Grab a chance to avail 6 Months of Performance Module for FREE

Book a free demo session & learn more about it!

-

Will customized solution for your needs

-

Empowering users with user-friendly features

-

Driving success across diverse industries, everywhere.

Grab a chance to avail 6 Months of Performance Module for FREE

Book a free demo session & learn more about it!

Superworks

Modern HR Workplace

Your Partner in the entire Employee Life Cycle

From recruitment to retirement manage every stage of employee lifecycle with ease.

Seamless onboarding & offboarding

Automated compliance & payroll

Track performance & engagement

8 Best Practices for Managing Employee Payroll – Processing, Taxes, Compliance!

- Superworks

- 6 min read

- February 7, 2024

The process of paying your employees appears to be a simple matter of running the numbers. However, managing payroll is not smooth and compliant unless efforts are made in advance. Given that you’re an HR professional, you might not need to know “What is employee payroll?”, but we’re sure that knowing how you can enhance it can help. Follow these best practices for successful payroll processing from both a business workflow and compliance standpoint:

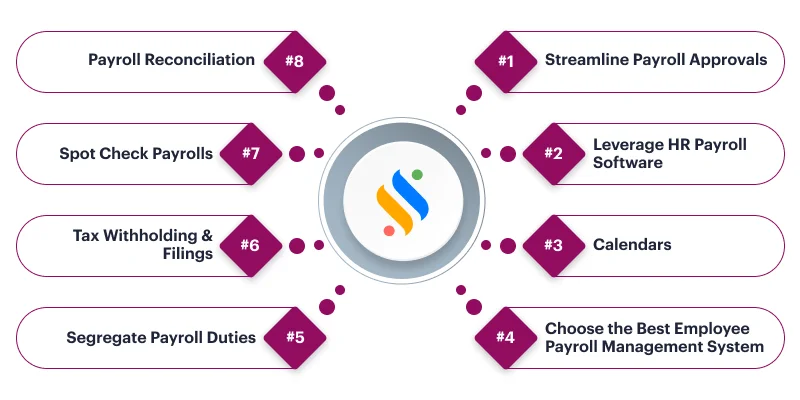

8 Best Practices For Ultimate Employee Payroll Management System

1. Streamline Payroll Approvals

Tedious approvals delay the payroll processing process and annoy managers. Use employee payroll software India on the simplified approval path. Establish guidelines for automatic approval of common overtime or exception cases to minimize bottlenecks. Allow managers to use self-service options for reviewing timecards and flagging issues early. Automate secondary approvals after the primary manager has signed off.

2. Leverage HR Payroll Software

Automate payroll processes through a powerful payroll management system integrated with time and attendance monitoring. Set up rules and workflows that fit your processes, not error-prone spreadsheets. Select a current product that would provide you with such features as self-service, report analytics, easy integrations for accounting, benefits, and other HR system tools.

3. Calendars

Maintain employee payroll calendars that outline key dates including deadlines for timecard completion, payroll processing days, paydays, tax due dates, and blackout periods. Share calendars with managers and employees to know what is expected of them. Employ online payroll software reminders and alerts before deadlines so that everyone is made aware of the dates.

4. Choose the Best Employee Payroll Management System

Make sure that accuracy, compliance, and security service quality are taken care of. Demand SOC1 and SOC2 Types for assurance of IRS certification. Compare integration methods with your HRIS, timekeeping, and accounting software.

Read more: 5 Top Challenges in Managing Global Payroll and How to Overcome Them Easily

Looking for the Best Software for Payroll Management? – Try Superworks!

With our Super Payroll, you can process and track your payroll data easily and accurately.

Discover how Superworks can help you save time, eliminate errors, and comply with laws.

5. Segregate Payroll Duties

Split the payroll process among several trained team members for quality control. For instance, have an individual handle a timecard while another reviews and handles the data in the payroll in HR management system. Segregation of duties assists in preventing intentional and unintentional payroll mistakes.

6. Tax Withholding & Filings

Work closely with your tax advisor and payroll vendor to ensure that taxes are collected, and paid on time. It should include correct year-end reporting that needs to be done accurately. Create processes and controls over tax operations. Keep track of changing regulations that are related to payroll and tax schemes.

7. Spot Check Payrolls

Check a small sample of employees per payroll service to ensure payment is calculated correctly before finalization. The checks should include high-risk calculations such as overtime, bonus reimbursements, and garnishments. Regularly, review the allowances for reviews along with their rate of tax and deductions.

8. Payroll Reconciliation

The payroll registers from the system are reconciled against the general ledger after every round of payment. Check totals of gross wages, taxes withheld, benefits deductions, and employer taxes for net payments. Investigate and rectify any inconsistencies before issuing payroll.

Also, See: Payroll Outsourcing Service and Payroll Software- What to Pick!

Tips to Enhance Employee Payroll Processing at Your Workplace

– Compliance Checks

Conduct regular internal audits to compare payroll practices against federal, state, and local laws. Record pay practices regarding compensation based on baseline, overtime deductions, and more including required posting. Confirm that new hires are given payroll policies. Formalize the processes and train leave application to manager as required.

– Employee Self Service Payroll

Offer employees online and mobile self-service access to pay statements, and tax documents with the authority for changes in permissible areas of Payroll. Make sure the platform is easy to use and responsive on different devices. Train employees on capabilities. Employee’s payroll management system minimizes manual work and increases transparency and accessibility to users.

– Payroll Process Review

At regular intervals schedule meetings of the payroll team members along with cross-functional leaders to discuss processes, procedures, tools, and responsibilities. Address challenges, inefficiency, and risk factors. Use technology improvements or process modifications to find windows for optimization, automation, and narrowing the margin of error.

– Standardize Pay Policies

A well-documented policy should be provided and it must clearly state pay policies for holidays, paid time off, and overtime as well as the periodicity of payment cycles that comply with existing labor laws. Create uniform definitions of exempt vs. non-exempt status; employees vs contractors, overtime calculations, and the time codes for paid dealings. Applying pay rules consistently minimizes confusion. It reduces dispute and compliance risk.

– Employee Education

Proactively educate employees on pay and deduction definitions, types of gross vs net earnings, and how to request a correction. Share the following resources on how to read paychecks and tax forms. Establish clear expectations early on to prevent downstream problems. With empowered employees, more accurate payrolls are achieved.

– Change Management

Communicate any changes, upgrades, or migrations of payroll company technology and plan them carefully to promote seamless adoption. To do so, offer appropriate training and sufficient resources for both payroll management system users and general employees. Timing and how to migrate historical data should be defined.

– Annual Compliance Review

keep an eye on the annual comprehensive compliance review of payroll practices, process filings, and payments. Identify objectively any areas of risk, payroll processing in India improvements, training gaps, and noncompliance. Use the findings to improve your payroll function and controls even further.

In conclusion,

payroll can be run effectively to have strong processes, controls, and compliance practices. Then, observing these best practices eliminates frustration and makes sure that your business runs with complete confidence.

Adhering to standardized procedures and proactively training employees while monitoring vendors is important. It helps you ensure the long-term seamless running of the payroll operations. Are you looking for the best payroll software in India? Look no further than Superworks! Our employee payroll system is equipped with all the tools you need to keep a payroll running smoothly! Stay compliant by integrating it with our workforce management software and maximize efficiency!

Also See: outsourced HR solutions | Indian Payroll Process Steps | payroll process in india