Grab a chance to avail 6 Months of Performance Module for FREE

Book a free demo session & learn more about it!

-

Will customized solution for your needs

-

Empowering users with user-friendly features

-

Driving success across diverse industries, everywhere.

Grab a chance to avail 6 Months of Performance Module for FREE

Book a free demo session & learn more about it!

Superworks

Modern HR Workplace

Your Partner in the entire Employee Life Cycle

From recruitment to retirement manage every stage of employee lifecycle with ease.

Seamless onboarding & offboarding

Automated compliance & payroll

Track performance & engagement

How To Pay Employees On Time By Using Online Payroll Portal?

- payslip portal

- 10 min read

- July 12, 2024

Every single person is working for the money/pay/salary. By working a whole month every single person wants their salary on time!

But what if HR or the company is not capable of doing their payroll on time? Delays in salary disbursement can lead to decreased morale and productivity, ultimately impacting the overall efficiency of an organization.

In today’s digital age, leveraging a payroll portal can streamline the payroll process, ensuring timely and accurate payments.

In this blog, we will explore the common problems HR faces while paying employees, the solutions provided by payroll automation, and the benefits of using HR and payroll software.

Which Problems HR Faces While Paying Employees?

HR managers encounter numerous challenges in the payroll process. Some of the most common HR problems are:

– Manual Errors

Manual errors in payroll processing are a significant issue faced by HR departments. These errors often occur due to incorrect data entry, miscalculations, or overlooking necessary deductions and contributions. This is one of the main reasons for the late salary.

For instance, entering the wrong hours worked or failing to update tax codes can result in inaccurate salary payments. These errors not only lead to discrepancies in employee salaries but also cause dissatisfaction among the workforce.

– Compliance Issues

Compliance with tax regulations and labor laws is another major challenge for HR professionals. Tax laws and labor regulations frequently change, making it difficult for HR teams to stay updated. Non-compliance can result in hefty fines and even legal action against the organization.

For example, failing to adhere to new tax laws or labor regulations can lead to incorrect tax filings, which can attract regulatory scrutiny. Ensuring compliance requires constant monitoring and updating of the payroll portal, which can be a daunting task for HR departments.

– Time-Consuming Processes

Traditional payroll solutions portals are often labor-intensive and time-consuming. HR personnel has to manually gather and verify employee work hours, calculate salaries, and process payments. This process can take several days to complete and the salary will not be disbursed on time.

The time spent on these Payroll Process Steps could be better utilized for strategic HR activities such as employee engagement and development.

– Lack of Integration

Many organizations struggle with integrating their payroll management software with other HR functions such as attendance tracking, leave management, and employee benefits. Disconnected systems can lead to data discrepancies, as information needs to be manually transferred from one system to another.

For example, if the attendance system is not integrated with the complete payroll solutions portal, HR personnel have to manually input attendance data into the manual HRMS system. This is increasing the risk of errors. Lack of integration can result in delays in payroll processing and inaccurate salary payments.

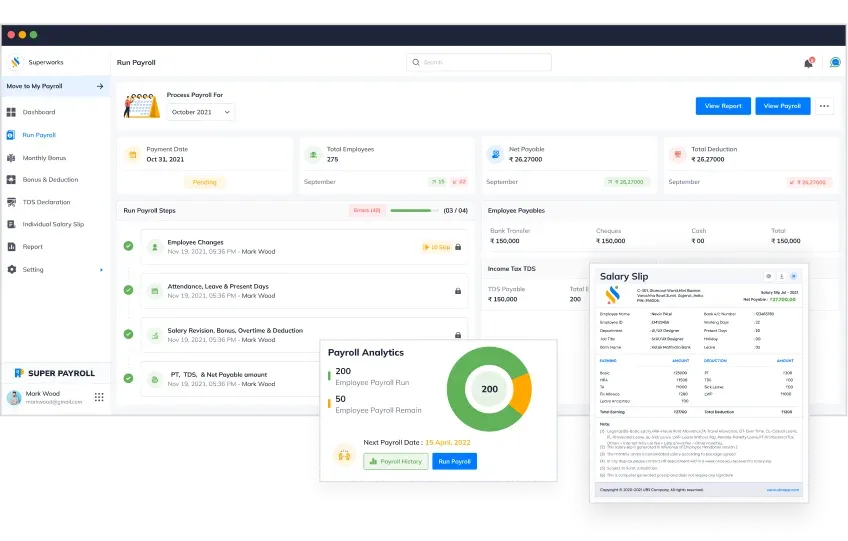

Save up to 30% time on payroll with Super Payroll!

