Grab a chance to avail 6 Months of Performance Module for FREE

Book a free demo session & learn more about it!

-

Will customized solution for your needs

-

Empowering users with user-friendly features

-

Driving success across diverse industries, everywhere.

Grab a chance to avail 6 Months of Performance Module for FREE

Book a free demo session & learn more about it!

Superworks

Modern HR Workplace

Your Partner in the entire Employee Life Cycle

From recruitment to retirement manage every stage of employee lifecycle with ease.

Seamless onboarding & offboarding

Automated compliance & payroll

Track performance & engagement

The Significant Role of Payroll Software For Ensuring Accuracy In An Employee Payslip

- salary slip software

- 9 min read

- January 9, 2024

Who doesn’t want a receipt for what they get?

A detailed employee payslip is crucial as it has information:

-

Employee information

-

Working days

-

Holidays

-

Basic salary

-

Variables

-

Deductions

-

Taxes

-

Pay of 1 day

The salary slip is a crucial document that companies provide to their employees regularly.

The employee payslip paper contains information about the employee’s earnings before and after deducting taxes, along with details about other deductions such as insurance and pension contributions. It not only outlines the gross and net salaries but also provides insights into various company schemes.

Sometimes it happens, you may make mistakes while generating employee payslip manually. Having a template for payslip management proves to be an invaluable tool, aiding in the efficient organization and distribution of these essential financial documents. Furthermore, the payroll software system can work for you.

- What is a Salary Slip?

- Employee Payslip Format

- Components That Payroll Management Software Can Handle To Add In Employee Payslip

- Manual Payslip Generating Leads Errors- How?

- A Digital Solution For Accurate Payslip- Online Payslip Generator

- With Superworks, You’re Guaranteed An Accurate Payslip

- What Do You Get From Superworks Payroll Software?

What is a Salary Slip?

A salary slip is a paper your boss gives you when they pay you.

This employee payslip online paper shows how much money you earn before taxes and other deductions.

It also shows the final amount you’ll get in your pocket.

People in charge of Human Resources usually create this salary pay slip online sample. To make their job easier, you can use special computer programs such as HR payroll software that do all the math for them. These programs also update your workers’ payment records online.

To Read More : Everything About Payslip Generator Online You Must Know!

Employee Payslip Format

All organizations use different styles for their salary statements, but they all include the same basic information.

Here’s a list of the important things you’ll find:

-

It includes – the company name, employee name, employee code, job role and department, address, logo, and the month and year of the payment.

-

Personal details like Aadhar/PAN number and important bank information.

-

UAN (Universal Account Number) and EPF (Employees Provident Fund) account numbers.

-

Details about the salary you earned and the deductions taken out.

-

Total work days, actual payable days, and the total number of leaves.

-

The final net pay is shown both in numbers and words.

A manual or automated employee payslip? – Get a customized one!

Explore the benefits of the Superworks payslip generator and enhance your employee satisfaction today.

Click here to learn more and improve your payroll process!

Components That Payroll Management Software Can Handle To Add In Employee Payslip

– Basic Salary/ Base Salary

Basic Salary is the fixed amount of salary that an employee earns before any additional payments, or deductions are factored in.

It serves as the core component of an individual’s salary and typically constitutes 30-50% of the total salary package. It is counted easily by using payroll software India.

Importance: Basic Salary forms the foundation of an employee compensation, influencing various other elements like bonuses, allowances, and benefits.

– Dearness Allowance (DA)

Dearness Allowance (DA) is an additional payment provided to employees to counteract the impact of inflation. It is usually a percentage of the basic pay and is determined based on the cost of living and the employee’s location.

Importance: DA- Dearness Allowance helps employees maintain their purchasing power in the face of rising prices. Its adjustment reflects economic conditions and ensures that the real income of employees remains relatively stable.

– House Rent Allowance (HRA)

House Rent Allowance (HRA) is a component of the salary given to employees who reside in rented accommodations. It is designed to assist in covering the expenses associated with renting a house.

Importance: HRA recognizes the financial commitment of employees living in rented homes, offering them a means to offset a portion of their housing costs, thereby enhancing their overall financial well-being.

– Performance Bonus

Performance Bonus is a variable component of an employee’s compensation that is contingent upon their job performance. Employers grant this bonus to motivate employees and reward exceptional contributions, which can be viewed in the Payslip Online.

Importance: Performance bonuses serve as incentives to drive employee productivity and commitment.

– Leave Travel Allowance (LTA)

Leave Travel Allowance (LTA) is a benefit provided by some organizations to cover the travel expenses of employees while doing trips within the country. It is subject to certain conditions, such as the requirement for proof of travel.

Importance: LTA supports employees in taking breaks with the finance help as well. They help by contributing to their overall well-being and work-life balance.

– Conveyance Allowance

Conveyance Allowance is provided by employers to cover the commuting expenses of employees traveling between their residence and the workplace.

