For your information, there indeed are many types of payroll, and the list goes like this:

In-House Payroll: A payroll processing that is managed completely internally by the company's own HR team or finance department

Outsourced Payroll: In which a third-party provider handles a company's payroll [because they specialize in payroll services].

Automated Payroll: In this process, we utilize software to automate payroll processes, and reduce manual intervention.

Global Payroll: Best way to manage payroll for international employees, is by addressing their country's various tax laws and regulations.

Grab a chance to avail 6 Months of Performance Module for FREE

Book a free demo session & learn more about it!

-

Will customized solution for your needs

-

Empowering users with user-friendly features

-

Driving success across diverse industries, everywhere.

Grab a chance to avail 6 Months of Performance Module for FREE

Book a free demo session & learn more about it!

Superworks

Modern HR Workplace

Your Partner in the entire Employee Life Cycle

From recruitment to retirement manage every stage of employee lifecycle with ease.

Seamless onboarding & offboarding

Automated compliance & payroll

Track performance & engagement

How Promising Digital Payroll Saves You Time And Money!

- transformation of payroll

- 8 min read

- November 14, 2024

Harsh payroll truth, that we are not ready to hear out are heartbreakable! Because numerous businesses that are not using digital payroll are facing payroll troubles! And for them, manual payroll has become the biggest cause of payroll errors!

We can keep adding one shocking truth after another regarding the payroll throughout the blog, and still, there will be many to remain! Because even with so much digitalization, we haven’t yet successfully modernized our payroll systems!

For that reason, many companies are stuck with lots of errors, high costs, and long, long time-consuming processes! And as soon as they [organizations] start to understand the cruciality of payroll management, they keep accepting the new and amazing digital payroll transformation!

Because this transformative solution is indeed bringing numerous benefits to your table, however, here we will focus on greater aspects…

- First—How it can help you save time, and

- Second—How it can save lots and lots of money for you!

In this blog, we’ll explore how digital payroll systems revolutionize payroll management and continue to offer numerous benefits that can help you boost your business efficiency. So, let’s start the extremely important learning session about the digital transformation of payroll, and how you can benefit from it!

What is Digital Payroll?

Digital payroll and compliance refers to the use of automated software systems that help businesses handle all aspects of payroll processing. And unlike the manual payroll, you don’t have to use spreadsheets and paper-based methods here.

Rather with this modern way of doing payroll, you can leverage technology and directly streamline all the calculations, tax filings, and employee payments.

And by the way, these modern payroll services are an epitome of digital transformation, hence they are free from limiting to a place only. These systems for your prior information, are cloud-based, allowing businesses to access payroll data from anywhere, at any time.

What is the Difference Between Digital Payroll and Payroll Done Manually?

Other than “how to prepare payroll” people also keep searching for the difference between digital and manual payroll! So, let us mention that the primary difference between a digital and manual payroll service lies in automation and efficiency.

Manual payroll requires significant time and effort and that too just to calculate wages, deduct taxes, and ensure compliance with labor laws. And especially when even one of the payroll procedures is happening, it indeed will be too tedious, and eventually lead to costly mistakes.

While on the other hand, the digital system of payroll will directly automate all of such tasks. And will subsequently reduce the likelihood of payroll errors and will provide better security.

So, here the difference is quite clear, on the one side you lose time, lots of effort, and even money sometimes. But with the digital payroll platform, you regain all three of them plus you get to boost your employee productivity. Moving forward let’s see what more benefits can be acquired once you start using a digital payroll platform.

Also See: Payroll Gujarat: High Tech Workforce Management For All Busines

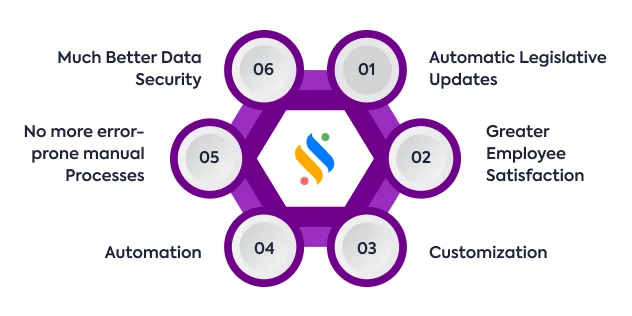

How Businesses Can Benefit From Digital Payroll?

Adopting a digital system for your payroll management puts you on a beneficial side because it offers a multitude of benefits for businesses of all sizes, such as;

Automatic Legislative Updates

Staying compliant with those ever-changing labor laws and tax regulations of your nation can be quite a challenging task. Digital systems for payroll are efficient enough to automatically update to reflect the latest legislative changes, and that will ensure that your payroll processes remain compliant.

Greater Employee Satisfaction

We know one thing employees in the long run do appreciate timely and accurate payroll processing. And that is when your HR team can be preparing payroll records and doing the on-time payroll only when you have the digital payroll systems!

This function really is like a blessing in enhancing employees’ overall satisfaction and boosting their trust in the organization. Moreover, the modern employee self-service portals are also there for the staff to view their payslips, request time off & update personal information, which further improves their experience.