Reduce errors & experience seamless payroll management with Superworks.

– Employee Dissatisfaction

Delayed or incorrect salary payments can lead to significant employee dissatisfaction. Employees rely on their salaries to meet their financial obligations, and any delay can cause financial stress. Moreover, a lack of transparency in the payroll process can create mistrust between employees and the organization.

What Can Help To Solve These Payroll Problems?

To address payroll challenges, organizations can implement various strategies and tools such as HRMS Payroll software in India:

Automated Payroll Systems

Automated top-rated payroll portal can significantly reduce the risk of manual errors and ensure accurate salary calculations. The best HRIS and payroll software use automation, and advanced algorithms to process payroll data, minimizing the likelihood of mistakes.

For example, payroll and compliance services can accurately calculate time, leaves, overtime pay, taxes, and deductions based on predefined rules. This HRMS ESS portal software ensures employees receive their correct salaries on time.

Moreover, the payroll solutions employee portal can handle complex payroll scenarios, such as multi-state tax calculations, making them an essential tool for HR departments.

Regular Training and Updates

Regular training and updates for HR personnel can enhance their efficiency and ensure compliance with the latest regulations. Training sessions can cover topics such as new tax laws, payroll self-service portal updates, and best practices in payroll processing.

By staying updated with the latest developments, HR personnel can ensure accurate payroll processing and compliance with regulations. For instance, regular training on new tax laws can help HR personnel accurately calculate tax deductions and avoid non-compliance penalties.

Integration of Systems

Integrating payroll systems with other HR functions such as attendance tracking, leave management, and employee benefits can streamline data flow and ensure accurate payroll processing. Integrated systems can automatically transfer data from one function to another, reducing the risk of errors and delays.

For example, an integrated system can automatically update attendance data in the HR and payroll system, ensuring accurate salary calculations. This integration enhances the efficiency of the payroll process and reduces the workload on HR personnel.

Employee Portal

The employee self-service payroll portal allows employees to view their personal information, give payroll payslips, and track their attendance and leave balances. Employees can access their payslips through the HRIS employee portal.

This transparency reduces confusion and dissatisfaction among employees. Moreover, the Payroll ESS portal empowers employees.

What Is Payroll Automation?

Payroll automation refers to the use of technology to manage the payroll process with almost human intervention. An online payroll portal automates various aspects of payroll, from data entry to salary disbursement, ensuring accuracy and efficiency.

Key Features of Payroll Automation:

- Automated Calculations: Automatically calculates salaries from attendance, taxes, and deductions, ensuring accurate and timely payments.

- Compliance Management: Ensures adherence to tax regulations and labor laws, reducing the risk of non-compliance penalties.

- Direct Deposits: Facilitates direct bank transfers to employee accounts, eliminating the need for manual check processing.

- Reporting and Analytics: Provides detailed reports and insights into payroll data, helping HR departments make informed decisions.

What Is Employee Portal?

An Employee Portal, also called a Payroll Portal.

The employee payroll portal is an online tool that helps employees access various online HR services easily by accessing the dashboard. The portal offers useful HR information, self-service options to answer questions and case tracking. This tool improves the employee experience, making them more satisfied and engaged.

The ESS or payroll portal lets employees access important information and perform tasks themselves from a central site.

Depending on the software or portal, employees might update personal details, get payslips, and do many important things. We’ll explore these and other important features to look for in a payroll portal.

How Payroll Automation Can Help To Do Employee Salary On Time?

Implementing payroll automation through an ESS payroll portal offers several benefits:

– Accuracy

Software from a payroll software company helps minimize human errors in calculations. This ensures salary payments. Automated systems use algorithms to calculate salaries, taxes, and deductions accurately.

An automated system can correctly calculate overtime pay and apply the appropriate tax rates, reducing the risk of errors. This accuracy ensures that employees receive the correct salaries and helps maintain trust and satisfaction within the organization.

