Grab a chance to avail 6 Months of Performance Module for FREE

Book a free demo session & learn more about it!

-

Will customized solution for your needs

-

Empowering users with user-friendly features

-

Driving success across diverse industries, everywhere.

Grab a chance to avail 6 Months of Performance Module for FREE

Book a free demo session & learn more about it!

Superworks

Modern HR Workplace

Your Partner in the entire Employee Life Cycle

From recruitment to retirement manage every stage of employee lifecycle with ease.

Seamless onboarding & offboarding

Automated compliance & payroll

Track performance & engagement

The Importance of Having an Online Payroll Management System

- payroll processing

- 6 min read

- December 26, 2023

In today’s dynamic business environment, managing various aspects of an organization can be challenging, especially when it comes to payroll management. To streamline this critical function, many organizations are turning to Payroll Management System Online Software.

In this blog, we will explore the importance of having the best online payroll management system and discuss how it can benefit your business. We will also delve into why you should consider adopting such software, offer guidance on finding the best HR payroll software, and conclude with an additional tip to optimize your payroll management process.

What is Payroll Management System Online Software?

Payroll Management System Online Software, commonly known as payroll software, is a specialized tool designed to automate and simplify the HR payroll process of managing employee compensation, including salaries, wages, bonuses, and deductions.

The online payroll system can handle a variety of payroll-related tasks, such as calculating employee salaries, tax deductions, and generating payslips, among other functions. By utilizing payroll software, organizations can significantly reduce the time and effort required for payroll processing, minimize errors, and ensure compliance with tax laws and regulations.

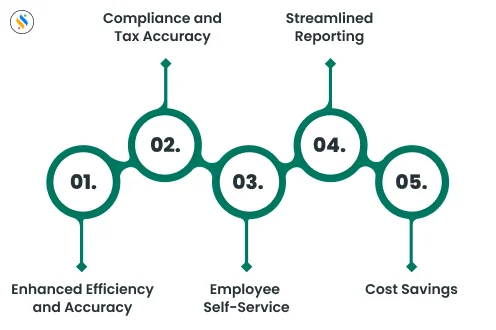

5 Important Things That Payroll Software Can Do For Your Business

1. Enhanced Efficiency and Accuracy

Payroll processing India software automates repetitive and time-consuming payroll service tasks, reducing the risk of human errors. It can calculate employee salaries, taxes, and deductions accurately, resulting in error-free payroll processing. This efficiency can save your HR department countless hours and reduce the likelihood of payroll-related disputes.

2. Compliance and Tax Accuracy

Staying compliant with ever-changing tax laws and regulations is crucial for any organization. Payroll software is designed to keep up with these changes, ensuring that your payroll processes are always in line with the latest tax rules. It calculates and deducts the correct amount of taxes, helping you avoid costly penalties and audits.

3. Employee Self-Service

Many payroll software solutions offer self-service portals for employees. This empowers your workforce to access their payslips, tax documents, and other relevant information online, reducing the burden on your HR department. Employees can also update their personal details and tax information, ensuring that the data is always up to date.

4. Streamlined Reporting

Payroll software provides robust reporting capabilities, allowing you to generate various reports related to employee compensation, taxes, and labor costs. These reports can help you make informed decisions and provide valuable insights into your organization’s financial health.

5. Cost Savings

Investing in Superworks – payroll software may initially seem like an expense, but it can result in significant cost savings in the long run. By automating payroll processes and reducing errors, you can lower the risk of fines and penalties. Additionally, the time saved by your HR team can be redirected toward more strategic tasks, ultimately contributing to your organization’s bottom line.

Read More : How To Streamline Payroll Management Process By Using Cloud Payroll Software?

Transform your payroll process with our Payroll Management System

Revolutionize your payroll with our Payroll Management System – effortless, error-free, and efficient!

Upgrade your payroll with our streamlined Payroll Management System today!

Why You Should Adopt the Payroll Management Software?

The adoption of the best payroll software India offers several compelling reasons for organizations:

1. Time Savings

One of the most evident benefits of adopting payroll software is the time saved. Manual payroll processing can be labor-intensive and prone to errors. With payroll software, you can automate calculations and processes, reducing the time required for payroll administration. This allows your HR team to focus on more strategic and value-added tasks.

2. Error Reduction

Manual data entry and calculations are susceptible to errors, which can result in discrepancies in employee pay and compliance issues. Payroll software minimizes these errors by performing accurate calculations and ensuring that tax regulations are adhered to. This reduces the risk of costly mistakes and disputes.

3. Enhanced Compliance

Tax laws and regulations are constantly evolving. Staying compliant can be challenging, but payroll software is designed to stay up-to-date with these changes. This ensures that your organization remains compliant with tax laws and avoids penalties or audits.

4. Improved Employee Satisfaction

payroll solution often includes self-service portals that allow employees to access their payroll information, view employee payslips, and update personal details. This transparency and convenience can lead to increased employee satisfaction and engagement.

5. Scalability

As your organization grows, so does the complexity of payroll processing. Payroll software can scale with your business, accommodating a larger workforce and more intricate compensation structures without significantly increasing administrative overhead.

Read More : Steal These 5 Really Easy Payroll Process Steps From Us!

Ways To Get The Best HR Payroll Software

Selecting the right HR payroll software for your organization is a crucial decision. Here are some key steps to help you find the best fit:

1. Assess Your Needs

Before you start searching for payroll software, assess your organization’s specific payroll requirements. Consider factors such as the size of your workforce, your industry’s compliance needs, and any unique compensation structures you have in place.

2. Research Options

Explore different payroll software solutions available in the market. Look for reputable vendors with a track record of providing reliable and user-friendly software. Consider reading customer reviews and seeking recommendations from peers in your industry.

3. Features and Customization

Evaluate the features offered by each payroll software solution. Ensure that it can handle your specific payroll needs, including tax calculations, benefits administration, and reporting. Additionally, check if the software allows for customization to adapt to your organization’s unique requirements.

4. Integration Capabilities

Consider how well the payroll software integrates with your existing predictive hr analytics and accounting systems. Seamless integration can streamline data flow and reduce manual data entry.

5. Cost and ROI

Compare the costs associated with each payroll software option, including licensing fees, implementation costs, and ongoing maintenance expenses. Calculate the return on investment (ROI) by factoring in the time and cost savings it will provide.

6. Support and Training

Check if the vendor offers adequate customer support and training resources. A responsive support team and comprehensive training materials can ensure a smooth implementation and ongoing use of the software.

Wrapping Up With an Extra Tip

In conclusion, adopting an online payroll management system is a strategic move for any organization. It offers enhanced efficiency, accuracy, compliance, and cost savings, ultimately benefiting both your HR department and your workforce. When selecting payroll software, assess your specific needs, research available options, and consider factors such as features, integration capabilities, and support. By making an informed decision, you can streamline your payroll processes and focus on growing your business while ensuring that your employees are paid accurately and on time.

To maximize the benefits of your payroll software, consider conducting regular reviews of your payroll processes and staying updated on changes in tax laws and regulations. Continuous improvement and adaptation will help your organization make the most of this valuable tool and ensure ongoing success in managing your payroll efficiently and effectively.

Also see: human resource payroll services