Grab a chance to avail 6 Months of Performance Module for FREE

Book a free demo session & learn more about it!

-

Will customized solution for your needs

-

Empowering users with user-friendly features

-

Driving success across diverse industries, everywhere.

Grab a chance to avail 6 Months of Performance Module for FREE

Book a free demo session & learn more about it!

Superworks

Modern HR Workplace

Your Partner in the entire Employee Life Cycle

From recruitment to retirement manage every stage of employee lifecycle with ease.

Seamless onboarding & offboarding

Automated compliance & payroll

Track performance & engagement

A Comprehensive Beginner’s Guide to A Modern Payroll System For 2024

- Payroll Systems

- 9 min read

- January 8, 2024

It is the era of technology, whether it is 2023 or 2024 – who doesn’t want to be updated with new technology? Who doesn’t want modern solutions such as the payroll system?

Only- desktop, web, mobile, online & cloud-based is not enough, AUTOMATION & AI are the future! Here in this blog, we will talk about Payroll Automation- Modern Payroll Systems- Online Payroll Software, and many more.

People who still use manual payroll methods, don’t know the magic of payroll system software. A payroll system handles everything from counting salaries to paying employees on time. Moreover, payroll management software helps to keep track of hours worked, figure out payroll, taxes, and other deductions, and print and deliver paychecks as well.

Usually, payroll software is used by HR managers, finance managers, or employers.

The software is used for payroll, and it doesn’t need much effort from employers. Employers just need to enter information like working hours and salary, and the payroll software does the math, subtracts taxes, and more.

What is a Payroll System?

What is payroll software? – A payroll system or software is an online payroll software that is used to handle and automate the process of paying employees.

The payroll system is like a salary management system for employees. It calculates

-

How much employees should be paid,

-

Helps to take out taxes,

-

It keeps track of their work hours,

-

It gives them their money.

Even if a company needs one person to manage the software they use a modern payroll system. Setting up a payroll system is important for all businesses, even though it may not be the most exciting part.

When employees get the right amount of money on time and can easily see their pay details, they are happy. Keeping the payroll organized ensures that everyone gets paid correctly and on time. However, doing payroll can be boring and time-consuming, especially for larger companies.

In India, managing payroll involves many tasks and rules. If you make a mistake, there can be a big financial penalty.

Today, Why Do Businesses Prefer Automated Online Payroll Systems?

In India, handling payroll for a business involves a variety of tasks, and the specifics can differ based on the type of business and its regulations. However, payroll software for India can help you to eliminate challenges. Most of the time compliance errors can come and people have to process fine.

Additionally, businesses need to manage other payroll aspects like reimbursements, and meal allowances, ensuring timely payroll processing and report generation, and submitting taxes and payments like PF to the appropriate authorities. PF and esi calculation software also best for calculate employee payroll.

These payroll tasks include establishing a comprehensive payroll policy that incorporates accurate time tracking, leave management systems, accurately calculating employee pay while considering deductions, and detailing various pay components such as basic pay, payslips, variable pay, HRA, and more.

Read more: 5 Top Challenges in Managing Global Payroll and How to Overcome Them Easily

Ready to upgrade the payroll system? – Get an automated one!

Make your life easier with an automated solution! Streamline processes, ensure accuracy, and save time.

Say goodbye to stress and hello to efficiency. Take the leap – automate your payroll today!

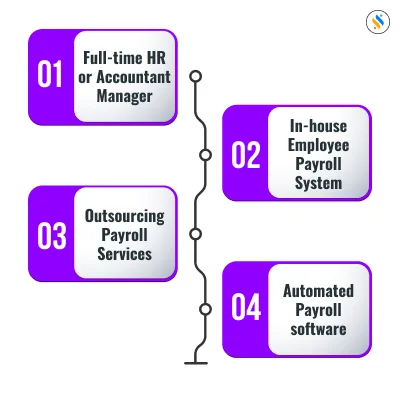

Types of Payroll Systems That Most Businesses Prefer To Use

There are 4 main types of payroll systems:

1. Full-time HR or Accountant Manager

If you have an HR manager or finance account manager in your office then, it is one of the traditional ways to manage payroll. An accountant is a money expert who can handle payroll and tax forms for you. Hiring an accountant can offer support and advice, managing the entire payroll process.

2. In-house Employee Payroll System

Some businesses manage their payroll internally with any kind of employee payroll management system, with the business owner or a human resources employee handling it manually. This employee payroll management system project can be cost-effective for small businesses, but it may become challenging as the team grows.

3. Outsourcing Payroll Services

People who don’t know the benefits of payroll system consider outsourcing the payroll providers specializing in running payroll for businesses. The service providers offer various hr outsourcing services, including time tracking and tax filing, usually for a monthly payroll run. If you want in house payroll software you can check hr and hr and payroll software pricing at superworks.

