Grab a chance to avail 6 Months of Performance Module for FREE

Book a free demo session & learn more about it!

-

Will customized solution for your needs

-

Empowering users with user-friendly features

-

Driving success across diverse industries, everywhere.

Grab a chance to avail 6 Months of Performance Module for FREE

Book a free demo session & learn more about it!

Superworks

Modern HR Workplace

Your Partner in the entire Employee Life Cycle

From recruitment to retirement manage every stage of employee lifecycle with ease.

Seamless onboarding & offboarding

Automated compliance & payroll

Track performance & engagement

Top 5 Ridiculous Payroll Mistakes You Should Stop Right Away

- top 5 payroll mistakes

- 8 min read

- March 4, 2024

Sometimes, Payroll can be complex like the composition of blood in our veins, but since both have multiple elements in them, you can’t question any of its importance! And in whatever way you look at it, correct pay is one of the most basic expectations of employees! But even then only the Payroll Mistakes become the new normal in the system. Then you can imagine the damage it can cause to your credibility.

You may have been thinking about the absurd comparison of Payroll to the blood, but it just explains the importance of both. A continued Payroll wouldn’t even grab someone’s attention, but even once it gets missed, it will be the topic for days. This missing payroll is one of the most grave payroll errors ever, that would force an individual to think, ‘How to avoid them?’ ‘Payroll errors and how to avoid them?’

Payroll Mistakes And Its Impact On Your Business!

As per the recent events in multiple countries, we have got the data that without enough resources and the right tools this payroll may seem extremely difficult. But when these conditions are not managed well, there can be a free fall of errors costing, quality employees, their time, and money!

That is why, whatever happens, you just can’t afford to lose employee satisfaction, no one can! Because the payroll is one of the most important reasons behind the working of an employee. That is why in both conditions of a payroll error, more or less, a business would be the one at a loss!

Due to common payroll mistake, one gets overpaid- and now they have to return it BACK! Dissatisfaction!

And when due to some common payroll mistakes, one was underpaid and how they been short on money- Dissatisfaction!

So we have explained both the situation of a payroll error, and how both of them would lead you to grave loss for any business. In this way, what will be your next move, will you search for the most common payroll mistakes? Sorry, there are no other options, and as the management of your payroll company, you have to deliver employee salary on time, without any exceptions.

To Read More : Compliance Benefits of Using Payroll Services – Switch to Superworks!

Tired of making mistakes while doing Payroll? – Try Superworks Then!

Whenever you find yourself lost in the dilemma of making Payroll Mistakes

Then you should understand that it’s time to enroll or Superworks- for better Payroll!

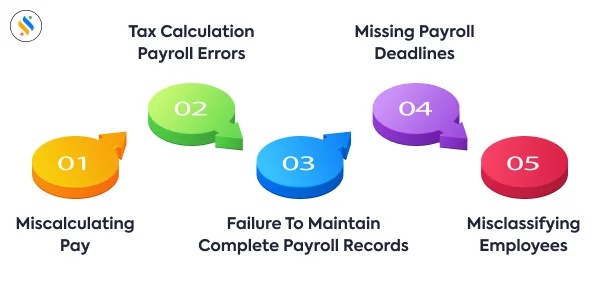

Top 5 Payroll Mistakes You Should Stop Right Away

Right above, we have explained the circumstances where payroll compliance mistakes would directly impact your business. That is why, moving further we want to you get every detail regarding the payroll computation errors [and the manual ones], and how to avoid them! So here are those 5 mistakes you should have to stop immediately!

1. Miscalculating Pay

Whenever you sit to disburse the salaries, you get to know about so many of its crucial salary components, right? Some of the most common ones are Overtime, Deductions, PTO [paid time off], commission, and so many more! And the amazing thing about that is that you must keep track of all those! As per the payroll records and payroll processing guidelines, disbursing the payroll can be quite tricky. But only when you don’t have any automation in the payroll system.