Customization

Every business has its unique payroll needs, hence they require room for customization, modern payroll management software offers that quite well. With it, you can get the flexibility to accommodate diverse payroll scenarios, so you can handle different pay structures, benefits, or deductions easily.

Automation

Automation is at the heart of the digital transformation of payroll because when you start automating all of your repetitive tasks [such as wage calculations, tax filings, and direct deposits], you significantly reduce administrative overhead.

And for that reason, we can this automation magical, because this not only saves time but also allows HR and finance teams to focus on more strategic initiatives. You can also use a highly efficient HRMS & payroll software for payroll automation.

No more error-prone manual Processes

When you handle payroll processes manually, you tend to stay prone to errors, and that can create various compliance issues. However, digital automation of payroll can help you avoid these risks and provide surety of calculations and consistent processing.

Much Better Data Security

Protecting sensitive payroll data is an all-time high priority for all experts. And to negate that concern, modern payroll solutions like Superworks come into the picture that offer enhanced security features including;

- Secure data storage,

- Encryption, and

- Access controls.

These extreme measures always help in safeguarding payroll information against potential breaches and unauthorized access. And provides the ultimate surety for your data, so it can remain confidential and secure.

Make your payroll errors vanish & directly streamline the entire payroll process!

Upgrade to a better & greater payroll solution now!

Trending Features in Digital Payroll Solutions

After discussing the thorough benefits of digital and global payroll, it’s time to talk about all those trending features of it! Because to be honest, it continues to evolve, and the latest features keep enhancing both the functionality of the software and user experience.

And on that note, let’s have a look at some of the most popular trends in digital payroll solutions;

1. Mobile Accessibility

In this modern age, the number of people working from remote locations is increasing day after day! And with this rise, what we require is mobile accessibility, as it really has become a critical feature to have.

And to solve that problem, the digital transformation of payroll systems comes with needed mobile applications. Because of these applications, both employees and employers can access all the possible information on the go! This flexibility really helps businesses to ensure that payroll management stays convenient and accessible, regardless of the location.

2. Data Analytics and Reporting

To do the business, we all just have to need reports and analytics, because both are an integral part of the modern payroll systems! Because these features of the digital systems of payroll management tend to provide comprehensive reports and help businesses analyze payroll data effectively.

And when you start leveraging these crucial insights, you get access to make data-driven decisions to improve efficiency and reduce costs.

3. Sustainability and Eco-Friendly Payroll Practices

With the air that you breathe every day and the consistently melting ice, we just have to stop contributing to global warming, right away! And for that reason, we should adopt more and more sustainability practices for our businesses.

To contribute to sustainability, one really should choose modern payroll systems as they subsequently reduce paper usage! Because it digitizes both the process of documentation and the mode of payment. And this not only supports environmental goals but also streamlines a company’s payroll processes.

4. User Experience and Interface Design

A user-friendly interface is a need today for all kinds of businesses and no one can deny that point! It’s highly essential to have it so one can instill the easiness and better effectivity by using the modern digital payroll systems.

And for that reason, modern payroll software emphasizes intuitive design and keeps instilling much smoothness for users to navigate and manage payroll tasks better. With such smoothness, the user experience improves and we get surety that both employers and employees now can utilize the system efficiently.

Conclusion

The world has been modernized, but one thing that really needs an upgrade is our payroll system! And we can do that with Super Payroll [a great product of Superworks]! This software we are talking about is among the top payroll software in India, that has a user base of 30,000+!

Super Payroll is known for its smooth and non-complex interface design which is cherished by lots of professionals around the nation! And whether it’s about sustainability, mobile accessibility, analytics, security, or else, this amazing payroll software has it all!

By leveraging its latest digital payroll technology, numerous businesses are already streamlining operations, improving employee satisfaction, and focusing on strategic growth.

So, if you’re still using manual payroll processes, please upgrade to Super Payroll and give your HR some time to make better strategies for your business! It’s time to consider the benefits of going digital in terms of payroll, book a free demo, and connect with our experts, today!

Also see: payroll process in india | best payroll software | payroll system software | payroll management software india | payroll service providers

FAQs

What are the types of payroll?

Which software is used for payroll?

People in our country are using several other payroll software, and each comes forth with different features to suit various business needs. However, Super Payroll in this list is topper, because it has all the payroll features that a company [regardless of its size] would need!

What is online payroll?

Online payroll refers to payroll systems that can be accessed via the Internet, even from remote locations! Through these cloud-based payroll solutions, businesses can easily manage their payroll processes from any location.

How to calculate payroll?

The procedure of calculating payroll involves several steps, so let's see what are they:

Determine Gross Pay: First, you calculate the total earnings of an employee before deductions, and that includes wages, salaries, and even overtime.

Calculate Deductions: Then you subtract all the taxes, insurance premiums, retirement contributions, and various possible withholdings.

Determine Net Pay: It's the amount employees take home after all paying all the deductions.

Process Payments: Then comes the distribution of the payments via direct deposit or checks.

File Taxes: And in the end it submits payroll taxes as per the government laws.