Grab a chance to avail 6 Months of Performance Module for FREE

Book a free demo session & learn more about it!

-

Will customized solution for your needs

-

Empowering users with user-friendly features

-

Driving success across diverse industries, everywhere.

Grab a chance to avail 6 Months of Performance Module for FREE

Book a free demo session & learn more about it!

Superworks

Modern HR Workplace

Your Partner in the entire Employee Life Cycle

From recruitment to retirement manage every stage of employee lifecycle with ease.

Seamless onboarding & offboarding

Automated compliance & payroll

Track performance & engagement

The Role of Technology & Automation in Modernizing Payroll Process in HR

- payroll software in India

- 8 min read

- December 12, 2023

A most important operation – Payroll processing is quite complex. If you are an HR or account officer you must know how daunting is Payroll Process in HR.

Payroll involves a bunch of tasks such as payroll calculation, processing, reports, and all. To figure out that you need to consider – how much money employees should get, taking out deductions, and making sure everything follows tax and labor laws. It requires careful payroll calculations and attention.

In this blog post, we’ll explain what is payroll, what is payroll processing, and everything else you should know about this important business function. You need to know this because this can help you to save your time.

One of the most important tasks in payroll is actually processing it. Employees rely on the company’s process to get paid on time. No matter how big or small the company is, payroll plays a crucial role in managing human resources to ensure that payroll is going smoothly.

What Is Payroll Processing?

Payroll Processing is the way to pay employees with well well-defined method.

Processing payroll involves several steps, like making payroll policy, payroll calculation, collecting information about employees, including things like deductions and allowances, and setting up rules for taxes and other adjustments.

Once the salaries are given out, there’s still more to do and it needs to add in payroll activities. Considering file reports, provide payslips to employees, and make sure everything is done according to the laws and company policies.

In simple terms, if payroll is the money the employer gives to the employee, by adopting a complete process-based payroll management strategy.

What Is Payroll Process In HR?

A payroll officer has to plan carefully when working with the HR payroll process. There are always tasks that need attention, and it’s important to keep an eye on any changes. Changes that might happen regularly as per the attendance of employees, salary and withholdings, contribution to social security funds, etc.

Payroll calculation is an integral part of the payroll process, It involves determining the total amount of money and this calculation depends on the various HR factors such as attendance, leave, period, salary, wages, bonuses, and many more. However, payroll calculation can be a complex and challenging task at Payroll Processing India due to the country’s diverse tax and regulatory requirements.

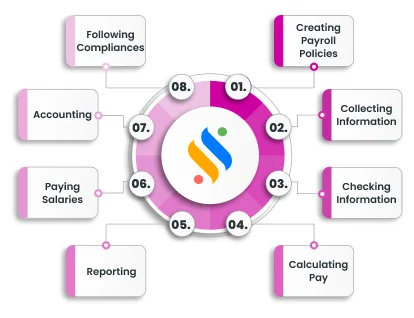

What Are The Steps In Payroll Process?

Here’s a list of tasks the payroll administrator needs to accomplish in the payroll management process.

1. Creating Payroll Policies

First, you need to make rules (policies) for how to handle payroll. These rules, like how much to pay and when to give leave, need approval from the bosses. This is considered in pre-payroll activities of payroll processing.

Payroll policies decide how much employees get paid, attendance policies set rules for when employees should be at work, and leave and benefits policies determine how time off and additional perks are managed.

2. Collecting Information

Next, you need to gather information from different departments to calculate pay correctly. This is one of the important steps in the payroll HR management process.

You can collect the data from here:

-

Employees: PAN card details, income tax details, facilities or allowances, etc.

-

HR Team: All employees’ salary details, Benefits eligibility, bonuses, deductions, etc.

-

Finance Team: Recoveries, deductions, etc.

-

Technical Department: Attendance and work shift data, etc.

It might seem like a lot, so using payroll software with features like leave management system, and attendance management can help. Whenever HRMS software is integrated with the payroll management system it makes everything hassle-free.

3. Checking Information

After gathering data, you check if it’s correct. Yes, it is very important before the payroll process in HR is done. You make sure only active employees are on the list, the data follows company rules, and it’s in the right format. This is also one of the important steps in pre-payroll activities.

Double-checking the information involves ensuring their net pay, basic pay, gross salary, income tax details, and many more, particularly in the context of salary slip generation. Additionally, confirming that the information is presented in the correct format is crucial to ensure accuracy.

4. Calculating Pay

Now, you put the checked data into the payroll system for the actual payroll calculation. The result is the net pay after taxes and deductions, and it is counted as actual payroll activities. You check again to avoid mistakes.

Payroll calculation involves inputting the verified data into the payroll management system, which then calculates the net pay after adjusting for taxes and deductions. This step includes a thorough recheck to eliminate any chances of payroll errors.

Also, See: Payroll Outsourcing Service and Payroll Software- What to Pick!