Moving forward also have to look after statutory compliance and state policies to obey the law. So among all these, and the abundance of the right tools, there can be miscalculations in the payroll. Moreover, if you don’t have any fine time tracking capabilities in your company then possibilities such as miscalculations can skyrocket. And whatever you do as a payroll provider, whether you underpay or overpay your employees, that will look terrible.

2. Tax Calculation Payroll Errors

When it’s time for the new year, not everyone is celebrating as there’s also a payroll provider, whose day is purely hectic. Because it is time to send out tax forms, inform tax rates to the employees. And just like the Payroll mistake, you can not fail to deliver the right form to the right employee. Because that can result in trouble, for you and the employee.

That is why we have to ensure an employee gets everything as right as possible. And doing that manually is very tricky and we know that. For that reason, you need to get a fine payroll software for your business, so you don’t have to face failure to distribute tax documents, among your employees.

3. Failure To Maintain Complete Payroll Records

This failure to maintain payroll records always happens due to short staffing, [or we can say that your payroll process does not have sufficient keepers]. As a payroll provider, even in a critical situation, you can not afford to make such a mistake. Because it would outline the error of not keeping payroll data properly in the payroll system.

We are not scaring you guys, because we understand that that to keep records of worked hours, payroll dates, payment rates, and so many more can be quite challenging. But if we still include the following, payroll errors of such kind would create a mess.

4. Missing Payroll Deadlines

There are laws and morals to abide by, and when we miss them, we have to take penalties! We get you, doing so many tasks is a process that can make you lose track of the time! But also need to understand that employees are putting their trust in payroll providers, and no one can afford to lose it. But imagine putting yourself in the shoes of your payroll receiver [the employee]. Would it help you to see your payroll getting behind the deadlines? Nope, you won’t!

5. Misclassifying employees

Another common and frequent error made in payroll processing is the Misclassification of the company workers. Because companies have mostly two kinds of employees, one is a full-time employee, and another one is a freelancer! The mistakes happen while they are listing, like suppose the full-time employee is listed as the freelancer or otherwise. If the conditions are like that, there can be government fines, additional fees, and else. So let’s make sure not to do that.

How to Avoid Payroll Errors and Improve Your Payroll Management?

How do I fix payroll mistakes? This will be the first question that pops up in your mind, after reading all these possibilities on the payroll errors. And the fear of making payroll mistakes underpayment, or payroll mistake overpayment can be scary!

But if the conditions like this ever happen to you then you should report the matter, right away. Because when it comes to payroll mistake, the longer you wait, the more the problem will worsen. That is why there is a common saying in the HR world!

‘common mistakes happen during payroll process, and there’s no denying that fact, but work to resolve it, not hide it.’

Keep a Payroll Process Checklist

-

Understand the reason behind the difference in your pay and look out how long it’s been going on.

-

Reach out to the employee and explain to them the inconsistency.

-

Look out for the financial challenges that may have caused due to this inconsistency.

-

Help to address the issue, specifically if it involves any financial strain on the employee.

-

Coordinate for repayment.

In general, mistakes made by most of the company can be avoided easily, with the help of the right tools [HRMS software], proper planning, and basic education! Most of the mistakes in payroll in HR department can be tricky but can be done smoothly with better payroll software. So, let’s understand what the best HRMS software can look like!

Superworks- The Best HRMS Software For Payroll Solution!

And when we look at it, the mistakes have lessened over the years because people have begun to shift more and more towards the payroll software! And you really can improve your payroll process and rule out the possibility of payroll errors with convenient Payroll Software!

For that reason, it’s high time to introduce yourself to better payroll software that can completely rule out payroll errors. Because let it be understanding the salary structure in india, reports, payroll & complaints, loan management, salary slip generation, or else. The solutions to every query of yours [related to payroll] would be on the top! So, hop on, and to get answers for payroll solutions, and how to avoid common payroll errors!

Concluding Tip To Avoid Such Mistakes!

In terms of the Payroll solution that was a quite detailed one right? But that’s better because now you would have the essential knowledge on this topic. So it’s time to be a responsible adult and accept the mistakes that have been made by us on the same. And if there are none, then don’t wait to make one, and choose the best payroll software like Superworks, for your business.