore, it offers real-time access to payroll data, which is crucial for maintaining business continuity, especially in today’s remote work environment. So, get one such software and manage payroll from anywhere.

Increase your payroll efficiency by 50% with our Super Payroll!

Experience the best payroll processing with India’s best Payroll software!

3. Mobile Accessibility for On-the-Go Management

With the rise of remote work all over the world, mobile accessibility has become an essential feature specifically for the SaaS provider for payroll processing! This amazing feature allows both employees and managers to access payroll information on the go! Moving forth, this ensures that payroll processes and tax management never get delayed, so make sure you have one for your company!

4. Adapting to the Gig Economy

In this modern landscape, the gig economy [which never existed a couple of decades before] has grown rapidly. And with that payroll software SaaS should also adapt accordingly and grow to handle diverse employment types, including freelancers and independent contractors.

A flexible SaaS payroll solution that can easily manage both traditional employees and gig workers, which indeed is crucial for businesses that rely on a varied workforce!

5. Preparing for Future Payroll Trends

The payroll industry is constantly evolving and what benefits administration of businesses would be the modern technologies! And that is why you are gonna need to keep regularly reviewing and updating your SaaS small business payroll software to incorporate the latest features!

6. Choosing the Right SaaS Payroll Software

And now we are on the final tip, which selecting or choosing the right SaaS provider for payroll processing! Because ultimately it indeed is a critical decision for any business. Hence, you should consider crucial factors such as;

- ease of use,

- scalability,

- integration capabilities, and

- customer support when choosing a provider.

Because this is the most crucial step, where you decide to choose the right SaaS payroll for large and small businesses. Hence you just have to make sure that such software should not only meet your current but also the upcoming business needs and ensure long-term success.

Superworks- Best HR SaaS Payroll Management Software

When you keep looking for the best HR SaaS payroll solutions over the web or even when you search ‘best India HR payroll saas you will reach out to the Super Payroll! And do you know the reason why? Because it is a highly efficient payroll that complies with all the modern requirements of the businesses and continues to provide payroll and HR solutions seamlessly!

Here, team Superworks quite understands the importance of a seamless payroll process and its dire need in the market! Hence they have designed cloud based payroll software that can easily with your existing HR and accounting systems. And such great assistance, you can seamlessly manage your payroll more efficiently, reduce costs, and ensure that your employees are paid accurately and on time.

So if your search is for a great SaaS provider for payroll processing, then with this amazing software your search has sufficiently ended! Therefore, get a step forward and book a demo for a better understanding of the software!

Also see: payroll management system software demo | payroll management software india | payroll tools in india | payroll service providers india

FAQs

What is the SaaS payroll system?

What is the best payroll software for payroll providers?

Generally, the best payroll software is a subjective matter because it will depend on your company's specific needs. But when it comes to the Superworks, this software stands out for its comprehensive features and user-friendly interface. As it offers robust tools for whatnot, like managing payroll, ensuring compliance, and providing employees with easy access to their payroll information.

How top SaaS payroll can be helpful for businesses?

Top SaaS payroll solutions are known to offer not one or two but numerous benefits to businesses, and that list can easily include scalability,

compliance management,

real-time data access, and

cost savings.

Furthermore, by automating payroll processes and integrating with other business systems, SaaS provider for payroll processing can help businesses manage payroll more efficiently, help reduce errors, and also make sure that employees are paid accurately and on time.

Is Superworks a SaaS company?

Yes, Superworks is indeed a leading SaaS company in India, as it continues to provide top-notch HR and payroll management solutions seamlessly. This platform of ours is designed to assist businesses in streamlining their payroll processes, ensuring compliance, and improving the overall efficiency of the workspace!