Struggling with the payroll process in HR? – Superworks has your solution!

Streamline your payroll woes with our user-friendly and efficient payroll software. Simplify complex calculations, ensure compliance, and save time.

Take the hassle out of payroll management and elevate your HR processes with us.

5. Following Compliances

During payroll, you must follow legal compliance. Considering that money taken out for things like EPF and TDS must be paid to the right authorities otherwise it may put you in trouble.

Adhering to legal rules is crucial during the payroll process in HR. Deductions like EPF, TDS, and ESI must be correctly calculated and paid to the respective government bodies. This is considered in Post Payroll Activities.

6. Accounting

Organizations need accurate payroll records. All kinds of salary management information must go into the accounting system and at the year’s end, it can be shown.

Keeping accurate records is essential for organizations. Salary details must be accurately recorded in the accounting or ERP system for proper financial management.

7. Paying Salaries

After all these steps, you can finally pay salaries through multiple methods either it is manual or automated. Consider the cash, cheque, or bank transfers for the payroll processing. Having employee bank accounts and payroll software in India makes it easier.

8. Reporting

The last step is making reports depending on gross salary, deduction, and many more things of the Indian payroll process. These reports go to the finance team or CEOs for analysis.

Reporting includes preparing detailed reports that provide insights into aspects like department-wise employee costs. These payroll reports are then submitted to the finance team or management for further analysis and decision-making.

Read more: From Problems to Precision: How Automation Reshapes Payroll Processing

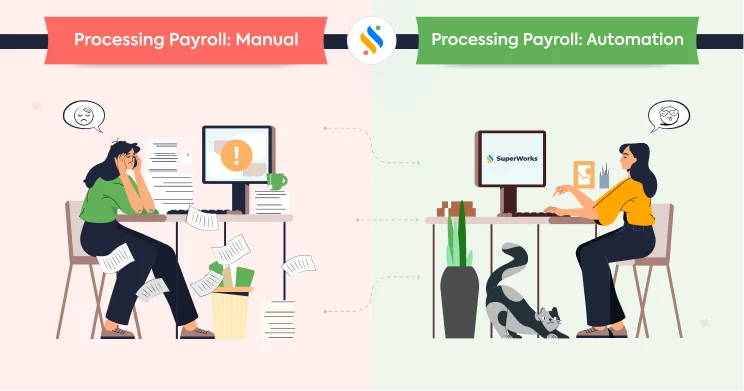

Methods of Processing Payroll: Manual vs. Automation

Depending on how much budget you have, how big the organization is, and the unique situation of each business, payroll can be handled in different ways. Many small businesses prefer – Payroll Processing Software.

– Manual

In the beginning, small business use spreadsheets, or documents for payroll because they don’t have many employees. They mostly use calculation templates with specific formulas to calculate the salary.

While this method is cost-effective, it becomes less suitable as a business hires more employees. Error chances will be high, also, using traditional methods instead of automated ones can be costly in terms of missed opportunities.

– Automation

Automated payroll software can solve the challenges of using spreadsheets or hr outsourcing services payroll tasks. There are many tools and modules available that can reduce the need for manual work and make things more efficient.

Besides handling payroll calculations, the software also needs to stay updated with the latest laws related to compliance.

Challenges in The Payroll System That All HR Faces Mostly

What are the challenges in managing payroll manually? Let’s talk about the problems that payroll processing systems often face:

Mistakes Prone: Imagine one person is struggling for processing payroll for 30 people. Mistakes can happen because of human errors during manual calculations and you need to make it correct as it is a matter of money. These mistakes might result in charges and fines.

Payroll Rules: There are many rules to follow, like labor laws, income tax, and federal regulations. It’s not a choice to follow these rules; it’s a must. But sometimes, many people don’t understand these complex rules, leading to issues with compliance and big fines.

Salary Delay: Dealing with the costs of running a business can be very complicated. HR might delay paying employees because of manual processes, regulations, taxes, and more, however, you can prefer HR and payroll software to stop this. Doing all the calculations for each employee’s paycheck by hand can be tiring, causing delays. When employees don’t get paid on time, they get upset, and some might even leave the company.

For small businesses, handling the accounting for costs isn’t easy for just one person. Payroll processing comes with challenges that affect how efficient and compliant your business is. One way to overcome these challenges is by using Superworks- HR Payroll Software.

The Best Payroll Software for Your Business

In conclusion, finding the best payroll software for your business is crucial for efficient and error-free payroll management. Depending on your business size and the needs of your organization, choosing between manual methods, such as spreadsheet-based payroll for smaller operations, and embracing automation with specialized payroll software for larger enterprises can make a significant impact.

The right payroll solution not only streamlines the complex Process of salary calculations but also ensures compliance with the latest regulations. As HR Technology continues to advance, opting for reliable payroll software such as Superworks can save time, reduce costs, and contribute to the overall success and growth of your business.

Also see: online hr payroll software | payroll process in india | hr payroll tools