4. Automated Payroll software

Using specialized HR payroll software allows you to automate the payroll process with the help of attendance management such as punching, biometric attendance, and payroll management system. The payroll software reduces the risk of mistakes, and many programs generate detailed reports and pay stubs for each pay period.

Setting up an best HR payroll software ensures that payroll tasks are done accurately and on time.

5 Key Features Of Modern Payroll Software

Payroll systems can do a lot to make HR jobs easier. How?

Because, the modern payroll system or payroll software india stores employee info, pays employees accurately, keeps you informed about tax laws, and handles tasks like calculating time, wages, and taxes.

Payroll software that works on automation is making sure everything is done correctly and follows the rules.

-

The main job of a modern payroll system is to manage payroll company.

-

The payroll software automatically figures out how much everyone should be paid on a regular schedule.

-

With the help of payroll software, you set it up with details like employee ID, payroll schedule, and job type.

-

With the help of payroll software, you can also include company policies and give specific access to certain people. Once it’s set up, the system runs on its own, unless you need to add some custom details.

A modern payroll system takes care of this by monitoring things like sick leave, hours worked, and overtime. It makes the process of paying employees much smoother.

Your payroll solution isn’t just about paying people. That’s why as per the attendance online monitoring and payroll system thesis you need to track everything with the attendance software for biometric. Some systems even let employees handle their own benefits, making it easy to keep track of financial info accurately. So, a good payroll system is a win for everyone!

Read More : How Payroll Management System Simplifies the Payroll Process?

6 Reasons Modern Payroll Systems Are Important For Your Business

Payroll is super important for every company. It’s not just about giving employees their salary – it also makes sure the company follows tax rules and compliance. Let’s break down why modern payroll systems are important:

1) Happy Employees

Who doesn’t want to make their employee happy? Making sure to pay your employees on time is crucial for keeping them happy. If your company has a good payroll system that consistently pays on schedule, it will positively affect the morale of your employees.

Moreover, wrong payments might make your employees worry about how stable the company’s finances are, and perhaps you can’t maintain employee retention. This worry can create a negative atmosphere in your company, affecting its overall vibe and the way employees approach their daily tasks, possibly leading to lower performance.

2) Good Company Reputation

A company not only has to pay its employees but also needs to make its reputation. The system makes sure its payroll follows the rules about taxes and work laws in the country.

By following these laws and meeting tax responsibilities properly, the company shows that it’s a reliable employer.

3) More Than Just Salary

Payroll isn’t just about the money but it includes many more things. Besides the basic salary, an employee’s overall pay includes extra things like bonuses and benefits. The payroll service also takes care of managing variables, bonuses, and salary bumps linked to how well an employee does in their job review.

4) Labour Laws Updates

Knowing and following labor rules is one more thing to make sure your employees are happy and that your company is doing the right things according to local and national laws.

Every state has different rules about things like how much to pay when to pay extra for overtime, and what to do when someone leaves the job. Payroll systems and the people who manage them help make these rules simpler to follow and understand.

5) Reporting to the Government

Companies need to tell the government about their payroll. This includes how much they pay to employees, how much they pay in taxes and the status of their employees. This reporting happens every few months or once a year. This can be easy if you have human resource analytics payroll system- Superworks at your company.

6) Paying Taxes on Time

Employers usually pay for some of the benefits employees get, and this cost might be taken from the employee’s total pay. In most payrolls, the employer’s payroll system takes out federal and state income taxes from what the employee gets paid.

This money needs to be paid to the government on time. A good HR payroll software can help to do this on time.

Also, See: Payroll Outsourcing Service and Payroll Software- What to Pick!

A Winner – An Automated Payroll Software System

In the age of everything being digital, this is the best and most modern payroll system you can use for your organization.

Businesses should pick the right payroll system based on what they need and what it costs.

-

This helps manage the stressful, hard, and time-consuming payroll process better.

-

Payroll software is a smarter, more practical, and right move forward.

-

Automated payroll software has many benefits that make payroll processing smoother, more effective, accurate, and a better way to manage payroll.

Wrapping Up

No matter how big or small your business is, a payroll system can probably help you manage all payroll operations. There are many options to pick from, but the tricky part is finding the right one. Choose the right method and then it’s important to think about the size of your business and your budget when choosing.

Make a list of what you need from a payroll system and keep it handy when you’re looking. This way, you can find a system that has everything you need without a bunch of extra things you don’t. Try Superworks – a payroll system that can help you to manage the whole payroll operation.

Also see: payroll management services | payroll process in india | best payroll software | payroll software company india |