– Efficiency and Speed

Automated payroll systems can process payroll faster than manual methods. These payroll systems can handle large volumes of data and perform all payroll calculations in a fraction of the time it would take to do manually.

For example, an automated payroll system can process payroll for many employees within a few hours, ensuring timely salary disbursements.

– Compliance

Automated payroll systems ensure compliance with tax regulations and labor laws. These systems are regularly updated with the latest regulatory changes, ensuring that payroll calculations adhere to current laws.

For example, an automated system can automatically update tax rates and apply them to salary calculations, reducing the risk of non-compliance. This compliance management reduces the risk of legal issues and penalties, providing peace of mind for HR departments.

– Satisfaction By Payslip Portal

Timely and accurate salary payments boost employee morale and satisfaction. Payroll automation ensures that employees receive their salaries on time, reducing financial stress and increasing trust in the organization.

Moreover, automated systems provide employees with access to their payslips through a payslip portal, enhancing transparency. Employees can view their salary breakdown, deductions, and contributions, reducing confusion and dissatisfaction.

– Data Security

Payroll systems from a payroll vendor provide secure platforms for processing and storing payroll data. These payroll systems use advanced security measures to protect sensitive employee information from unauthorized access.

This security ensures that employee information is protected, enhancing trust in the payroll process.

– Eliminates Repetitive Tasks

Payroll processes are often filled with repetitive tasks such as updating Excel spreadsheets, entering time and attendance data, and sometimes even handling paper payrolls.

The time-consuming tasks can be automated, reducing the chances of errors and significantly cutting down the time required to complete payroll activities.

– Identifies Fraudulent Practices

Payroll automation assists employers in detecting fraudulent activities by analyzing payroll reports. For example, it can help identify if employees are billing for hours they did not work!

By highlighting trends in employee behavior, employers are equipped with the information needed to address issues or plan alternative staffing arrangements.

– Enhances HR Functions

Modern payroll software generates a vast amount of data that can be harnessed for strategic business purposes. This data can improve various HR functions such as workforce planning, evaluating performance, managing benefits and pensions, and streamlining the onboarding process.

With advanced technology, HR departments can mine this data to enhance the overall HR experience.

– Simplifies Multiple Payrolls

In today’s economy, businesses often manage multiple payrolls due to various work contracts. The automated payroll simplifies this process by moving away from Excel spreadsheets and adopting solutions with multiple functions. This is making it easier to manage different payrolls efficiently.

– Customizable Reporting

Advanced payroll systems, like those provided by TopSource Worldwide, offer flexible payroll report builders.

7 Benefits Of Having A Payroll Portal For The Salary Process

Using comprehensive payroll software, such as Superworks, offers numerous advantages:

1. Speed and Efficiency

The online payroll software eliminates the delays. You no longer have to wait to check the data again and again! This acceleration ensures that payroll tasks are completed much faster.

2. Security

Despite being accessible via the internet, the payroll system operates within a highly secure encrypted environment. This means all your payroll information is safe, avoiding the risks associated with insecure email communications.

3. Centralized Information

Having all payroll information in the cloud is a significant advantage. Many people appreciate the convenience of being able to view and manage all payroll data from a single platform.

4. Clear Audit Trail

The online payroll strategies system provides a transparent audit trail, documenting who approved what and when.

5. Reduced Paperwork

The payroll system significantly reduces the reliance on paper. This contributes to environmental sustainability by minimizing paper usage.

6. Continuous Improvement

The automated portal is constantly evolving with new features to enhance user experience. It is dedicated to responding to client needs and adapting to changes in payroll compliance.

7. Dual Approval Process

The payroll system includes an option for dual approval, allowing payroll to be reviewed and approved by multiple authorized users. This ensures thorough review and accuracy in payroll processing.

Wrapping Up,

The payroll portal is a valuable tool for ensuring timely and accurate salary disbursements. If HR people face challenges regarding timely salary, then use the automated HR payroll software.

Payroll software like Superworks offers comprehensive solutions to streamline payroll processes and drive efficiency. Embracing payroll automation is not just a technological upgrade but a strategic move toward a more efficient organization.

By leveraging the power of a payroll portal, organizations can ensure that employees are paid on time!