Importance: This allowance acknowledges the financial burden of daily commuting and facilitates employees in managing their transportation costs.

– Medical Allowance

Definition: Medical Allowance is an allowance that employees can claim by providing supporting documents for medical treatment costs incurred during their employment period.

Significance: Medical Allowance contributes to the overall health and well-being of employees, helping them manage unexpected medical expenses.

– Tax Deducted at Source (TDS)

This term is for salaried persons. Tax Deducted at Source (TDS) is the advance tax deducted from an employee’s earnings and deposited with the government on their behalf.

Importance: TDS ensures timely tax payments and helps individuals manage their tax liabilities. Investments in tax-exempted options can reduce the TDS amount, providing avenues for tax planning.

– Employee Provident Fund (EPF)

Employee Provident Fund (EPF) is a mandatory saving scheme in India, where both employees and employers contribute to the EPF account of the employee.

Importance: EPF serves as a long-term savings and retirement planning tool, providing employees with financial help during their retirement years.

– Professional Tax

Professional Tax is a small amount deducted from an individual’s salary based on the state they work in. It is collected by the employer and deposited with the government.

Importance: Professional Tax contributes to state revenue and supports local governance. Its variation across states acknowledges the diverse fiscal needs and capacities of different regions.

– Employees’ State Insurance Corporation (ESIC)

Employees’ State Insurance Corporation (ESIC) is a social security scheme provided by the government of India. Both employers and employees contribute to this scheme.

Importance: ESIC offers financial protection to employees in case of temporary or permanent disability, illness, maternity, or involuntary loss of employment. The scheme ensures social security and promotes employee welfare.

Manual Payslip Generating Leads Errors- How?

Manual time calculation of the pay is difficult and it may lead to errors. The salary slip shows how much you’ve earned, and if it is not proper then it can cause arguments between workers and bosses. This is because it can be hard to keep track of how long an employee salary has worked, especially if they did extra hours or switched shifts with someone.

Even though there’s no law saying how an employee payslip should look, although you have different kinds of payslip templates, there are common practices. Following these practices will make sure that the salary slip format can be looked at professionally.

-

Add employee name, id, and job position.

-

Put the total salary with different components.

-

List any deductions next.

-

Show the final amount you get at the bottom.

Different businesses use different styles for payslips. Smaller companies might use a simple design, while bigger ones use more complex ones.

The employee payslip can be on paper or sent electronically to the worker’s email. You can choose any but it should not be error-prone.

A Digital Solution For Accurate Payslip- Online Payslip Generator

A modern digital system- an employee payslip generator online free for paying employees can make things easier. How?

For example, Superworks time and attendance tracking can help you to count exact hours. If your employer uses a system like Superworks for managing work shifts and tracking time, it can

prevent disagreements between employers and employees. It also gives everyone a better view of things, and insights and makes everything clearer.

Superworks Payslip Helps You To:

-

Explain things that affect their salary in a specific pay period. (working hours etc)

-

Help employees understand how their pay is calculated.

-

Let employees compare their salary between pay periods and see differences in bonuses or other payments.

Moreover, Superworks- a payroll software for small business provide templates that can be personalized, quick to edit, & secure.

Not only free online payslip generator but when we talk about employee engagement and experience, we often forget about compensation and payroll. It’s time to focus on these things and smart tools like Super Payroll.

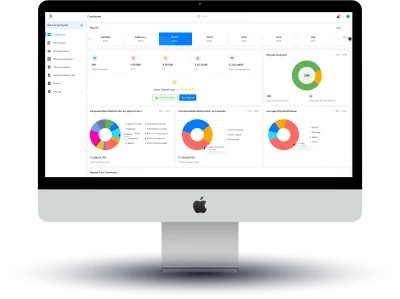

With Superworks, You’re Guaranteed An Accurate Payslip

When it’s payday, hr analytics data doesn’t have to do a lot of manual work to make sure everyone gets paid correctly. With Superworks, the work schedule can connect directly to the payroll system. It happens automatically with just one click.

Super Payroll is a complete solution for all the problems related to workforce management in a company. Whatever issues you have with your employees, Superworks has a solution for it. It helps you handle many tasks at the same time without much effort.

One important thing is payroll, This means it helps the company handle all the money-related things for employees. In the payroll section, there’s a part called employee payslip. It helps the human resources team and employees to check & handle salaries.

What Do You Get From Superworks Payroll Software?

Save Time and Resources:

Using Super Payroll means you don’t waste time writing down changes to the work schedule. You just need to approve or reject and these all things can be done easily.

No Mistakes:

Super Payroll makes sure everyone gets the right employee payroll payslip sample. Since everything is recorded digitally, there are no errors from manual entry.

Choose a System Everyone Loves:

Superworks is like HR around the world. It’s a guarantee that your workplace is picking a good system for managing all important things.

Read More: Track your expenses online | components of salary in india